Rewriting cross-border corporate tax rules could increase governments' tax revenues by up to 4%, or $100 billion annually, the Organisation for Economic Cooperation estimated on Thursday.

The OECD offered the estimates as food for thought for the nearly 140 governments that agreed earlier this month to negotiate the first major update international corporate tax rules by the end of the year.

Many governments are frustrated that the rise of big internet companies like Google, Facebook and Amazon is depriving them of revenue, because they can legally book profits in low-tax countries regardless of where their customers are.

The Paris-based OECD said that the revenue gains it expected from the overhaul of the rules were "broadly similar across high, middle and low-income economies".

The OECD did not give revenue estimates for specific countries. But it said that the new rules would hit offshore tax havens, where multinationals can currently park profits beyond the reach of tax authorities at home, particularly hard.

In the absence of updated rules, a growing number of countries are pushing ahead with plans to impose their own national tax on digital service companies. That's fuelling tension with Washington, which says such levies discriminate against U.S. companies.

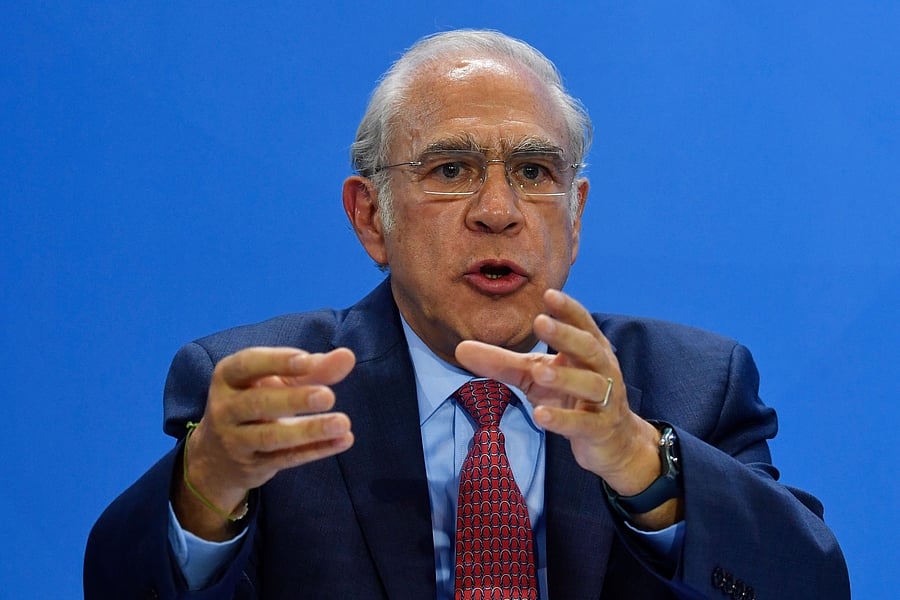

"Failure to reach a consensus-based solution will lead to unilateral measures and greater uncertainty," OECD head of tax policy and statistics David Bradbury said, presenting the results of the OECD's study online.

It estimated most of the additional revenues would come from plans for a minimum corporate tax rate, noting that it also depended on what rate governments agreed on.

Plans to give governments rights to tax a bigger share of profits in the country where end customers are located would yield small revenue gains for most countries, the OECD said.

More than half the profit shifted to countries where the client is based under the proposed changes would come from 100 international groups.

The OECD said that its estimates, which drew on data from more than 200 jurisdictions and more than 27,000 multinationals, were based on the assumption that whatever countries agree to the outcome would be mandatory for companies.

Concerned about difficulties pushing an international agreement through the U.S. Congress, Washington has suggested that companies should have the possibility deciding whether to opt in or out, which has found no support from other countries.