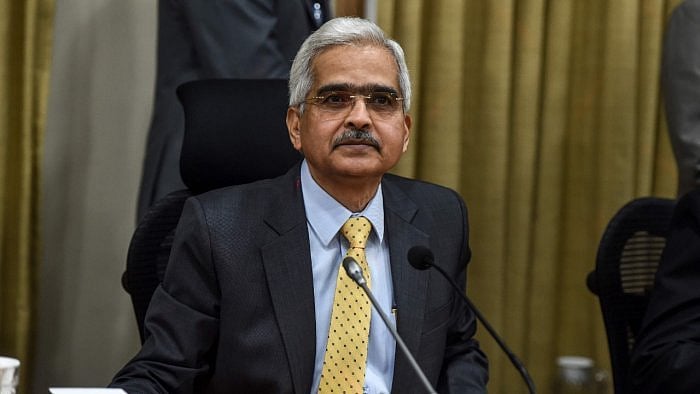

Resolving to be battle-ready to tackle Covid-19’s second wave, Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday announced steps to ease the economic hardship that included easier term of loan repayments by individual borrowers, small and medium businesses and others as well as Rs 50,000 crore liquidity for Covid-related healthcare infrastructure in the country.

The Rs 50,000-crore priority lending by banks is for hospitals, oxygen suppliers, vaccine importers, COVID drugs by March 31, 2022.

“The RBI is now focusing on increasingly channelising its liquidity operations, especially at the grassroots level,” Das said in an unscheduled press conference, adding that RBI stands in battle readiness to ensure financial conditions remain congenial and markets function efficiently.

He reiterated his commitment to work in close coordination with the government to lessen the impact of the pandemic on the people and businesses.

“The devastating speed with which the virus affects must be matched by swift, wide-ranging actions that are sequenced, calibrated and well-timed so as to reach out to various sections including the most vulnerable,” Das said.

He said India had flattened the COVID-19 infection curve in March. However, new mutants of the virus have emerged. He said wide-ranging and swift actions are needed against the spread of the second wave of Covid.

The steps announced are as such:

> Relaxation in rules for availing overdraft facility for state governments till September 30

> States to remain in overdraft for a maximum of 50 days vs 36 days at present

> Small finance banks allowed to on-lend to smaller microfinance institutions of asset size up to Rs 500 crore

> RBI re-opens one-time restructuring scheme for individuals, MSMEs till September

> Banks to create a Covid loan book under the scheme