Rare earth element produced by china - commercial war with USA

The buzzword in the planet’s history today is rare earth elements. These are required to manufacture batteries, renewable energy technology, defence infrastructures, mobiles and computers. China has funnelled $57 billion to control critical mineral supplies.

To counter China’s dominance in the supply chain of all critical emerging technologies, the new US administration is stepping up the extraction and processing of rare earth elements like dysprosium oxide and neodymium in Texas mines. Trump’s interest in Greenland, reportedly rich in critical and rare earth minerals, is part of a broader strategy to reduce US dependence on China.

The first significant use of REEs came with the adoption of colour TVs in the 1960s, initially mined in California. Mining these elements generates a massive overburden, leading to unprecedented environmental and health issues. The traditional mining of REEs was labour-intensive. However, with lower wages and laxity in environmental laws, China took it up in a big way, and the USA was left behind.

China built mines for the magnet industry, and high-tech countries like the USA and Japan depended on it. After the 2010 territorial conflict, China put an embargo on selling REEs to Japan. However, even today, a significant chunk of REE mined outside China continues to be sent to China for separation, refining and magnet production. China thus dominates the REE supply chain.

In support of building a robust and secure supply chain of REEs, US Congress has approved $800 million for research in mining and recycling, innovative separation and recovery technologies, and increasing efficiency to lower demand.

Currently, the USA, Australia and Malaysia occupy second, third and fourth positions. India is the fifth largest producer of REE. Brazil, Canada, South Africa, Sri Lanka and Thailand also contribute to global production. Due to the geopolitical situation, 35% of REEs were extracted outside China in 2022.

The chemistry

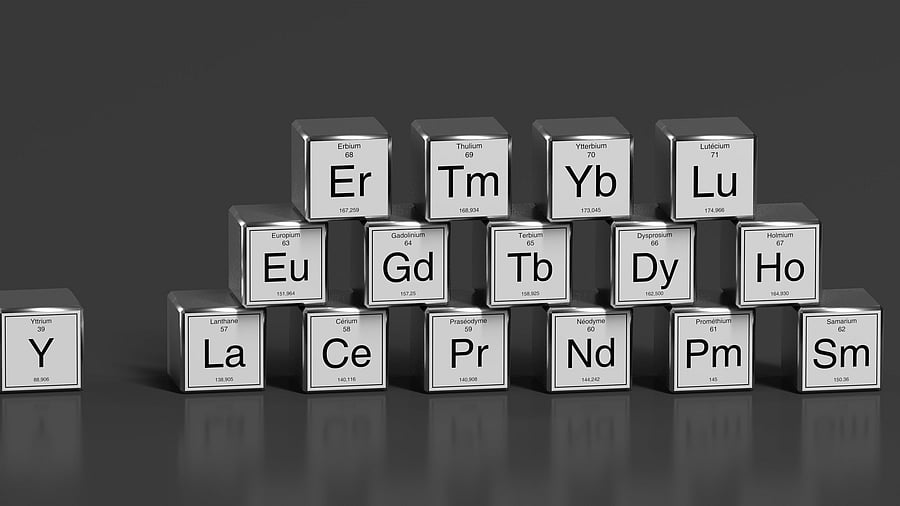

There are 17 rare earth elements (REEs) in Group 3 of the periodic table, comprising scandium, yttrium, and the lanthanide series of elements in the F block. All these are found in the same ore and deposits and possess similar physical properties. China, which accounted for 38% of global production of REEs in 1993, increased to 97% in 2013. Subsequently, other countries have stepped up REE production.

Lanthanum (La), cerium (Ce), praseodymium (Pr), nodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), scandium(Sc), and yttrium (Y) are the 17 REEs. The atomic number of the first fifteen REEs goes from 57 to 71, whereas the last two, i.e. Sc and Y, have atomic numbers 21 and 39, respectively.

In other words, La has an atomic number of 57, Ce has 58 and so on, and it ends with Lu, which has an atomic number of 71. All elements from La to Lu are called lanthanides, or transition or F block elements. One additional electron is filled in each successive element’s 4f orbital. The most important properties of this block are that the elements form coloured compounds and possess high magnetic strength.

Further, the elements of the block form coordinate compounds, which are generally unstable compared to ionic and covalent compounds. These elements are characterised by high density, melting point, conductivity, and thermal conductance. REEs usually occur in bastnaesite (a fluorocarbonate in igneous rocks), xenotime (Yttrium phosphate found in mineral sand deposits, loparite occurring in alkaline igneous rocks, and monazite (a phosphate).

High-value usage

These elements have applications in over 200 high-tech consumer products, namely electric and hybrid vehicles, computer hard drives, flat screen monitors and TVs, cellular telephones, and defence applications like electronic displays, guidance systems, lasers, submarines, radars, sonar systems, etc. Though the quantity of REE used is insignificant, it is essential for the functioning of any technology. For instance, magnets made of REE may look insignificant compared to the product’s total weight, but they are critical for the spindle motors and voice coils of desktops and laptops to function correctly.

Neodymium (Nd) magnets made of Nd, iron and boron have the highest strength and can withstand 230 degrees Celsius temperature. Magnets are used in automobiles, computer hard disks and digital cameras. Lanthanum (La) is used for digital and cell phone cameras. La is also used in petroleum refining and steel making. Eu, Y and Tb are used in phosphors that emit luminescence. Er is used in optical fibre and laser repeaters. Ce-based alloys are used in catalytic converters. Ce is also used in water purifiers.

Praseodymium (Pr), neodymium (Nd), dysprosium (Dy), and terbium (Tb) are a few REEs mainly extracted in India with high levels of purity. At the same time, several other heavy REEs are not available in extractable quantities. India’s REEs are found in monazite minerals in coastal states, mainly with thorium in coastal sands. Sand mining in coastal areas is thus strictly regulated.

Indian Major Earth Ltd in Visakhapatnam is a major player in mining, processing and producing rare earth compounds. It collaborates with Japan’s Toyota Tsusho corporation. India and the US also signed a collaboration last year focusing on processing and strengthening environmental, social and governance frameworks to reduce dependency on China’s REEs.

The extraction of REEs causes considerable environmental and health hazards, with large amounts of toxic waste contaminating air, water bodies, and soil. Every tonne of REE produced results in generating 2000 tonnes of toxic waste. Rare earth ores are laced with radioactive uranium and thorium, causing significant risk to human health, especially the mine workers on the extraction sites. Millions of tonnes of wastewater are generated in China annually during REEs’ extraction, separation and refinement.

Managing this is a costly affair, and experts say that the entire cost of cleanup should not only be shouldered by the Chinese government but also by rare earth industries, global companies and the consumers benefitting from the technologies.

(The author is a retired Principal Chief Conservator of Forests (Head of Forest Force) Karnataka)