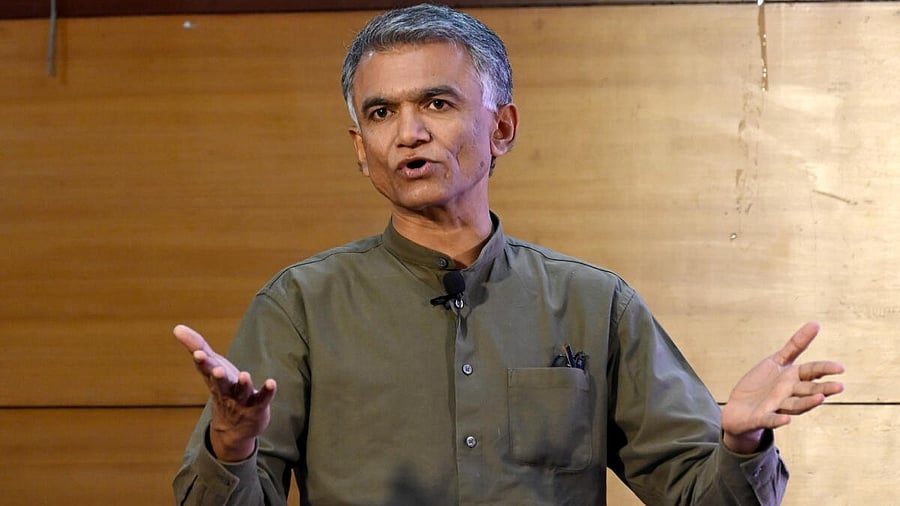

Krishna Byre Gowda.

Credit: DH Photo

Bengaluru: Revenue Minister Krishna Byre Gowda claimed on Tuesday that the proposed new GST rate rationalisation will cause Karnataka an additional loss of Rs 15,000 crore, in addition to the Rs 70,000 crore being lost currently.

"How can any state government have autonomous administration if there are such losses? No government can function without revenue. Should we stand with folded hands before the Centre? Should we run the government based on whatever they give? If it happens like that, what’s the meaning of state government? This will be a namesake government, but in reality a glorified municipality," he told a press conference on the eve of the GST council meeting.

“The union government says that if this is rationalised, income will rise due to revenue buoyancy. However, ever since the GST was introduced, each rationalisation has led to decline in income. Before GST, 6.1% of Gross Domestic Product (GDP) used to come from central excise and Value Added Tax (VAT). It dropped to 5.8% later. Similarly, Karnataka used to derive 3.6% of its Gross State Domestic Product (GSDP) from VAT. It dipped to 2.9% later.”

“More than 50% was used by companies for their profit. This has been shown by studies by GST council. The profit should completely go to people. If you don’t do that and only do rationalisation, corporate companies will benefit in the name of the people.”

Gowda, who will represent the state in the GST council meeting on September 3 and 4, explained the math behind how the state government had lost Rs 70,000 per year due to GST system.

Gowda said "progressive" states like Karnataka and TN were suffering due to GST system, where tax collected by these states goes as settlement (IGST) to other states.

Explaining why states like Karnataka, TN, Maharashtra and Telangana had progressed, he said: "We have physical infrastructure and human resources, because of which capital has come here. We have ensured social welfare. We aren’t getting everything that’s produced here. If our hands and legs are tied, won’t the country suffer?”