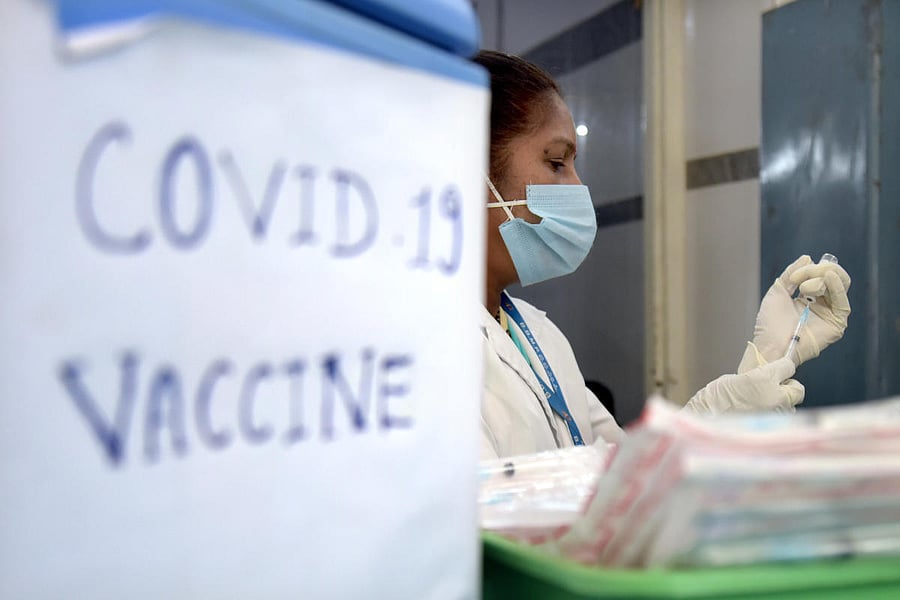

India is into the third week of vaccination against Covid-19, with some reports emerging of adverse events following immunisation (AEFI).

A concern many have, ahead of the vaccination being rolled out for all citizens, is whether medical insurance policies cover adverse effects.

Only frontline health workers are being inoculated now.The fallout of a vaccine is covered if the patient is hospitalised, says an insurance expert.

“A vaccine is a mild form of the virus meant to inoculate you against the virus. If your health is affected by this, then the insurance policy will definitely cover you,” he says.

Kiran B R, sales training manager (South India), Bajaj Allianz General Insurance, says, confirmed the hospitalisation caveat. “If the treatment is in the out-patient department, the policy does not cover it,” he says.

Bajaj Allianz’s ‘Corona Kavach’ provides coverage for 9.5 months and up to Rs 5 lakh. “This includes consumables like masks and PPE kits, but does not include non-medical expenses like sanitisation,” he says.

Muralidhara B A, agent for Oriental Insurance, says all expenses are covered in case of hospitalisation. “We have a Covid insurance policy, where consumables are also covered. The policy can be taken for three, six or nine months and the coverage can be up to Rs 5 lakh,” he says.

Medical insurance saw a boost in sales in 2020. “Its sales overtook motor insurance last year,” he says.

Dedicated packages

Clinikk Healthcare, which provides affordable health insurance and healthcare cover, has a comprehensive Covid-19 insurance plan.

“We have a team of doctors, and even our normal health insurance policy covers expenses when hospitalisation occurs,” says Bhavjot Kaur, co-founder.

Clinikk is planning to create a sachet policy, which covers all side effects of the vaccination, she adds.

Onsurity, a Bengaluru-based health-tech company, provides health insurance to MSMEs and startups. Yogesh Agarwal, founder, says, “Effects of vaccinations can be short term and long term. The ones that present themselves within two to three weeks are short-term and the others may surface after years of latency.”

The startup is planning a product that covers treatment short-term effects of the vaccine. “The sum insured is Rs 5 lakh. We hope to roll this out by the end of February,” he adds.

Vaccine makers’ liability

If someone administered the vaccine is affected permanently or dies due to the vaccine, a medical insurance policy won’t help.

“This comes under a comprehensive liability insurance policy either taken by the vaccine maker or whoever is administering it,” says an insurance

expert.

If the vaccine is in the production stage, coverage is through a clinical trial liability policy, he explains.