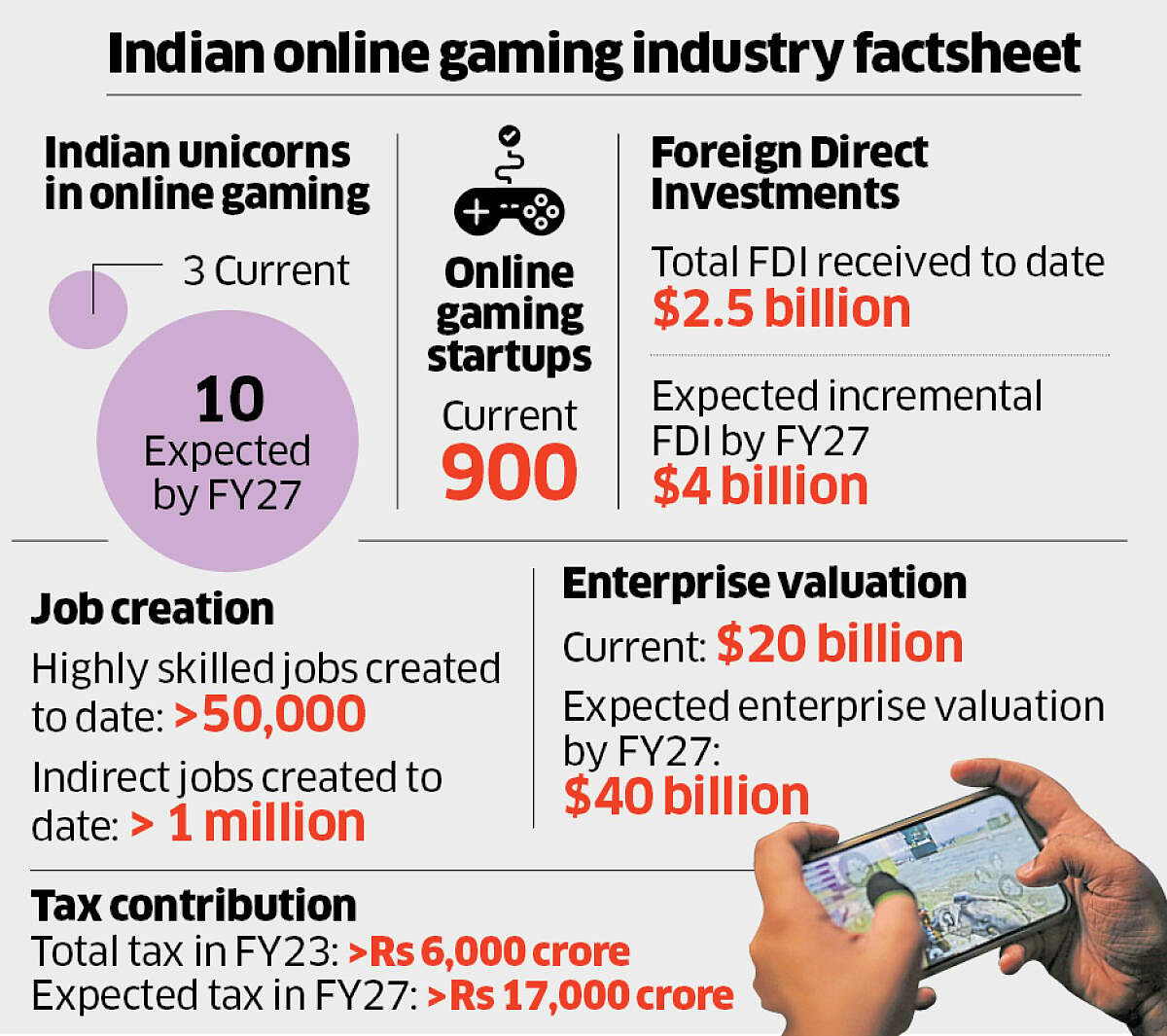

A group of 30 Indian and foreign investors backing online gaming companies has written a letter to Prime Minister Narendra Modi saying that the current proposal of imposing 28% goods and services tax (GST) on the full face value of online gaming transactions “will substantially and meaningfully erode investor confidence” and “adversely impact prospective investments to the tune of at least $4 billion in the next 3-4 years”.

“The current GST proposal will set up the most onerous tax regime for the gaming sector globally, which will lead to a potential write-off of the $2.5 billion capital invested in this sector,” the letter read.

Peak XV Partners (formerly Sequoia Capital India), Tiger Global Management, Steadview Capital, DST Global, ChrysCapital, Kalaari Capital and Alpha Wave Global. Bennett, Coleman & Company Limited are among the marquee investors who have signed the letter seeking a meeting with Prime Minister Modi or officials at the Prime Minister's Office to elaborate on their concerns.

The letter pointed out that the GST Council's decision has an “unintended consequence of equating the constitutionally protected legitimate online skill gaming industry with gambling, betting and other games of chance.”

By this approach “the GST burden will increase by 1,100% and on account of taxation of redeployed player winnings, the same money will get taxed repeatedly resulting in a scenario where over 50-70% of every rupee will go towards GST, thereby making the online real money skill gaming business model unviable. This will lead to write-off of investments made and would hurt investor confidence,” the letter argued.

Instead, it suggested, an “increase in the rate from (the current) 18% to 28% on the operator’s gaming revenue would have led to a 55% increase in GST collection for the exchequer from this sector without adversely impacting the sector.”

“We invested in this sector to make India the gaming capital of the world, which would help in generating, among other things, high-skilled jobs, billions in foreign capital and make the country a net exporter of innovation in gaming and allied areas such as animation, artificial intelligence, and visual effects," the letter further lobbied.

“If such marquee investors are writing to the PMO, one must understand it is not just an 18% versus 28% debate, it is a big deal and a message that investors are losing confidence in the Indian market,” said a source close to the matter.

“Even structurally taxing gross gaming revenues (being the price for the supply of service) as against the prize pool is more consistent with GST,” explained Gouri Puri, Partner, Shardul Amarchand Mangaldas & Co.