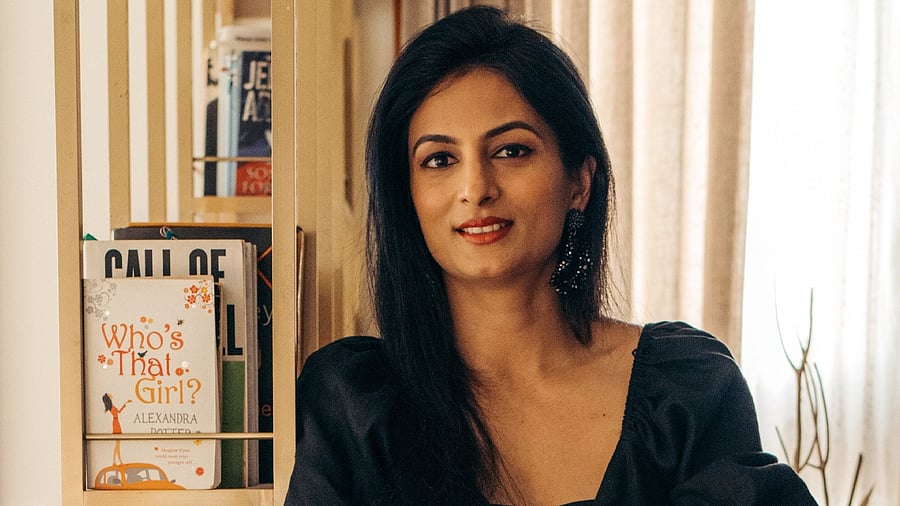

Real estate developer Brigade Group has partnered with Gruhas, a venture capital fund run by Nikhil Kamath and Abhijeet Pai, to launch a property technology (proptech) and sustainability focussed Rs 300-crore fund focusing on property technology (proptech) and sustainability. Christened Earth Fund, the fund is set up under Brigade’s Zoiros Projects Private Limited, and was announced on Tuesday. Speaking on the occasion, Nirupa Shankar, Joint Managing Director, Brigade Enterprises Limited, pointed out that currently, only 1% of India’s developers’ top line goes towards tech. Later in a conversation with DH’s Anushree Pratap, she spoke about spiralling land price around the Kempegowda airport, Bengaluru’s growing land acquisition problems, and Brigade’s own growth plans. Edited excerpts:

What has been the impact of the ongoing market downturn and global instabilities on the realty segment?

Frankly, real estate stocks obviously have been impacted and general sentiments are starting to get impacted. But overall if you look at the numbers, people are doing well on-ground with demand still strong. You may not see the same level of price uptakes that we saw in the last couple of years, but that was because of a backlog from Covid and other factors .With strong demand, we will continue to see price increases, maybe at low double digits, instead of high double digits.

Do you see affordable housing turning into a crisis, given that it has not really been addressed adequately by the government?

I don’t want to get that dramatic about it, but there is a huge demand for affordable housing. The only people that can help with this is the government, because you have to get land cost effectively. If you don’t get land at a cost effective rate, it is very hard for builders such as us to do affordable housing in a cost-effective manner. For most builders, the net profit is in the single digits. So if the margins are not there, it is very hard to make ends meet and to see success for a project. The government has to support by giving land in a very cost effective manner if they want to solve the affordable housing problem.

How has the government’s push for indigenisation affected the realty sector?

If you’re just talking about drones, most drones are made in China; there are very few indigenous drone technologies where the entire drone is actually made here. And drones have a huge impact on real estate, like to evaluate large land parcels, survey a landscape, monitor construction progress, heat mapping to determine where the leakages are. This is something Brigade is also doing.

After Brigade Reap and now this fund, what is your outlook on the proptech sector?

I’ve always been bullish on proptech. I’m interested in looking for solutions, especially in AI, because I think that can make us operate at a much quicker pace. For example, robotic arms helping in construction methodologies, waterproofing nanotech materials. There will not be a single technology which will come and disrupt the entire space. There are going to be little technologies that disrupt smaller processes within the overall space.

Are big developers also feeling the pinch of land cost and acquisition problems like other industries in Bengaluru?

Yeah, it is getting harder to find clean parcels of land with clear titles. And even the larger parcels of land, especially when they’re owned by corporates and come through auction. Then the prices just go to crazy, crazy levels. One way that we have tried to overcome this is by adopting the joint development method with landowners. We do 50% outright purchase and we do 50% joint development.

Any plans to venture into new cities in this fiscal, or the next? And launches planned for Bengaluru?

It is going to be Bengaluru, Chennai, Hyderabad. In tier-II, Kochi is going to be a new city for residential. We already exist in Kochi for office. Trivandrum also, we have started some office realty.

For Bengaluru, it depends on where we pick up our next parcel of land. From identifying a parcel of land and finalising it to launch, it can take 9-12 months. We are looking to tie up as many parcels of land as we can. We like to work in the sweet spot between Rs 1-5 crore ticket size. There is still strong demand for that.

What are your numbers for this fiscal?

Typically our top line, we look to increase by 15-20% per year. Earnings before interest, taxes, depreciation and amortisation (EBITDA) is around 27-30%, the balance 70% is cost. So we can kind of back calculate it that way.

Which areas of Bengaluru are seeing the most demand and price appreciation?

We are seeing a lot of push in north Bengaluru towards the airport. Land value has just skyrocketed there. Apartments are doing well there, people are looking to move their offices to north Bengaluru - we are seeing a huge push there.

In Brigade Hotel Ventures Ltd’s Draft Red Herring Prospectus (DRHP), there was a mentionof religious tourism. Can you expand on the plans?

We would want to see if there is anything in Ayodhya, any opportunity in Tirupati. That is a new segment we would like to evaluate.