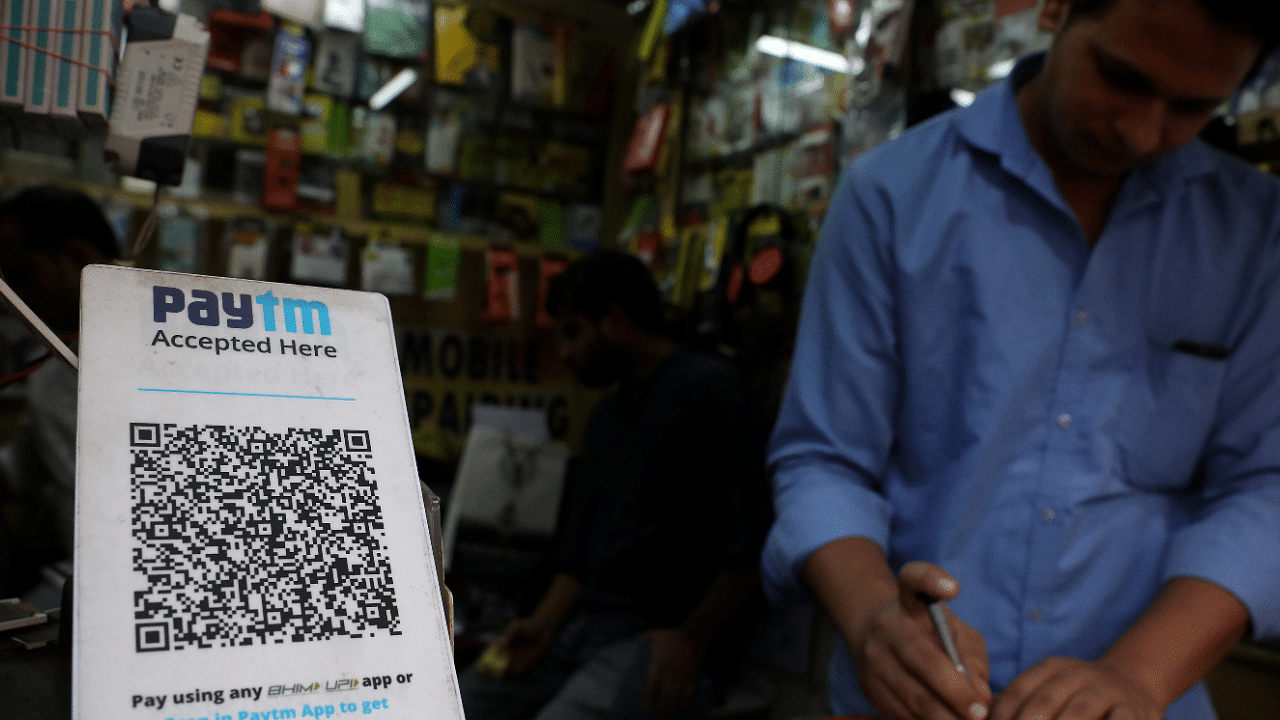

Paytm, the Indian digital payments startup whose stock has slumped 71 per cent since its November market debut, had its price target reduced further by an Macquarie Capital Securities (India) Pvt. analyst who was early to predict the company’s market troubles.

Macquarie’s Suresh Ganapathy cut his price estimate to Rs 450 from Rs 700, citing lower valuations for fintech companies globally. He didn’t change his earnings or revenue estimates for Paytm, which he rates underperform. The stock rose to Rs 634.05 on Wednesday.

Paytm pulled off the largest-ever initial public offering in India, but has since faced a number of challenges. Ganapathy cited fintech regulations and stricter compliance norms as potential headwinds -- on Friday, the Reserve Bank of India barred the company’s Paytm Payments Bank venture from accepting new customers, adding pressure on the stock.

The average 12-month price target among nine analysts covering Paytm is Rs 1,203, according to data compiled by Bloomberg.

The initial public offering by One 97 Communications Ltd., the parent company for Paytm, had been touted by some as a symbol of India’s growing appeal as a destination for global capital, particularly for investors looking for alternatives to China.

Ahead of the listing, Macquarie analysts including Ganapathy initiated coverage with an underperform rating and a price target of Rs 1,200. The IPO was priced at Rs 2,150.

Check out DH's latest videos