Credit: Special Arrangement

Bengaluru: While collections have improved marginally in the microfinance (MFI) sector in February and early March, several structural issues persist in the sector. Karnataka, however, has not even seen this relief. It is the only state in India which hasn’t seen any uptick in collection efficiency, according to insights shared by Anand Rathi Institutional Equities on Tuesday, based on a conference with multiple MFI companies.

Collections have improved as customers who missed collections in previous months have started repaying, signalling gradual recovery for the sector amidst other pressures.

Companies’ insights point to the Karnataka crisis triggered by customer suicides in May and subsequent protests, which prompted the government to issue an ordinance regulating loan officers' behaviour. This resulted in a 5-7 per cent drop in collection efficiency.

Asset quality also improved across regions barring Karnataka. Yet, other pockets of stress also exist in states such as Gujarat, Uttar Pradesh, Bihar, and Odisha, catalysed by over-leveraging, multiple-lender exposure, and political interference for loan waivers.

Another challenge the sector is experiencing is continued high employee attrition. Lenders are focusing on improving centre-meeting discipline and enhancing customer engagement. However, high workload from low centre-meeting attendance, borrower delinquency and competitive hiring pressures are creating obstacles.

There has also been a behavioural change, according to lenders. The joint liability group (JLG) structure is not as robust as it used to be pre-Covid as borrowers understand that it is a social contract, not legally enforceable. This change is observed in large group size loans with high ticket size.

Anand Rathi expects issues such as slower growth, lower return on assets, and behavioural changes perceived in customers to continue causing stress in the sector.

Growth is expected to be subdued in the near-term as lenders focus on collections.

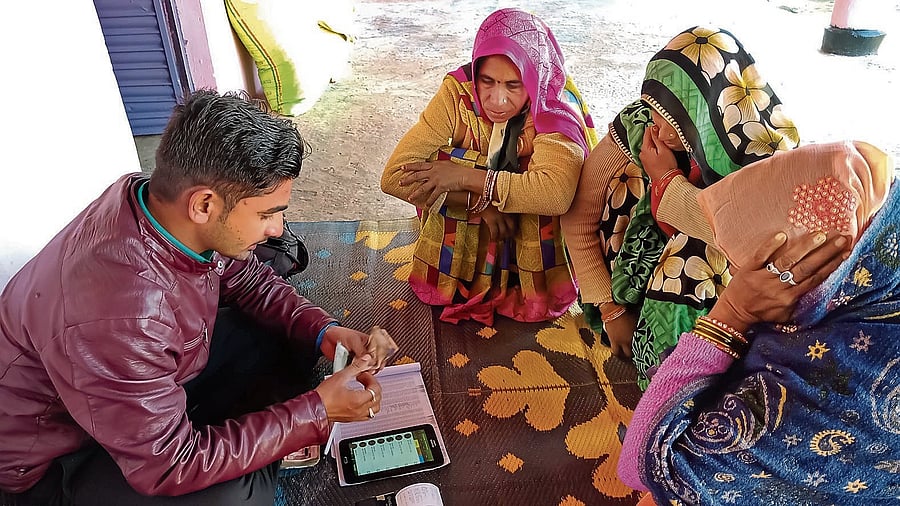

Other market gaps noted were the “missing middle" challenge, wherein a large segment (almost 500 million people) is not being catered to properly. Furthermore, ultra-poor households may require special financial products beyond traditional micro-finance.