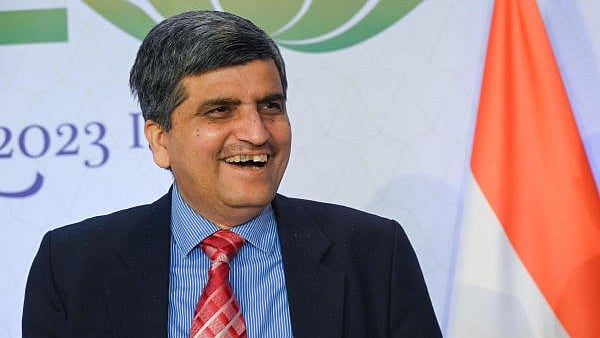

Economic Affairs Secretary Ajay Seth

Credit: DH Photo

New Delhi: India has asked the global agencies Fitch, Moody’s and S&P to rework their methodology of sovereign ratings as the current procedures don’t capture the true state of the economy, Finance Secretary Ajay Seth said on Friday.

Talking to reporters on the sidelines of a conference organised by Isaac Centre for Public Policy of Ashoka University, Seth said the Indian government was holding intense discussions with the rating agencies for the change in methodology.

He pointed out that the rating agencies give 15 per cent weight to governance in the sovereign ratings. “They take this input from the World Bank’s Worldwide Governance Indicator (WGI), which needs restructuring,” he said.

India’s current sovereign ratings by the global rating agencies are the lowest investment grade.

On economic growth, Seth said India's GDP growth in the current financial year is likely to be at the lower-end of 6.3 to 6.8 per cent range given in the Economic Survey.

He said data on GST collections and customs indicate strong momentum in the economy despite global challenges.

Speaking at the event Chairman of the 16th Finance Commission Arvind Panagariya said the Indian economy has shown resilience despite challenges like Covid pandemic.

“Macroeconomists are often seen as pessimists, but I’m optimistic. Looking at the short run, we experienced a sharp dip during the COVID crisis with a negative GDP growth of about -5.6 per cent. However, we came out of it remarkably well, with strong recoveries in subsequent years, growing 9.7 per cent in 2021-22 and 7.6 per cent in 2022-23. 23-24, we grew 9.2 percent, in 2023-24, we grew by 9.2 per cent, and the latest advance estimate for 2024-25 stands at 6.4 per cent. All things considered; that’s indeed a remarkable recovery,” he said.

Referring to the developed India vision, Panagariya said, “Prime Minister has set an ambitious goal for India to achieve developed country status by 2047. This will require us to grow per capita income by about 7.3 per cent annually. While it's a challenging target, the growth trajectory over the past few decades, despite multiple shocks, provides a strong foundation for optimism.”