The volatility in the Indian stock markets has surged by over 70% in 2020 to an 11-year high, which could be a note of caution to investors.

The volatility in Indian stock markets has gone up in the range of 72-78% during the current calendar year, a DH analysis of India VIX showed.

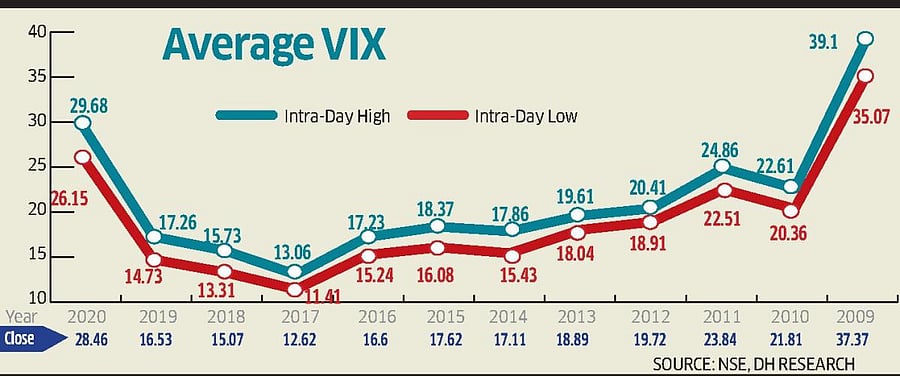

The numbers reveal that average intra-day high of India VIX in 2020 stood at 29.68 (72% more than 17.26 for 2019); the average intra-day low at 26.15 (77.5% more than 14.73 for 2019) and the average close at 28.46 (72.2% more than 16.53 for 2019).

The average volatility on India VIX in 2020 has been at its peak in 11 years. Previously, the average high volatility was witnessed way back in 2009 when the re-election of the United Progressive Alliance (UPA) had brought around a sharp rebound in the markets, which were anyway battered by the Global Financial Crisis.

Also, on March 24, 2020, India VIX touched its life-time high of 86.64 -- the highest volatility ever seen. On that day, markets had made a sharp rebound, gaining about 6% in the intra-day trade, after crashing by 39% from the all-time high in just two months.

Analysts expect volatility to be on the higher side for some more days, till the effects of the Covid-19 pandemic are fully gone.

"Due to the pandemic both in India and globally, every indicator has gone haywire, with uncertainty and no clear outlook on corporate earnings to economic recovery. Thus, volatility may continue to be high," Arjun Yash Mahajan, Head- Institutional Business at Reliance Securities said.

Volatility Index is a measure of the market’s expectation of volatility over the near term. Volatility is often described as the “rate and magnitude of changes in prices" and in finance, often referred to as risk. India VIX is a volatility index based on the NIFTY Index Option prices.

India VIX is the short name for the India Volatility Index, an index disseminated by the NSE. It measures the degree of volatility or fluctuation that active traders expect in the Nifty50 over the next 30 days. It was the Chicago Board Options Exchange which originally came up with the term VIX in 1993 and the NSE, with the CBOE’s permission, kicked off the India VIX in 2008.

The VIX calculation is based on the Black Scholes Model which is used to price options contracts.

The increased volatility is seeing more and more notes of caution coming from analysts. According to analysts, an increase in volatility would lead to an increase in risk and hence the probability of a correct decision goes down at an aggregate level. The investors will lose money.

"We advise investors to invest cautiously in quality stocks only," Mahajan added.