Chennai: Just when the textile hubs of Tiruppur and Coimbatore were optimistic about the India-UK trade agreement, which promised to enhance their competitiveness in the key British market, US President Donald Trump’s imposition of a 25 percent tariff on Indian products took them by surprise.

As much as 40% of bed linens, towels, and kitchen linens exported from Coimbatore and Karur go to the US, while over 35 percent of knitwear exported from Tiruppur is destined for the North American nation.

The levy of a 25% tariff plus penalties comes at a time when exporters in Tiruppur have been flooded with enquiries from several US brands ready to place orders due to heavy tariffs imposed on countries like Bangladesh (35%), Myanmar (40%), and China (125%).

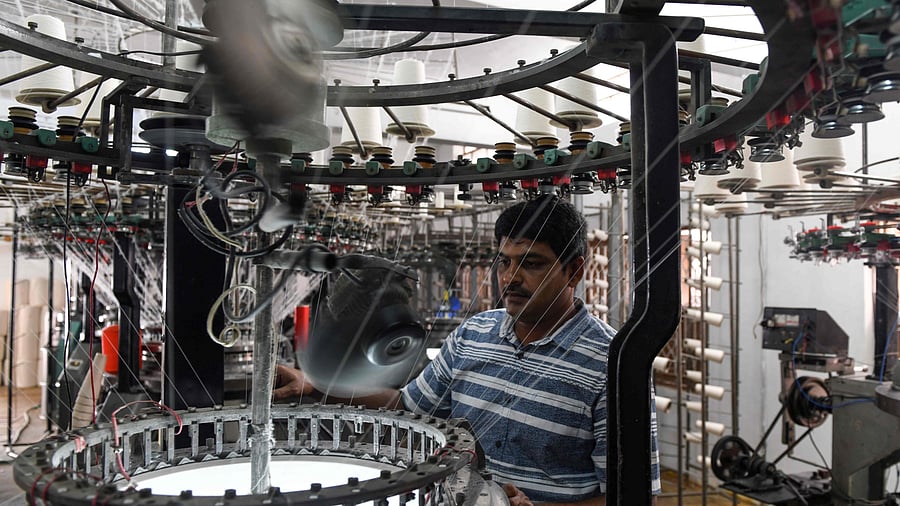

Tiruppur, known as India’s knitwear hub, contributes almost 55% of the country’s exports in the sector and supplies major US brands like Walmart, GAP, and Costco. These brands even appointed third-party audit firms in 2024 to evaluate companies that could handle increased orders amid the political crisis in Bangladesh.

In 2024-2025, Tiruppur recorded Rs 40,000 crore in knitwear exports and hoped to increase the figure by 10-15% in the 2026-2027 fiscal year. However, if the new tariffs are not withdrawn, they could pose a significant problem.

Tiruppur Exporters’ Association (TEA) President K M Subramanian told DH that knitwear firms will certainly be affected by the tariffs in the short term but expressed hope that they will bounce back. “We are already paying 16% import duty and 10% tariff. We don’t know what 25% means?” Subramanian asked.

He said major players in the US may continue to work with buyers in Tiruppur in the long run because India has the lowest tariffs among the countries exporting knitwear and textiles to America.

“The only country with lower tariffs than India is Indonesia, but it is not a major player in the textile industry. We hope the tariffs will be reduced due to pressure from American consumers, who will certainly protest against price hikes of the end products,” Subramanian added.

Dr K Selvaraju, Secretary General of The Southern India Mills’ Association, Coimbatore, said the tariffs would not be good news for mills, as many supply bed linens, towels, and kitchen linens to the US market.

“A 25% tariff will still be manageable in the short term, but we hope the Indian and US governments will sit down to resolve the issue soon. We cannot keep paying higher taxes,” he said.

Selvaraju also noted that the existing 11% import duty on cotton has already stagnated exports but expressed hope that the India-UK Free Trade Agreement will help scout new buyers in the British market.

Another leading exporter in Tiruppur said the only saving grace in this situation was the high tariffs imposed on countries that India competes with in the garment sector.

“We are the cheapest for US buyers, while even Bangladesh faces 35% tariffs. The disappointing part is that this comes at a time when the US market was opening up to Indian firms. Many firms are already adding machinery to meet increased US demand. We hope the tariffs are withdrawn,” he said.