Hubballi: Officials of the customs field formations and directorate of revenue intelligence (DRI) under the Central Board of Indirect Taxes and Customs (CBIC) have seized 10,202 kg of gold worth Rs 5,867 crore at the 22 international airports in the country over the last five years.

Nearly 25% of the total confiscation of illegal gold being smuggled into India was at Mumbai airport (2,578.4 kg worth Rs 1,460 cr) followed by Delhi (1,370.96 kg; Rs 742 cr), Chennai (1,274.25 kg; Rs 676 cr) and Calicut (1,159.11 kg; Rs 591 cr).

Karnataka, which has two international airports in Mangaluru and Bengaluru, saw the recovery of 135.85 kg (worth Rs 75 cr) and 441.58 kg of gold (worth Rs 263 cr), respectively, in the last five years.

Cases decline

According to a statement by the finance ministry in parliament recently, there has been a decline in smuggling of the precious yellow metal into India since 2024-25.

Data shows that customs officials seized the highest illegal gold consignments in 2023-24.

The CBIC, as per the reply in Rajya Sabha, attributes the confiscation of such huge consignment of gold to constant vigil and by taking operational measures based on intelligence, passenger profiling with the aid of Advance Passenger Information System (APIS), risk-based interdiction and targeting, non-intrusive inspection like baggage scanning; rummaging of carriers, including aircrafts, and coordination with other agencies.

Customs officials have arrested 5,689 people across India in gold smuggling cases during this period. However, only 16 people have been convicted for the crime in the last five years.

One of the main reasons for poor conviction, according to officials, is the lengthy legal process, where the accused persons can approach higher courts.

Narayanaswamy G, retired principal additional director general of the National Academy of Customs, Indirect Taxes and Narcotics (NACIN), says individuals are allowed to bring with them a certain amount of gold while returning from abroad.

“Men are allowed to carry gold worth Rs 50,000, while women can bring gold worth Rs 1 lakh as free allowance, if they have stayed abroad for more than one year. If they carry more gold than the free allowance and declare it to the customs, they are allowed to carry the same with them after paying 6% customs duty. If the passenger has not fulfilled this criteria, he or she is allowed to carry (reasonable quantity) gold, after the payment of 35% customs duty. Such passengers are allowed to re-export it, if they wish,” he says.

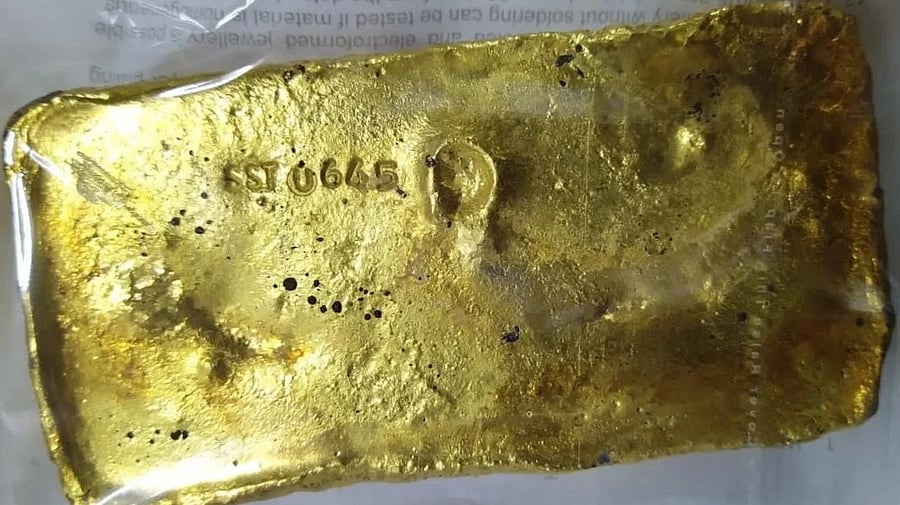

“In case of seizure and confiscation of concealed smuggled gold, it is deposited with the mint of Reserve Bank of India, which evaluates the gold and sets aside the money in nationalised banks. If the accused person wins the case, which is highly unlikely, the money is transferred to the person’s account. Otherwise, it goes to the government’s account,” he says.