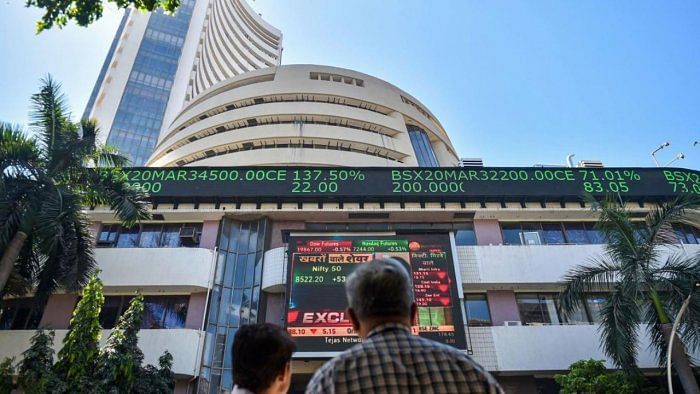

The domestic equity benchmarks climbed in early trade on Thursday amid positive trends from the US markets.

The 30-share BSE Sensex climbed 139.34 points to 60,244.84 in initial trade. The broader NSE Nifty advanced 39.35 points to 17,935.05.

From the Sensex pack, HCL Technologies, Titan, UltraTech Cement, Larsen & Toubro, Mahindra & Mahindra, Bajaj Finserv, HDFC and Maruti were the major winners.

Asian Paints, Axis Bank, Tata Steel and ICICI Bank were among the laggards.

However, later both the benchmarks were quoting on a flat note, paring early gains.

The 30-share BSE benchmark quoted 23.4 points lower at 60,082.10, while the Nifty traded 9 points down at 17,879.85.

Elsewhere in Asia, equity markets in Seoul and Tokyo were trading in the green, while Shanghai and Hong Kong quoted lower.

Markets in the US had ended in the positive territory on Wednesday.

"The US inflation data expected tonight will be market moving," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The 30-share BSE benchmark had dipped 9.98 points or 0.02 per cent to settle at 60,105.50 on Wednesday. The Nifty skidded 18.45 points or 0.10 per cent to end at 17,895.70.

"Market is likely to gain traction in early Thursday trade as a firm US market close overnight would boost investors' confidence. Investors will be eyeing the US inflation data later today... Back home, IT bellwether Infosys will announce its Q3 numbers today and traders will keenly watch the guidance," said Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities Ltd.

International oil benchmark Brent crude climbed marginally by 0.01 per cent to $82.71 per barrel.

Foreign Institutional Investors (FIIs) offloaded shares worth Rs 3,208.15 crore on Wednesday, according to exchange data.