An agenda for Modi 2.0

The new NDA government will take charge this week. The immediate task before the government is to prepare and present the Union budget. The budget exercise will be against the backdrop of a sub-par 4% inflation rate, a growth rate of a little higher than 7% and a Current Account Deficit (CAD) of slightly over 2%. The economic scenario thus looks comfortable on the surface and the economy to some extent appears resilient. These numbers, however, do not tell the underlying story. Consider that (a) agricultural growth has collapsed (3.8% in first advance estimates, declining to 2.7% in second advance estimates for FY2019 against 6.3% in FY17 and 5% in FY18); (b) factory output contracted for the first time in 21 months as reflected in the IIP numbers released in April 2019, with capital goods declining by as much as 8.7% year-on-year; and (c) the concerns arising out of the so-called twin balance sheet problem (balance sheets of banks and the corporates) remain largely unresolved for a prolonged period of time.

Further, there are new downside risks of a delayed and below-normal monsoon, reversal of benign crude oil prices and the possibility (indeed, certainty) of a fiscal slippage because of hard budget constraints arising out of downward rigidity in revenue expenditure. The burning problem of job creation is another that needs focused attention.

We know that around 50% of our population is engaged in agriculture though its share in economic growth is much lower (14.3% in FY19) than that of industry (23.3%) and services (62.4%). Faster growth may come from industry and services. But it is agri-growth and agri-productivity that drives economic growth at the grassroots and provides long-term economic stability. This is because the employment potential in agriculture is high so that the fruits of growth are spread out and leave their footprint across many other areas, leading to a more balanced growth that can benefit the largest numbers possible. Yet, this is a sector that has received little attention. It remains largely at the mercy of the weather, suffers from poor infrastructure, lack of skills development and lack of institutional support to drive innovation.

In part, this is because agriculture is a state subject. Pushing through reforms in agriculture, in particular kickstarting ideas from a reliable cold chain to modern day storages or warehouses and, in general, looking to give a boost to the rural economy will require a high level of Centre-State cooperation. The new government, in the interest of cooperative fiscal federalism, should have a forum or institutional arrangement to address this. The institutional mechanism can be under the auspices of the NITI Aayog, with chief ministers and members of the Union Cabinet as members under the chairmanship of the prime minister to push agricultural productivity, marketing and exports. This is easier said than done in light of the political divide in the wake of a bitter election and a sharp split along party lines that seems only to have widened. There is a trust deficit looming large, with many regional leaders who are not a part of the NDA but are managing the states. We’ll need a high amount of statesmanship to chart this road.

Enhancing employment in agriculture needs to be supplemented with job creation in manufacturing and in the services sector. This has two aspects. One is higher investment in physical and social infrastructure and the other is increasing efficiency through higher productivity. Given that the government has little funds, the public private participation (PPP) model has been institutionalised. The evidence, however, suggests that there has not been very encouraging progress in the PPP model, possibly because the state governments are not fully involved. Again, the government may consider an institutional arrangement involving the private sector, state governments and the Centre for policy-making, funding arrangement and implementation of projects.

In the above context of fund raising for infrastructure, two issues demand the attention of the government. One is the floating of infrastructure bonds by the private sector, with the government giving some tax concessions. Another aspect is encouraging Foreign Direct Investment (FDI) by relooking and revisiting the sectoral caps along with quality and efficient regulations.

Investment in the economy critically hinges on the savings of the economy and the interest rate. These issues relate to the arena of the financial sector. Financial sector reform is a continuing process. Now that the elections are behind us and the government will settle in for a five-year term, reforms must replace rhetoric. The government may revisit the shareholding pattern of public sector banks, nominee directors of government and RBI, issues related to NPAs and skill development in the financial sector in general and banking sector in particular keeping in view global best practices. The fact remains that we’ve learnt little from the NPA crisis –- the crisis is still with us but banks have not learnt to appraise loans better, practices to identify bad loans remain primitive and the tendency to fill bank (and also PSU) boards with nominees that ask few questions and support little governance still remains. In this context, it is important to point out that recently, the RBI merged all its three supervisory departments into one –- a meaningless merger unless the efficiency of supervision improves.

With regard to savings and interest rate, it is important to recognise that financial savings in different instruments such as bank deposits, mutual funds, small savings should go up and the flow of funds from financial savings to physical savings such as gold and real estate should be discouraged. It could happen in two ways: (a) higher interest rates on bank deposits, and (b) tax concessions on financial instruments. The government may revisit these options.

For some time, the GDP growth numbers have stagnated. The new government must address this with adequate attention to labour, capital and land productivity. A new focus will be required on technology and technological readiness, investment in physical capital such as machinery and equipment, skill development of the workforce, and quality development of natural resources, openness to cross-border trade and investment.

In sum, the new government will have to set the stage for faster growth and this will require deft management of the long term with the short term, carrying along different voices and ideas from across the political spectrum –- something that was particularly weak in the preceding five years but must now pick up if the next five years are not to be lost.

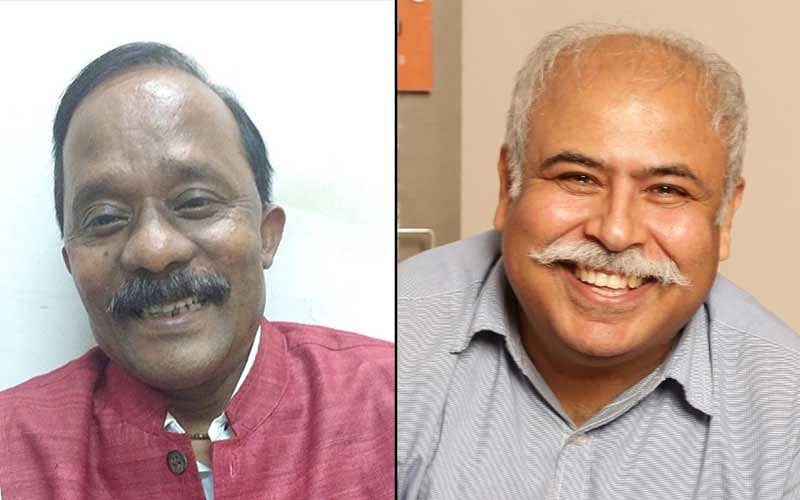

(Pattnaik is a former central banker and Rattanani is a journalist. Both are faculty members at SPJIMR)