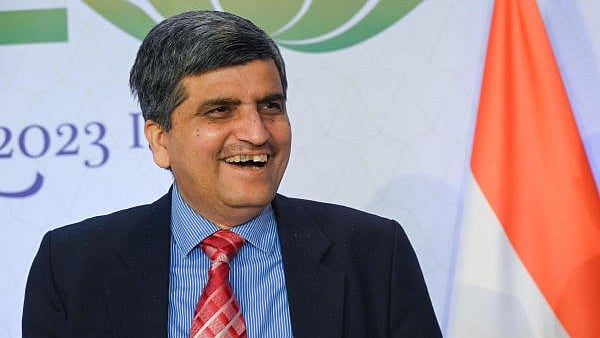

Economic Affairs Secretary Ajay Seth

Credit: DH Photo

Economic Affairs Secretary and Karnataka cadre IAS officer Ajay Seth is a core member of Union Finance Minister Nirmala Sitharaman’s team. His responsibilities also include heading the division that drafts and prepares the Union Budget. In an extensive interaction with DH’s Gyanendra Keshri and Arup Roychoudhury, Seth shared his views on India’s economic growth, noting that the current rate falls short of its potential. Excerpts:

Given the challenges of the urban consumption squeeze and geopolitical uncertainty, what was the Finance Ministry’s approach to this budget?

In the run-up to the budget preparation, the growth rate has moderated from the highs of the post-pandemic years. At about 6.5 per cent, the growth is lower than our potential. Our focus was on generating enough momentum to overcome the current economic moderation. In the year when the global economy has been doing well, we have done much better. When the global conditions are tough, we have performed slightly lower than our potential. So, the first thought was, how do we strengthen the domestic growth drivers? This gets reflected in how the budget tries to strengthen three domestic drivers: agriculture and the rural economy, MSME and manufacturing, and investment in infrastructure, people, and innovation. And the fourth one was the external global scenario. As per most organisations, for the next 3-4 years, global growth and trade will continue to be subdued. In that situation, how do we increase the competitiveness of our exports? We have to make decisions that are in India’s best interests. We should have better strength to compete, irrespective of what the rest of the world is doing.

Another issue was that we are at a stage where we require more investment, especially in labour, where we can improve the quality through skilling. In a populous country like ours, labour is not in short supply, but skilled labour is.

Then the issue with urban demand. While rural demand benefited from the monsoon, in urban areas some segments were doing better and some were not. Overall consumption is growing by 7 per cent, which is lower than the nominal growth rate in the economy. That is a clear signal that something needed to be done.

What kind of positive economic impact do you expect from the tax cuts? The initial estimate suggests a revenue foregone of Rs 1 lakh crore for the government, which effectively means injecting that amount directly into the economy. Beyond this direct impact, there’s likely to be a multiplier effect. Can you quantify how much this could boost consumption expenditure and GDP growth?

If you ask if there has been any modelling being done that X amount of tax foregone will lead to a Y amount of impulse to the economy, that kind of modelling is neither practical nor doable. But I can tell you what the different channels are through which this extra Rs 1 lakh crore, which is almost 0.3 per cent of GDP in the hands of the people, will do.

Say somebody has an extra Rs 1 lakh because of the tax savings. That person can buy an electronic good or a consumer durable, can repair their home, afford a better EMI to buy a new house or car, or go on a family trip, hopefully within the country. Or they can pre-pay their debt and be better prepared for their next requirement. Or if someone doesn’t need to immediately spend, they can invest or put it in a bank. That again gets ploughed back into the economy, and the impact of that will be immediate.

In the July budget, there were many schemes about jobs and skilling...

It has just been five months, those programmes are in the making, but there has been no discontinuity from that budget to this one. Take, for example, the PM internship programme. The idea was to test it and see what works and what doesn’t. That pilot has been done; the government is assimilating those lessons so that when the full programme is launched, it is without issues. As for the skilling schemes, they have been formulated, multilateral development banks are on board, and they are now in the final stages of approval. Similar is the case with the employment-linked incentive schemes. All these schemes will be launched shortly.

The budget also has a clear announcement on employment-led development. It says we will support the sectors wherein employment is significant. That is a statement of intent. Then the support to industries like footwear, a labour-intensive sector. Plus the manufacturing mission, which can improve processes and create more industries and jobs.

This budget had a renewed push on public-private partnerships. Is this another way of crowding in private investment, since there is a limit to the government’s own capex spending?

First, I will say that there is a clear continuity in thought and action. And then there is perseverance, which means one can keep on trying till one succeeds. The July budget clearly said that we will significantly improve public capex. The idea is to increase it to a certain level as a percentage of GDP and maintain it. The capex was increased to over 3 per cent of GDP in the July budget. In this budget also, it is above 3 per cent. Moving forward, our aim would be to maintain it at that level relative to the GDP. Moreover, the Government of India provides a significant amount to states for their capital expenditure. If you add all that, the effective capex is over Rs 15 lakh crore—around 4.3 per cent of GDP. Our fiscal deficit is budgeted at 4.4 per cent of GDP. Meaning, almost the entire borrowing of the GoI is being used for capital asset generation.

Can we aim for capex higher than fiscal deficit?

That's what it should be. Now, if you were to say that effective capital expenditure will be more than the fiscal deficit, that's a situation of a revenue surplus. From the mid-1970s onwards, we have not reached that position.

What about private capex?

We need to push capex from all three sides— the GoI to maintain it at over 3 per cent of GDP. States can have another 3 per cent with 2-3 per cent coming from the private sector. The July budget talked about a financing framework. That report is ready. We expect it to come out in the coming weeks.

There were expectations of PLI in more sectors like deep tech, but nothing of that sort was announced in the budget.

The PLI is a focused scheme. It is focused on those 14 sectors. That will be done. Now, the intervention is moving a notch higher. We will see what is missing in different sectors. Is it a quality issue? Are they facing problems in getting equipment? It is a more evolved way of supporting the industry. We are facilitating the private sector to be partners in research and development. Rs 20,000 crore has been provided for private sector-led R&D.

Union Budget 2025 | Nirmala Sitharaman, as Finance Minister, presented her record 8th Union Budget this time. While inflation has burnt a hole in the pockets of 'aam janata', the Modi govt gave income tax relief for those making up to Rs 12 lakh per year in salaried income. Track the latest coverage, live news, in-depth opinions, and analysis only on Deccan Herald. Also follow us on WhatsApp, LinkedIn, X, Facebook, YouTube, and Instagram.