For many of us in India— whether working in Bengaluru’s IT hubs, Chennai’s manufacturing corridors, or Hyderabad’s corporate offices—retirement often feels like a distant milestone. We’re busy juggling careers, EMIs, children’s education, and caring for aging parents. Planning for our own retirement rarely makes it to the top of the list.

More often than not, people begin to think about retirement only after a negative life event—such as a sudden health issue, a job loss, or a financial shock. But waiting for such a trigger can be costly. True financial resilience comes from preparing before the storm, not after it.

The Reality of Rising Costs

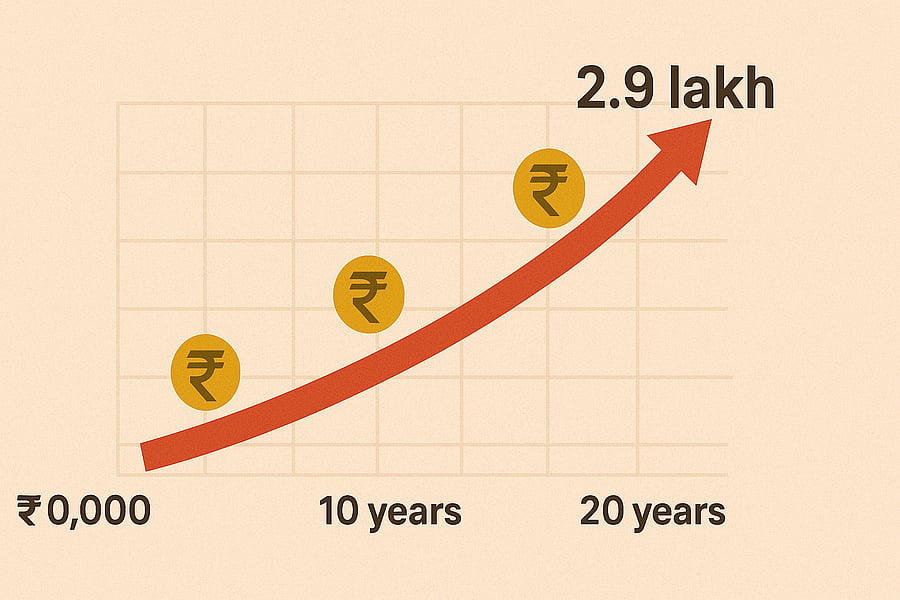

Let’s put things in perspective. The average cost of maintaining a middle-class lifestyle today in Indian metros is around ₹50,000 per month. Assuming an average inflation rate of 6%, this same lifestyle will cost:

• In 10 years: ~₹90,000 per month

• In 20 years: ~₹1.6 lakh per month

• In 30 years: ~₹2.9 lakh per month

That means a young professional in their 30s today will need several crores set aside just to maintain their current standard of living post-retirement.

Delaying your planning until a health scare or financial setback hits only makes the journey harder. The earlier you start, the more power compounding gives you.

Why HDFC Life Click 2 Retire Makes Sense

HDFC Life Click 2 Retire is designed for salaried professionals who want a stress-free retirement. It helps you prepare systematically with two standout benefits:

1. Market-Linked Growth

Your money is invested in funds that have the potential to deliver higher returns over the long term, helping you beat inflation and grow your retirement corpus.

2. Zero Premium Allocation Charges

From day one, 100% of your premiums are invested, ensuring your money starts working harder for you immediately.

By starting early, you give your retirement fund the time it needs to grow—without waiting for a negative life event to push you into action.

The Smarter Indian Way

In India, we often pride ourselves on planning ahead—whether it’s for our children’s education, building a family home, or starting a business. Retirement deserves the same foresight.

Don’t wait for a crisis to remind you of the importance of financial security. Begin today and let HDFC Life Click 2 Retire help you build a future that is strong, independent, and dignified.

Learn more about how you can start early: HDFC Life Click 2 Retire