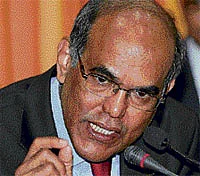

“Our reserves comprise essentially borrowed resources, and we are therefore more vulnerable to sudden stops and reversals, as compared with countries with current account surpluses,” he said he at the Special Governors’ Meeting in Kyoto, Japan.

India’s foreign exchange reserves increased by $1.97 billion to $299.39 billion for week ended January 21. The forex reserves were $297.41 billion in the previous week ending January 14. Further, Subbarao said India’s forex reserves are a result of capital inflows in excess of its economy’s absorptive capacity. Among the components of capital flows, India prefers long-term flows to short-term flows and non-debt flows to debt flows, he added.

“India has experienced both ‘floods’ and ‘sudden stops’ of capital flows. It has followed a consistent policy on allowing capital inflows in general and on capital account management in particular,” Subbarao said.

FDI has dipped 26 per cent during January-November 2010 to about US$19 billion from US$25.5 billion in the year-ago period. During 2010, FIIs whose investments have often been called ‘hot money’ because they can be pulled out anytime, have purchased stocks and debt securities worth Rs 9,60,000 crore. At the same time, FIIs sold shares and bonds worth Rs 7,80,000 crore during the year — still leaving behind a record net investment of over Rs 1.75 lakh crore for the year.

He further said India should move towards capital account convertibility gradually, taking cues from domestic and global developments. Capital account convertibility is the freedom to convert local financial assets into foreign financial assets and vice versa at market determined rates of exchange.

Effectively, it allows anyone to freely move from local currency into foreign currency and back. RBI Governor implies that “capital account convertibility should serve as a means for higher and stable growth and not as a standalone objective.”

Cautious stance

“We believe our economy should traverse towards capital convertibility along a gradual path — the path itself being recalibrated on a dynamic basis in response to domestic and global developments,” Subbarao added.

In the aftermath of financial meltdown, the RBI had adopted a cautious stance on financial reforms, including full convertibility of the local currency.

Subbarao added that RBI doesn’t disclose the currency composition of the country’s reserves and it has been criticised for lack of communication in this regard.

“The information is market sensitive and disclosure could potentially impact our commercial interests adversely. Disclosure also has wider implications for our international relations,” Subbarao added.

Furthermore, he stated, market efficiency is in no way affected by our non-disclosure. Indeed non-disclosure is the norm around the world, Subbarao said adding: “a majority of the countries, particularly the large reserve holders, do not disclose the composition of their foreign exchange reserves.”