New Delhi: In 2017, Masayoshi Son, CEO of Japanese conglomerate SoftBank, offered to invest $1 billion in Paytm. He raised that offer to $1.6 billion within a few minutes of conversation with Paytm founder Vijay Shekhar Sharma. Sharma disclosed this at an event organised by industry body PHD Chamber of Commerce and Industry in 2023.

“I was thinking if I get $100-200 million it would be good; $500 million would be great… Masa (Masayoshi Son) said, ‘I want to invest a billion dollars in your company’,” Sharma said, recalling his meeting with investors while raising funds to expand the digital payment platform he founded in 2010.

As Sharma was still processing the far better-than-expected billion-dollar investment proposal, he said that the SoftBank chief went on to sweeten the offer further.

SoftBank later announced a $1.4 billion investment in Paytm’s parent company One97 Communications, raising the valuation of the company to $7 billion. Just months earlier, in August 2016, chipmaker MediaTek had invested $60 million at a valuation of $5 billion. In less than a year, Paytm's valuation rose by over 40 per cent. Paytm went public in 2021 with a valuation of nearly $20 billion.

Like Paytm, several startups witnessed an exponential rise in valuations between 2010 and 2020, driven largely by the e-commerce and fintech sectors. Many companies that started business in early 2010s had turned unicorns — achieving valuation of over $1 billion — by 2020.

Annual funding raised by tech-dominated startups jumped from about $550 million in 2010 to nearly $15 billion by 2019, according to data analysed by startup intelligence platform Tracxn.

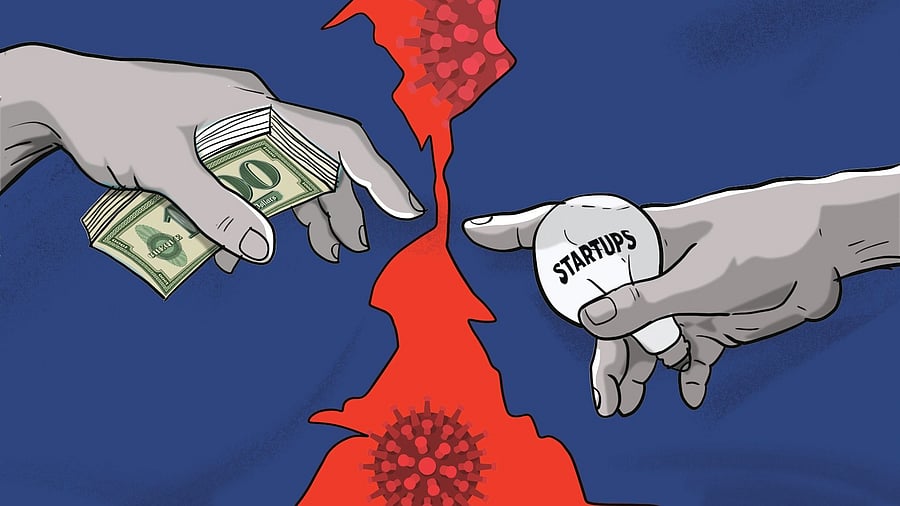

Big-ticket funding for late-stage startups has dried up in the post-Covid period. Startup funding fell from around $20 billion in 2021 to $4.2 billion in 2024. The median deal size dropped from $245 million in 2021 to $76 million in 2024. It declined further in 2025, falling to $32 million in the first half of the year.

The success of ChatGPT, which was launched by OpenAI in November 2022, has boosted artificial intelligence (AI)-powered startups, making AI the latest buzzword reshaping the tech ecosystem. However, venture capital and marquee investors don’t seem to be enthused by the hype.

Sumeet Hemkar, a partner at Deloitte India, a leading global consulting firm, said investors have become more cautious and are investing only when convinced of the real value of businesses.

“There is a marked difference on how investors are evaluating businesses. Look at what happened to Byju’s. They attracted large investments and their valuation skyrocketed and suddenly it turned out to be that there are actually not so many subscriptions or value of curriculum,” said Hemkar.

Byju’s, founded in 2011 as Think and Learn Pvt Ltd, became India’s first edtech unicorn in 2018. Its learning app was launched in 2015 and the pandemic-fuelled demand turned its founder Byju Raveendran into a poster boy of India’s startup ecosystem.

The company’s valuation peaked at $22 billion in 2022. By June 2023, however, Byju’s defaulted on loan repayment and the company is now mired in lawsuits and insolvency proceedings, with its valuation effectively dropping to near zero.

Hemkar said the Byju’s fiasco has forced the entire business ecosystem to think about what could be wrong in their portfolios. “Investors are now once bitten, twice shy. A lot of intelligence checks are happening. They want to make sure that what they are investing in is real,” he added.

The total value of big-ticket startup deals ($100 million and above) declined to around $2.5 billion in 2025 from $3.7 billion the previous year, according to data sourced from Venture Intelligence, a market intelligence firm. In contrast, the collective value of mid-sized deals ($10-50 million) increased from $3.5 billion in 2024 to $3.8 billion in 2025.

Government push

The Union government launched the startup India initiative in 2016 with an aim to “nurture innovation and catalyse the growth of startups across the country”. Nearly a decade later, about 1.8 lakh startups are recognised by the Department for Promotion of Industry and Internal Trade (DPIIT). India has emerged as the world’s third-largest startup ecosystem, with Bengaluru, Hyderabad, Mumbai and Delhi-NCR serving as the major hubs.

According to Tracxn, the total number of startups in the country stands at over 6.18 lakh. Of these, around 33,000 are funded companies that have collectively raised about $627 billion in venture capital and private equity. India is home to as many as 90 unicorns.

Over the past five years, 61,269 new companies have been founded, raising more than $8.78 billion in funding. Startups in India have witnessed 5,001 acquisitions and 5,441 IPOs, while about

1.06 lakh startups have shut down

operations.

AI ecosystem

AI has emerged as a key focus for startups in recent years. Nearly 89 per cent of new startups launched in 2024 incorporated AI in their products or services, according to a report released by the PIB Research unit. Leading sectors in AI adoption include industrial and automotive, consumer goods and retail, banking, financial services and insurance and healthcare. Together, they account for around 60 per cent of AI’s total value.

India ranks third globally in AI competitiveness, according to Stanford University’s 2025 Global AI Vibrancy Tool, a report that assessed AI growth and innovation between 2017 and 2024. The report mentions that India has the highest number of active users of AI apps like ChatGPT, Gemini and Perplexity.

“India’s AI ecosystem is moving from promise to performance, driven by initiatives like the IndiaAI Mission, large investments in cloud and digital infrastructure, and a vibrant developer community building solutions that meet global standards,” said CP Gurnani, co-founder and vice chairman, AIonOS, an AI innovation company, and former CEO of Tech Mahindra.

Global boom

The global AI market is projected to soar from $189 billion in 2023 to $4.8 trillion by 2033, a nearly 25-fold increase in just a decade, according to a UN Conference on Trade and Development (UNCTAD) report. AI is expected to emerge as a dominant force in the global frontier technology market, with its share rising from 7 per cent in 2023 to 29 per cent in 2033. The value of the frontier technology market that includes the internet of things, blockchain, electric Vehicles, solar photovoltaic, AI and others was estimated at $2.5 trillion in 2023. It is projected to jump to $16.4 trillion by 2033.

To capitalise on this boom, investors have poured hundreds of billions of dollars into AI infrastructure and related businesses.

According to a Stanford University report, global corporate AI investment reached $252.3 billion in 2024, with private investment rising by 44.5 per cent and mergers and acquisitions increasing by 12.1 per cent from the previous year.

Companies’ capital spending on AI is estimated to rise to $527 billion in 2026, according to a Goldman Sachs Research report.

US-based companies like Microsoft, Alphabet (Google), Amazon, Meta (Facebook, Instagram, WhatsApp), Nvidia and IBM dominate AI investments. These firms exercise significant control over AI infrastructure and are poised to reap maximum benefits.

UNCTAD has flagged widening global divides in AI development. In 2022, just 100 companies – mainly in the United States and China – accounted for 40 per cent of global AI research and development (R&D). Together, the two countries hold 60 per cent of all AI patents and produce about a third of global AI publications.

The United States received around 80 per cent of the global AI funding in 2025. Cumulative private-sector investment in the US from 2013 to 2024 stood at $471 billion, China ranked a distant second with $119 billion.

India lags behind

India lags far behind in investments in AI infrastructure. According to the UNCTAD report, India ranked 10th globally in attracting private investments in AI. In 2023, total private investment in AI in India stood at $1.4 billion, compared with $67 billion in the United States and $7.8 billion in China.

In March 2024, the Union government launched IndiaAI Mission with a five-year budgetary outlay of Rs 10,372 crore ($1.25 billion).

The allocation appears modest when compared with the plans outlined by several other countries. China has announced a $100 billion investment in AI while Saudi Arabia has outlined a $100 billion investment plan to establish itself as a major player by 2030.

What 2026 holds

This year, India aims to launch indigenously developed foundational AI models, including Large Language Models (LLMs). It is expected to be launched at the AI Impact Summit, which is scheduled to be held in New Delhi from February 19 to 20. This will be the first global AI summit ever hosted in the Global South.

“Sovereign AI will move from a policy conversation to a hard requirement, as governments and enterprises demand ownership over data, models and inference. AI in 2026 will be coordinated, voice-first, and sovereign by design,” said Ganesh Gopalan, Co-founder & CEO, Gnani.ai.

Apurv Agrawal, Co-Founder & CEO, Squadstack.ai, said the AI startup ecosystem in India would enter into a more mature and outcome-driven phase. “Investors are becoming far more discerning. Capital is flowing toward AI startups that are embedded directly into core business workflows, not sitting on the edge as assistive tools,” said Agrawal.

Ankush Tiwari, Founder & CEO of pi-labs, said, in 2026, AI capital would shift from model-centric bets to platforms that unlock real economic value. “We expect strong investment momentum in AI middleware, infrastructure and security layers that enable accuracy, scalability and cost efficiency at enterprise scale,” Tiwari said.

India’s startup ecosystem is witnessing a significant reality check. Post-2022, the influx of venture capital has slowed. There is a marked shift in strategy from prioritising “growth at all costs” to a focus on profitability, sustainability and solid fundamentals. Investors are now looking for a clearer path to profitability rather than just promises and high valuations. It would be interesting to see if AI could give the much-needed push to the startup ecosystem.