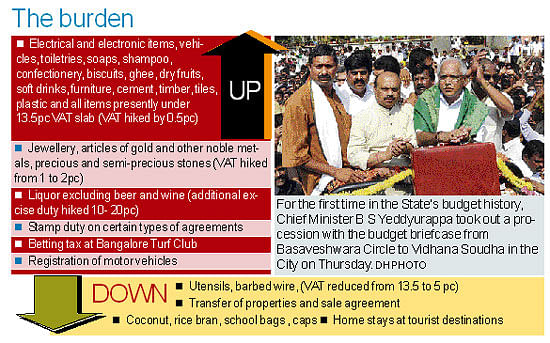

But in the bargain, the chief minister proposed to impose additional tax on the common man. Presenting the State Budget for the next financial year beginning April 1 in the Assembly on Thursday, Yeddyurappa proposed to increase the Value Added Tax (VAT) on motor vehicles, electrical and electronics goods like televisions, refrigerators, soft drinks, cement, plywood and a host of other items from 13.5 to 14 per cent.

His fresh tax proposals included doubling the VAT rate on gold jewellry, silver, precious and semi-precious stones from the existing 1 per cent to 2 per cent. In addition, the betting tax on horse races in Bangalore will go up from 4 to 8 per cent. The new tax proposals are expected to generate an additional revenue of Rs 1,020 crore which is nearly Rs 800 crore less compared to the last budget.

Two documents

Yeddyurappa created history of sorts by splitting the financial statement into two documents, one exclusive for agriculture and its allied sectors and the other the general budget. Among the dozen key sectors, the highest allocation has been made to agriculture and irrigation sectors combined — Rs 17,857 crore — an increase of one percentage point over the 17 per cent budget for all the heads brought under the separate “Agriculture Budget”. All types of subsidies given to farmers through various departments have been brought under the new head.

Other than beer and wine, liquor will be costlier as the chief minister proposed to increase the additional excise duty by 20 per cent along with a hike in “declare price” by Rs 25 on almost all varieties of liquor.

Stamp duty on trusts other than public, religious and charitable trusts will be levied at six per cent on transfer or disposition of property.

Yeddyurappa, who read out the Agriculture Budget for an hour and 20 minutes prior to presenting the general budget, announced loan from co-operative institutions to farmers at 1 per cent interest, interest-free loan to farmers’ children for higher education and Rs 10,000 to each farmer for cultivating dry land besides enhancing the agriculture revolving fund to Rs 1,000 crore from Rs 500 crore.

The free of cost replacement of pumpsets scheme will begin in Chikaballapur, Udupi and Dakshin Kannada districts. The chief minister also promised to regularise one lakh unauthorised irrigation pumpsets by spending Rs 100 crore.

The chief minister, who went back on his words of not imposing additional tax, strongly defended his decision to tax the already taxed people more. He said he has to increase tax because he has to raise additional resources that are required to for the general benefit of the state. Any tax increase should be only on those who can afford to pay, Yeddyurappa said. Yeddyurappa has not taken any step to contain mounting subsidies. The burden on the exchequer due to subsidies is estimated to be Rs 6,242 crore — Rs 617 crore more compared to the last year. A major portion of it is going to power subsidy to farmers at Rs 4,301 crore, followed by food at Rs 850 crore (rice at Rs 3 per kg).

The total outlay for the 2011-12 budget is Rs 85,319 crore — Rs 65,034 crore revenue expenditure and Rs 20,285 capital expenditure. He is expecting Rs. 66,313 crore tax revenue, thus projecting a revenue surplus of Rs 1,278 crore. A bulk of the of capital receipt is expected through borrowing, which will be about Rs 12,500 crore.