The financial year 2011-12 was the second in a row when the country’s life insurance companies – there are 24 players in the industry – reported a fall in first year premium (or new premium) income.

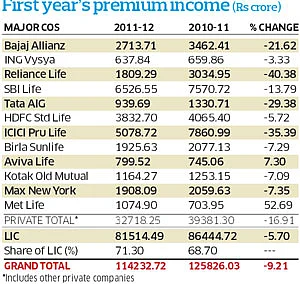

The life insurance industry, as a whole (including public sector giant Life Insurance Corporation), collected Rs 1,14,232 crore in 2011-12, 9.21 per cent lower than Rs 1,25,826 crore in 2010-11. Worse, 23 strong private sector players registered a sharper 16.91 per cent drop in new premium income to Rs 31,718 crore from Rs 39,381 crore.

The primary reason for the sharp fall is the lower premium income from individual single premium policies. The industry, as a whole, according to the latest data from the Insurance Regulatory and Development Authority (IRDA), sold only 27 lakh single premium policies in 2011-12 collecting Rs 18,410 crore and these numbers were just about half of what the industry did in 2010-11.

Since most single premium policies are unit-linked (where a large part of the premium money is invested in equity and debt), the lackluster performance of share markets has made such investments less attractive. Besides, IRDA’s stringent norms for unit-linked policies have dampened the enthusiasm. It is also true that as an investment tool, single premium policies are inferior to regular premium policies where premiums are paid annually, quarterly or monthly.

The reason is that in case of a single premium policy, the insurer has a limited pool of funds to deduct all charges and mortality expenses from.

But in case of a periodical and regular payout of premiums, the costs of mortality charges keep coming down every year in an incremental progression leaving more money for investment and higher return.

The new premium collection data (see table) for major private sector companies illustrate the fall in premium income in 2011-12 ranging from 35 per cent to 3 per cent, except for two companies: Aviva Life Insurance and Met Life. LIC too witnessed a drop of 5.70 per cent.

The fall in new premium, however, does not necessarily mean lower premium income for life insurance companies. In fact, with greater emphasis on the collection of renewal premium (premiums for policies sold in earlier years), many companies have reported good growth in income and profits.

Max New York Life Insurance, for instance, recorded 10 per cent growth in gross premium to Rs 6,391 crore in 2011-12 despite a 7 per cent fall in new premium. Its profits also increased 159 per cent to Rs 733 crore. “Though the market continues to remain challenging, we have responded extremely well,” said Max New York Life Insurance CEO & MD Rajesh Sud.

Aviva Life Insurance is another private sector player that reported a net profit of Rs 74 crore in 2011-12, 155 per cent more than Rs 29 crore in the previous year. In 2011-12, the renewal premium was estimated to have accounted for 70 per cent of the total premium income. This and large-scale cost consolidation are clear signs of maturity in the industry.