The focus is to identify and bring properties under the ambit of our taxes,” Rural Development & Panchayat Raj (RDPR) Minister Priyank Kharge said.

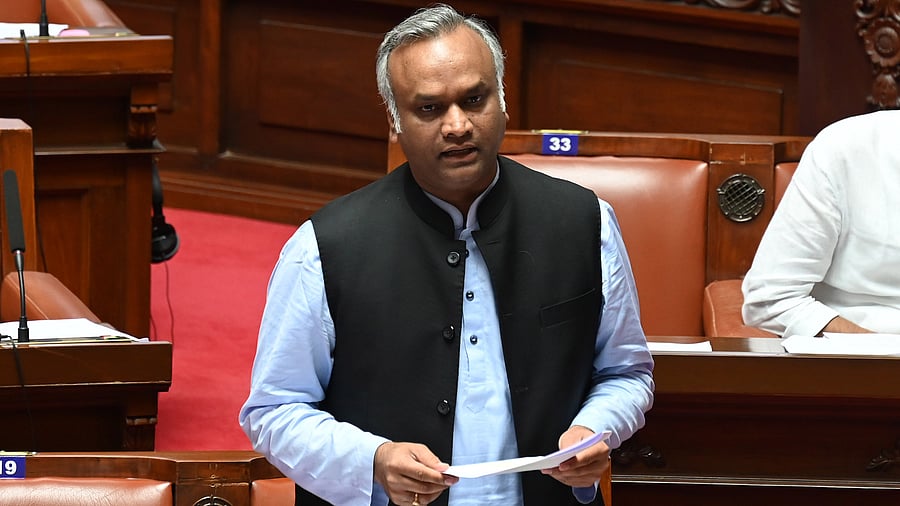

Credit: PTI File Photo

Bengaluru: The state government has drafted a new set of rules to streamline taxation and increase levies in rural areas.

The draft of the Karnataka Gram Swaraj & Panchayat Raj (Gram Panchayat Taxes, Rates and Fees) Rules, 2025 have been notified and are up for public scrutiny.

The rules propose a survey of all rural properties in March so that assets that have been left out can be brought under the tax bracket from April.

“The focus is to identify and bring properties under the ambit of our taxes,” Rural Development & Panchayat Raj (RDPR) Minister Priyank Kharge said. “At present, there’s taxation only on land. No tax is levied on any building that comes up on that land. Even the building should come under the tax net,” he said.

According to the minister, many properties, including educational institutions, are not under the tax net of gram panchayats.

In 2024-25, gram panchayats collected Rs 1,237 crore in taxes. This was just around 54% of the total tax potential, Priyank said.

The rules propose to cover apartments, villas, homestays, resorts, complexes, malls and other types of buildings.

Under the draft rules, “capital value system” is followed for taxation methodology. The capital value of a property is calculated based on the prevailing guidance value, which is bound to increase the rate of tax.

However, Priyank said the draft rules have not been prepared with the intention of hiking taxes. “There’s no question of upward revision. This is about identifying properties and monetising them,” he said.