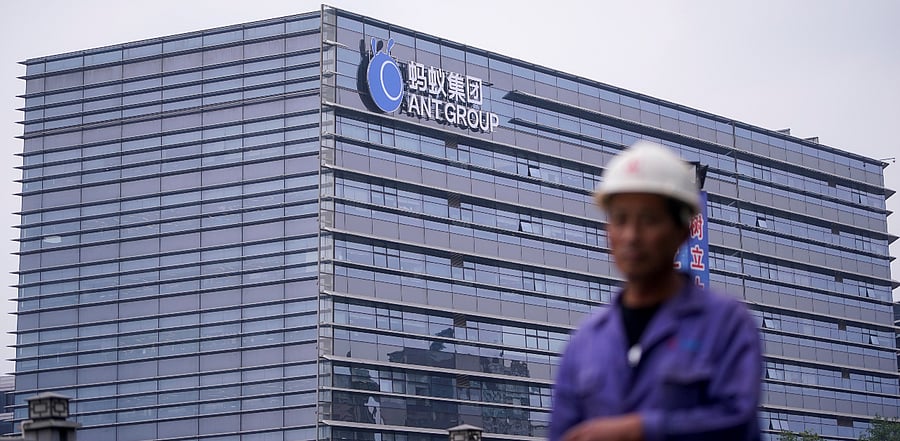

The Shanghai Stock Exchange suspended first-day trading in Ant Group on the Shanghai stock exchange just before its scheduled listing Thursday.

The exchange cited changes in the financial technology regulatory environment after regulators held a meeting Monday with senior Ant Group executives, including founder Jack Ma.

“This material event may cause your company to fail to meet the issuance and listing conditions or information disclosure requirements,” the stock market operator said in a statement issued to Ant Group.

Ant Group did not immediately comment.

In a statement issued on Monday, the People’s Bank of China, the China Banking and Insurance Regulatory Commission, the Securities Regulatory Commission and the State Administration of Foreign Exchange, said they had conducted “regulatory interviews” with Ma, Ant Group Chairman Eric Jing, and its president, Hu Xiaoming.

No further details about the meetings were disclosed by the authorities or Ant Group, although such a move by regulators is typically seen as a warning or dressing down of sorts.

Ant Group’s shares were due to begin trading in Hong Kong and Shanghai on Thursday, Nov. 5, after it was expected to raise at least USD 34.5 billion in what would have been the world’s biggest stock sale. Retail investors in Shanghai had placed bids for nearly USD 3 trillion worth of shares.

The company has come under increased scrutiny and tighter regulation as it has expanded the range of financial technology services it offers. Among the new regulations in recent months are caps on the use of asset-backed securities to fund consumer loans, new capital and licensing requirements and caps on lending rates.