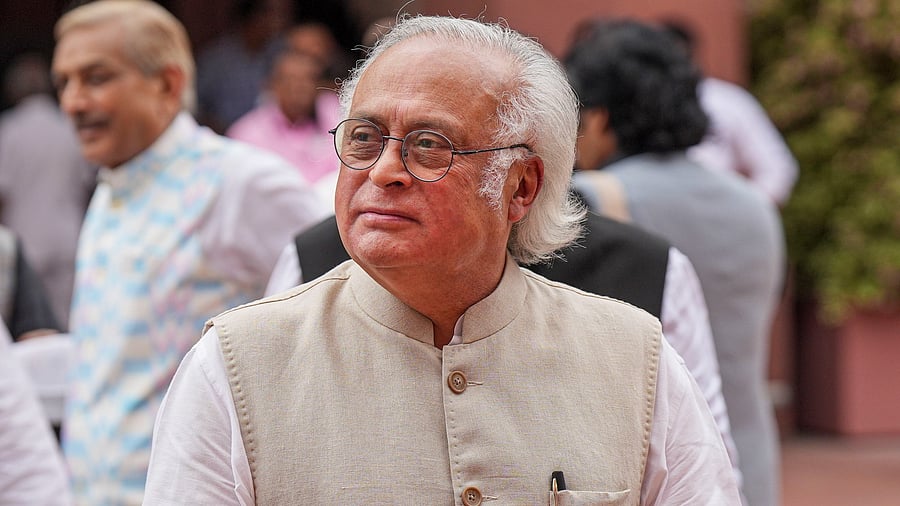

Congress general secretary in-charge communications Jairam Ramesh.

Credit: PTI Photo

New Delhi: Congress on Friday night attacked the Narendra Modi government for abstaining from voting in International Monetary Fund (IMF) when it considered fresh loans of USD 1.3 billion, saying a "strong no" would have sent a powerful signal.

The party had on April 29 said that Congress expects India to strongly oppose the proposal for a new USD 1.3 billion loan under the IMF's Resilience and Sustainability Facility at a meeting of the Executive Board of the multilateral body.

"On April 29, the INC had demanded that India vote against the IMF loan to Pakistan, which was considered today by its Executive Board. India has only abstained from the vote. The Modi government has chickened out. A strong NO would have sent a powerful signal," Congress General Secretary (Communications) Jairam Ramesh posted on 'X'.

Late night, the Ministry of Finance said in a statement that India pointed out in the IMF meeting that rewarding continued sponsorship of cross-border terrorism sends a dangerous message to the global community, exposes funding agencies and donors to reputational risks, and makes a mockery of global values.

"The IMF took note of India’s statements and its abstention from the vote," the Ministry said in a statement.

Congress Media and Publicity Department Chairman Pawan Khera said, "The Modi government was expected to not only vote against but also to lobby with other members to oppose fresh IMF loans to Pakistan. But the Modi govt chose to abstain from voting."