Despite facing economic and career uncertainties, two-thirds of Gen Z remain optimistic about the future. They are confident of their finances, health and the social environment — showcasing their resilience and positive attitude, the survey shows.

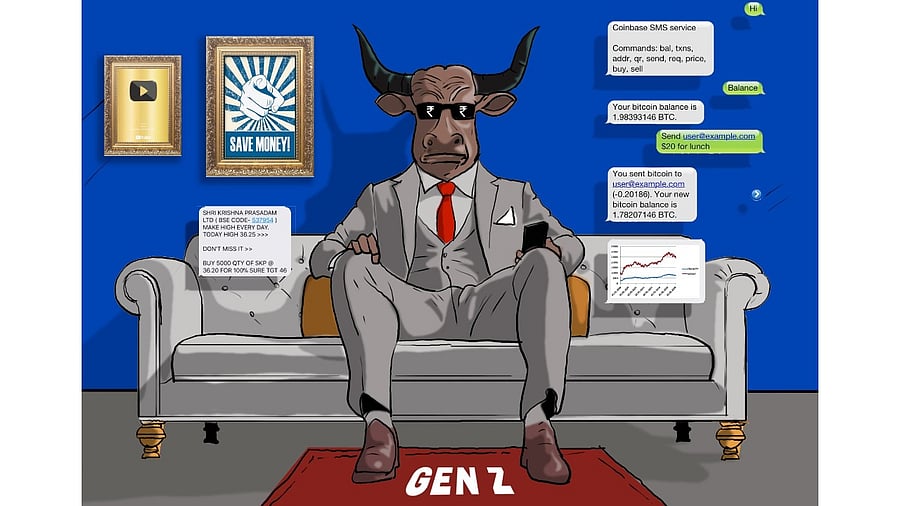

Credit: DH Illustration

New Delhi: At 78, Donald Trump is the oldest president elect in the history of the United States. One of the key reasons for his success in the US presidential election has been the support of young men. He received more support from young men than any Republican candidate in over two decades. As per Associated Press’ VoteCast poll, nearly half of young voters (between 18 and 29 years of age) voted for Trump in the 2024 election. In the last election, only 36 per cent of this age group had voted for him.

Why did young voters choose Trump over his younger opponent Kamala Harris? One of the key factors that contributed to such decision-making was concerns about the economy, as per the AP VoteCast poll. Trump’s ‘edgy and rebellious personality’ reportedly went down well with young voters. While Harris promised to retain the status quo largely, Trump promised to dismantle the political and economic order.

Concerns about the economic performance of the country are not specific to the United States or to the voters of Trump. Young populations are growing increasingly worried about jobs, price rise and unemployment.

A large portion of such populations believe that radical changes are needed to address the economic challenges of the present and the future. This has been reflected in successive Indian elections too.

According to a survey report released last month by Boston Consulting Group (BCG) and Snap Inc, Generation Z (a demographic cohort of people born between 1997 and 2012) sees change as an opportunity for growth. Over 70 per cent of Gen Z, or Zoomers, are enthusiastic about embracing ‘the new’ across various aspects of their lives.

Despite facing economic and career uncertainties, two-thirds of Gen Z remain optimistic about the future. They are confident of their finances, health and the social environment — showcasing their resilience and positive attitude, the survey shows.

Nearly one in every five Gen Zoomers on this planet is Indian. India is often referred to as a young country, with around 65 per cent of the population below 35 years of age. Over half of the country’s estimated 140 crore population is under 25 years of age.

Around 37.7 crore Indians are estimated to belong to Generation Z, which is more than the entire population of the United States. The oldest of those born into this demographic cohort are in their late 20s. Many have graduated, are married or starting families. The youngest may be just 12 years old.

Gen Z might be the most tech-savvy generation at present. Right from their childhood, the youth of today have been exposed to the internet, social media and mobile systems. This is the first generation to have portable digital technology from an early age.

The term ‘digital native’, coined by American author and technologist Marc Prensky in an article titled ‘Digital Natives, Digital Immigrants’, is perhaps applicable to how this generation has assimilated technology. It is no wonder that technology plays into Gen Z’s financial management as well.

“Gen Z's financial management is heavily reliant on technology. Real-time budgeting, investment tracking and automated savings are all made possible by popular mobile apps,” said Rohit Mahajan, co-founder of fintech firm plutos ONE.

Avinash Shekhar, co-founder and CEO of Pi42, a cryptocurrency futures trading platform, underlined this technological reliance. “They seek experiential advice through influencers, podcasts, online reviews, and tutorials, shaping their financial decisions,” he said.

Their approach to saving, spending, and investing is bold and dynamic. As true digital natives, they leverage technology for risk assessment, budgeting, and investment decisions, Shekhar added.

Knowledge transfer

Traditionally, parents and elders would pass on knowledge of financial management and investments. However, increasingly, younger generations do not rely on these sources. There is a growing appetite for self-directed learning through platforms like YouTube and Instagram.

Investing attitudes that are shaped in this way, through online information overloads, result in a preference for high-return assets and digital tools for budgeting.

According to a report from Fin One, an initiative by brokerage firm Angel One, stocks have overtaken mutual funds as the preferred investment option for India’s Gen Z. A survey conducted by Fin One, in collaboration with Nielsen, recently revealed that 72 per cent of respondents between 18 and 21 prefer to invest in equities over the low-risk options like fixed deposits (FD) and gold.

“When it comes to investments, Gen Z exhibits a significantly higher appetite for risk than millennials. They gravitate toward assets like cryptocurrencies and crypto derivatives, drawn by their potential for quick wealth creation,” Shekhar said.

According to Jaideep Kewalramani, Head of Employability Business and COO, TeamLease Edtech, a significant shift in the investment ecosystem has led to the change in investment patterns of Gen Z over the previous generations.

“The asset classes have diversified offering more variety. Digital has played a big role in removing friction in access to different instruments and the process — instant KYC, faceless transactions and faster settlement make things easier,” Kewalramani said.

The availability of credit lines and a virtual safety net due to a growing economy have made things attractive. Albeit, this has also led to some risky assets causing some amateurs to lose a lot of money, he added.

Talking about the investment and spending patterns of younger generations, Manish Bhandari, CEO and portfolio manager of Vallum Capital Advisors, said, “Younger generations will be investing more in experiential goods. They have grown in concerns related to the worsening condition of the environment around them and hence are high on embracing ESG (environmental, social and governance) in their investment and spending.”

“Their inclination toward sustainable and diversified portfolios reflects a mature mindset, ensuring their spending and saving habits align with modern economic realities,” said Kirang Gandhi, a personal finance mentor.

Gandhi, however, also underlined the challenges in Gen Z spending behaviour and possible debt traps.

"Despite access to technology and financial tools, Gen Z faces challenges in balancing spending and saving. The influence of social media trends and instant gratification, such as 'buy-now-pay-later schemes', often lead to impulsive purchases and debt traps, overshadowing long-term financial discipline and proper asset allocation,” he said.

Without consistent efforts to build financial literacy, many in this generation risk compromising their future financial security in a rapidly changing economic environment, he added.

Cryptocurrency

While stocks and mutual funds are among the most popular, a significant proportion of Gen Z have also invested in alternatives like cryptocurrencies, NFTs (non-fungible tokens), and other digital assets.

“A significant portion of our user base comprises first-time investors aged between 18 and 35, with Gen Z forming a vibrant and growing segment,” said Balaji Srihari, business head of CoinSwitch, a cryptocurrency exchange and trading platform.

Comfort with digital tools and platforms naturally positions younger generations to explore emerging financial ecosystems like cryptocurrencies.

“Crypto, being a volatile and fast-evolving industry, demands a high-risk appetite — an attribute that aligns well with Gen Z’s approach to investing. They are not only more inclined to experiment with unconventional asset classes but also demonstrate a strong interest in understanding the technology and purpose behind their investments,” Srihari said.

Stock markets and cryptocurrencies witnessed record-breaking rallies following the US election results. The leading cryptocurrency Bitcoin soared to a record high of $98,000 recently.

“The re-election of Trump has reinvigorated enthusiasm within the crypto community, supported by a noticeable uptick in institutional investments,” Srihari said.

“This has caused a ripple effect across the globe including India. Over the past four weeks, BTC has surged by 50 per cent, driving a 5x increase in trading volumes on our platform,” he added.

Consumption

India is primarily a consumption-driven economy. Domestic consumption accounts for around 60 per cent of the country’s gross domestic product (GDP). Gen Z is the largest demographic group in India and is set to reshape the country’s consumer landscape.

As per BCG's analysis, 37.7 crore Indians were born between 1997 and 2012. This is the largest demographic group, followed by millennials — with over 35.6 crore births recorded between 1981 and 1996. The total number of 'Gen X' (born between 1965 and 1980) stands at 24.6 crores while 15.9 crore Indians are 'Baby Boomers'. Over 30 crore of the country’s population was born after 2012, which forms 'Generation Alpha'.

Around $860 billion or 43 per cent of India’s total consumption expenditure is driven by Gen Z, according to the report by BCG and Snap Inc.

Out of this, around $200 billion comes directly from Zoomers’ earnings, while $660 billion comes from influenced spending — purchases shaped by their recommendations or preferences.

By 2035, direct spending by Gen Z is projected to reach $1.8 trillion, indicating that this population cohort will drive every second rupee of consumer spending. “From snacks to sedans, Gen Zers are impacting almost every second rupee spent today across categories,” the report noted.

Jobs

As per a Nasscom report, Gen Z and Millennials account for around 90 per cent of the total Indian tech workforce and 70 per cent of Gen Z college students aspire to join tech companies.

Job satisfaction and good working environments are the key asks for Gen Z. Millennials were found to provide two-fold more importance to financial benefits when compared to Gen Z.

According to a survey conducted among 10,000 Gen Z professionals by the professional networking platform Apna.co, eight out of 10 respondents prioritise mentorship and clear career growth pathways over traditional metrics like salary, reflecting a stronger focus on personal and professional development.

Unlike previous generations, where financial stability was the primary concern, Gen Z adopts a more deliberate approach, seeking clarity and purpose in their careers. They aim to build skills that naturally lead to rewards, emphasising a future-oriented, strategic mindset over short-term gains.

“Gen Z is redefining professional success — moving beyond monetary rewards to seek purposeful, growth-oriented roles. They are curious, self-aware, and eager to contribute meaningfully while expecting clear career trajectories and alignment with their personal values,” said Nirmit Parikh, founder and CEO of Apna.co.

“There is a strong direct correlation between employment and work environment. A more secure and upwardly mobile career avenue leads to a higher risk appetite and investment fund,” said Kewalramani.

As per BCG, one of four Zoomers is already in the workforce. Within the decade, every other Gen Zer will be earning.