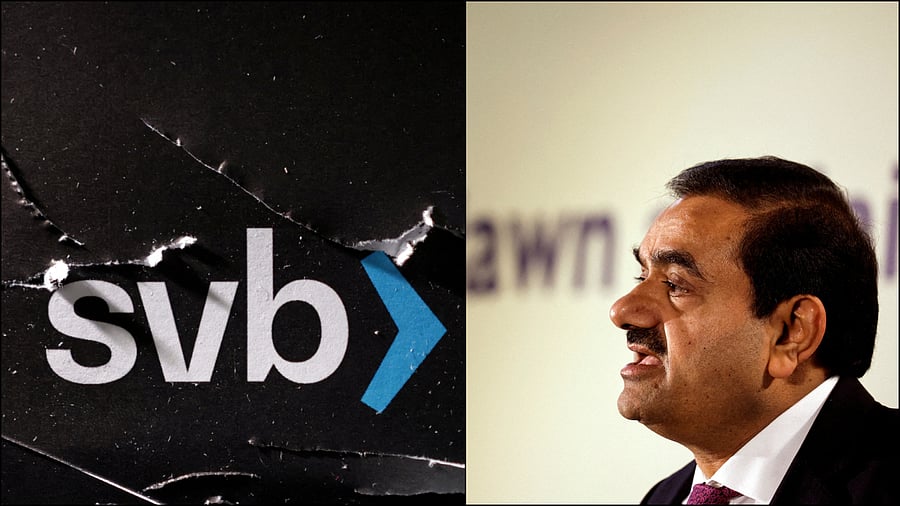

California banking regulators shut down Silicon Valley Bank (SVB) on Friday after a run on the lender, which had $209 billion in assets at the end of 2022, with depositors pulling out as much as $42 billion on a single day, rendering it insolvent.

SVB was deeply entrenched in the tech startup ecosystem and the default bank for many high-flying startups. The bank slid into insolvency when its customers, largely technology companies that needed cash as they struggled to get financing, began withdrawing their deposits. The bank had to sell bonds at a loss to cover the withdrawals, leading to the largest failure of a US financial institution since the height of the financial crisis in 2008.

However, this news sparked fresh criticism of US short-seller Hindenburg Researcher, which had flagged discrepancies in stocks of the Adani Group, which led to a rout in Indian stocks sending Adani's market capital plummetting. Twitterati were quick to call out Hindenburg's 'accuracy' which failed to flag SVB's collapse.

One Twitter user said "Adani Group has paid back all of its loans (on share Collateral), whereas Silicon Valley Bank has collapsed. Hindenburg Research labelled Adani as a scam but said nothing about SVB. It sort of demonstrates how accurate Hindenburg Research is."

Another used said, "Albeit with short position, had the Hindenburg or George Soros warned US agencies on time, this could have been averted."

"Why couldn't Hindenburg see SVB?! Proof that Hindenburg was just doing a hit job on Indyeah..." said another.

A lot of users on Twitter said that Hindenburg should have "worked on SVB instead of wasting time on Adani".

Since Hindenburg's report on Adani, the Opposition in India too has been demanding a Joint Parliamentary Committee probe into its links with the Modi government. The Opposition believes that the group of companies received several unfair advantages under the regime.