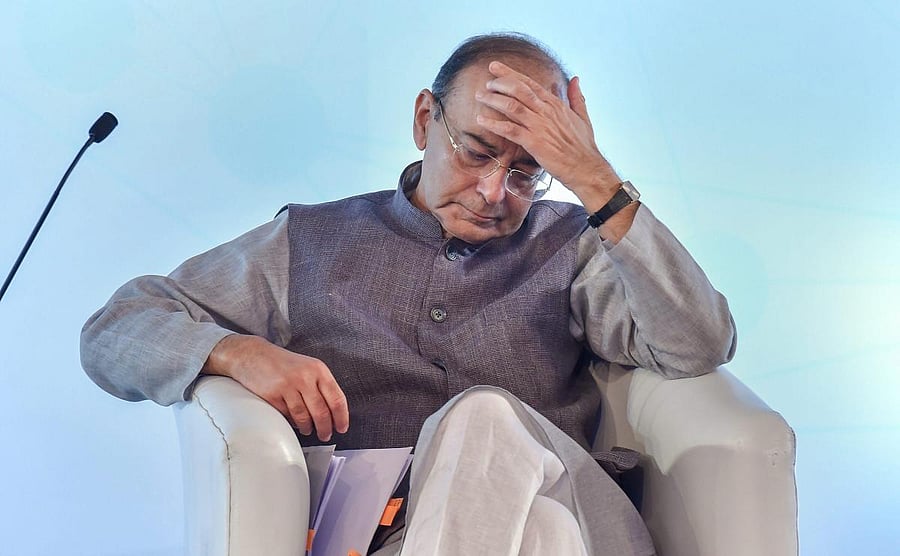

Finance Minister Arun Jaitley on Saturday made a case for reducing taxes on petrol and diesel but only after the non-oil taxes increase to contribute enough to the country's gross domestic product (GDP).

“Taxes on oil must come down in India but, not at the cost of Fiscal Deficit. Non-oil tax to GDP ratio in India has to increase. Once that happens the dependence on oil taxation will come down," he said at ET Awards ceremony.

Consumers in India pay over 50% tax on petrol and diesel, one of the highest rates in the world.

Historically, the governments in India have reduced the prices of transport fuels by cutting duties on them which has a huge impact on their finances as a fiscal deficit or the differences between government's expenditure and revenue rises.

Jaitley said a wide array of reforms undertaken in the last four-and-a-half years of Prime Minister Narendra Modi-led government such as GST and demonetisation were the game changer and have increased the tax base like never before.

He, however, said that oil prices continue to pose a big challenge for the country which is a net importer. To this context, he said if other fiscal targets are kept under control, the ability to face this challenges will be higher.