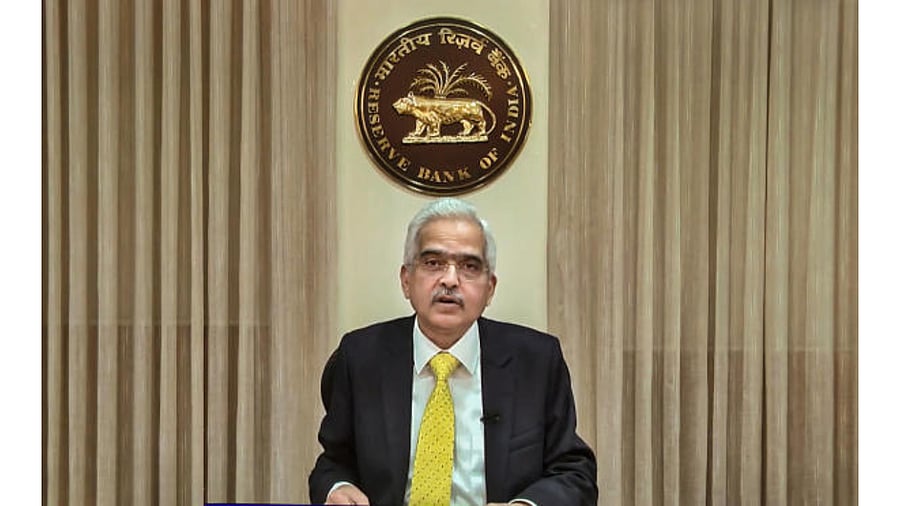

The Reserve Bank of India will allow banks to borrow and lend government bonds in a move that could add depth and liquidity to the market, Governor Shaktikanta Das said on Wednesday.

The move could facilitate wider participation in the securities lending market by providing investors an avenue to deploy idle securities and enhance portfolio returns, Governor Das said in his monetary policy address.

Bond market participants expect the facility to benefit insurance companies and mutual funds, even as they wait for the detailed draft directions to be issued separately.

Currently, mutual funds are allowed to borrow only to meet redemptions while life insurance companies are not allowed to borrow at all, a senior member of the treasury team at a Mumbai-based private bank said, speaking with Reuters Trading India.

The introduction of lending and borrowing in government bonds will curb the volatility in liquidity, said Nilesh Shah, managing director at Kotak Mahindra Asset Management Company.

Some market participants said this move could aid short sellers, who run the risk of getting squeezed if they can't get the securities through the CROMS trading platform for government securities (g-secs).

"Shorters will have more avenues to acquire bonds, and this should minimise the risk of getting squeezed, which leads to exaggerated price moves," a trader with a private bank said.