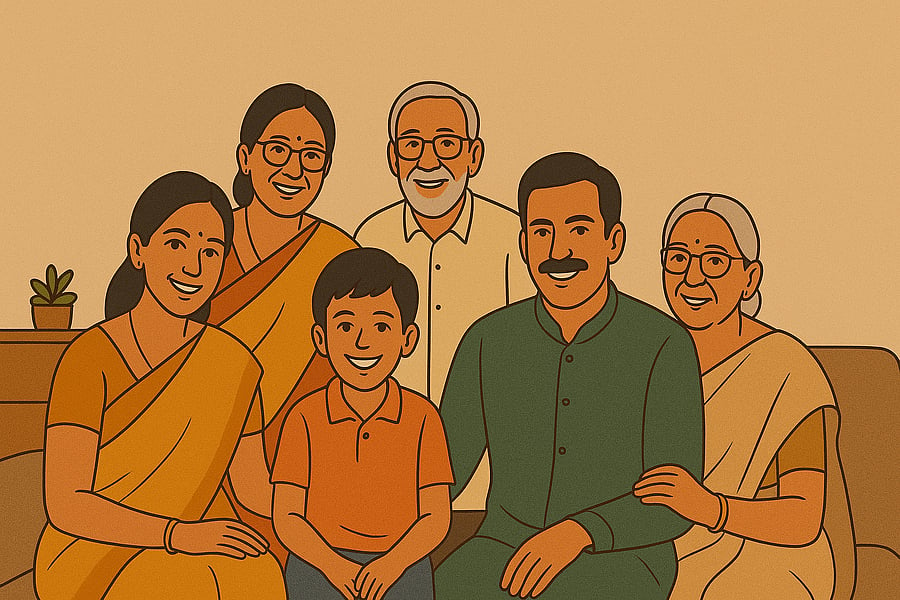

In many homes across South India—whether in Bengaluru, Chennai, Hyderabad, Kochi, Coimbatore, Madurai, Vijayawada or Mysuru—family is a connected system where responsibilities and support flow across generations.

This closeness is our strength — but it also means financial protection must extend beyond just one earning member.

This is where a family-first term insurance plan becomes important.

Why HDFC Life Click 2 Protect Supreme Fits Multi-Generational Households

1. One Plan to Protect the Entire Family

Instead of maintaining multiple policies, you can cover yourself, your spouse, your children, and even parents/grandparents under one plan.

This reflects the joint-family ethos many South Indian homes value.

2. Flexibility to Choose Protection Based on Needs

The plan offers multiple cover variants, such as:

Life Protect – Pure life cover

Income Plus – Life cover + regular monthly income to family

Life & Critical Illness – Covers up to 60 critical illnesses

This ensures your protection matches your family’s realities.

3. Covers Medical Emergencies & Unpredictable Events

You can enhance the plan with:

Accidental Death Benefit

Premium Waiver Benefit in case of critical illness

Critical Illness Benefit that supports treatment costs

This helps safeguard both health and financial well-being.

4. Option to Get Your Money Back

With the Return of Premium option, all premiums paid are returned to you at policy maturity — allowing protection without loss.

5. Adjust Cover as Your Family Grows

If you:

Get married

Have a child

Take a home loan

You can increase coverage without having to buy a new policy.

A Real Example in Our Region

Anitha and Prakash from Coimbatore:

Both work in the IT sector

Raising a young child

Supporting elderly parents at home

By choosing HDFC Life Click 2 Protect Supreme, they ensured:

Protection for both spouses

Future financial security for their child

Support and dignity for Prakash’s parents

This gives the family emotional peace + financial clarity.

Because Family Means Standing Together

We celebrate together.

We support each other.

We grow together.

So why should only one person be protected?

A family-based term plan ensures that your family's progress continues — no matter what.

Protect the Family That Protects You

Learn more about the plan here:

https://www.hdfclife.com/term-insurance-plans/click-2-protect-supreme

Insurance is the subject matter of solicitation. Please read all scheme-related documents carefully.