The sentiment turned bullish in the opening trade itself after a five-day losing streak. Marketmen said investors became aggressive buyers after the announcement of EU-IMF package, which prompted the foreign institutional investors to return to emerging economies, including India.

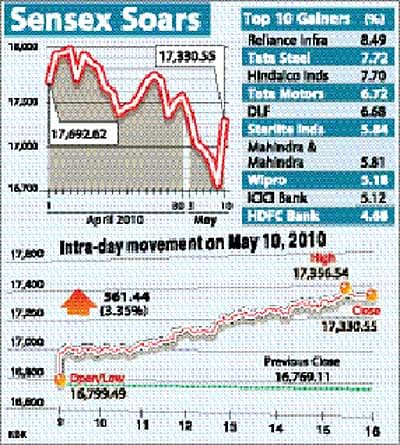

The Bombay Stock Exchange's the 30-share Sensex closed the day higher by 561.44 points or 3.35 per cent to settle at 17,330.55. In the five days of straight losses, the index had lost 789 points to trade below 17,000-level.

The biggest one-day gain before today was on July 17 when the index rose 561 points.

IIFL Vice-president (Research) Amar Ambani said today's aggressive buying and positive investor sentiment matched the rally seen when the UPA was returned to power at the Centre.

The wide-based 50-share Nifty index of the National Stock Stock Exchange too 3.50 per cent to end at 5,193.60 points.

The bailout package was announced in Brussels before the opening of trade in Asia. Brokers said domestic markets rose in tandem with Asian bourse and got a further boost in mid-session after European shares opened sharply higher.

The 27-nation European Union and the IMF on Sunday night reached a deal on a gigantic 750 billion-euro (USD 1 trillion) "crisis fund" to defend their common currency euro from attacks by speculators and to help bailout heavily indebted economies facing bankruptcy.

Under the plan, the European Union will make available 60 billion euros (USD 75 billion), while the countries from the 16-nation eurozone would provide bilateral backing through a 440-billion euros (USD 570 billion) fund.

The bailout package fuelled a rally in markets across the globe. Asian bourses ended with gain in the range of 0.39-2.5 per cent, while European markets zoomed upto 8 per cent in the mid-session.

On the BSE, Reliance Industries surged 4.48 per cent to Rs 1,080.20. Among 30 constituents of the Sensex, 28 ended in green, while two scrips bucked the trend and closed in negative zone.

Sector-wise, barring the BSE Health Care Index, all other 12 sectoral indices settled in green with BSE Realty Index jumping over 6 per cent.

"The Sensex, which had slipped below 17,000 due to the euro-zone debt crisis, bounced back on massive loan package made available to EU member countries," Ambani said.

Buying at lower level in index heavyweights like Tata Motors, Tata Steel, Hindalco and others saw the benchmark to surge over 560 points, Ambani added.

Reliance Infra and Reliance Communications, the two Anil Ambani Group companies, saw heavy buying and rose 8.49 per cent and 1.21 per cent, respectively. Reliance Infra was the biggest gainer among the Sensex companies.

ADAG shares were hammered on Friday after the Supreme Court verdict in RIL-RNRL gas dispute. The apex court ruled that the government would have the final say on the natural resources, which the market found was in favour of RIL.

Tata Steel, Hindalco, Sterlite Industries rose in the range of 6-8 per cent. Tata Motors, M&M and DLF jumped 6.72 per cent, 5.81 per cent and 6.68 per cent, respectively.

ICICI Bank jumped 5.12 per cent, HDFC Bank by 4.68 per cent and SBI by 3.61 per cent.

Pharma major Cipla lost 6.42 per cent after it reported below than expectated fourth quarter results.

Some marketmen, however, said, the domestic bourses will be in tenter hooks in days to come. "Till we have clarity on global scenario, the domestic markets will continue to remain in tenter hooks and no well defined movement will be seen.," L&T MF CEO Sanjay Sinha said.