The Rs 11,400 crore fraud detected at Punjab National Bank could trigger prompt corrective action (PCA) by Reserve Bank, leading to stoppage in lending by it for sometime, says a report.

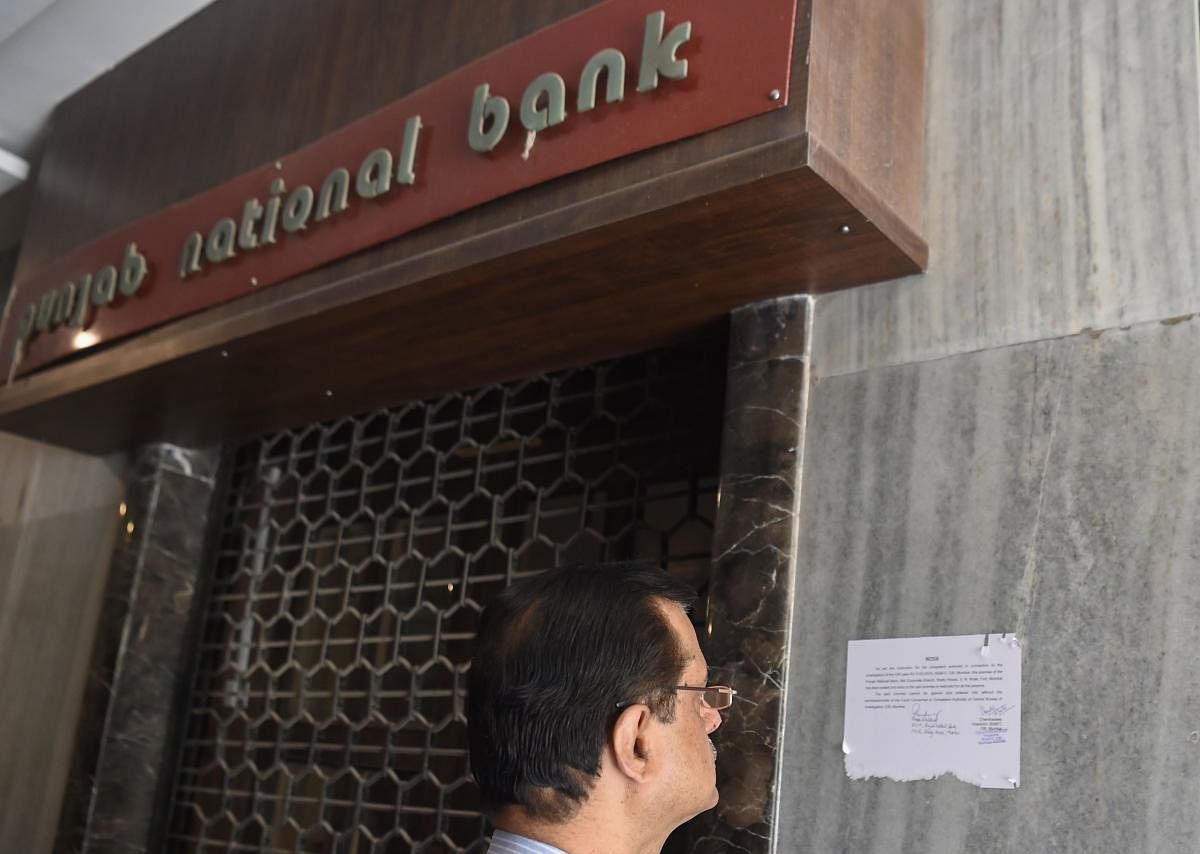

The state-run lender had detected fraudulent transactions worth $1.77 billion (Rs 11,400 crore) at one of its branches in Mumbai.

The transactions were carried out by diamond jeweller Nirav Modi by acquiring fraudulent letters of undertaking (LoU) from the lender's Brady House branch in Mumbai to secure overseas credit from other Indian lenders.

The lender had said it would honour all 'bonafide' contracts suggesting that some of the claims may be disallowed while the other public banks are suggesting that this may not be the case.

"The impact on PNB, if this fully materialises is meaningful. Adjusting for the nine-month FY18 profits and the recent capital infusion, we expect tier-1 ratio at 7% implying an impact of 230 basis points from this incident," the report said.

For the nine months ended December 31, the lender reported a net profit of Rs 1,134 crore as against Rs 1,063 crore in the year ago period.

As of December 2017, the lender's tier 1 ratio stood at 9.15%.

"While a PCA cannot be ruled out on the bank given these lapses, it would nevertheless force the bank to pull back lending for some time till it shores up its capital base," Kotak Institutional Equities said in a report today.

The bank can sell stake in some of its subsidiaries and joint ventures to raise money but since they are contractual agreements, it may take some time.

PNB shares down over 2%

Meanwhile, PNB stock went down 2.09% to end at Rs 114.65 on the BSE. During the day, it lost 2.90% to Rs 113.70. At NSE, the shares of the company slipped 2.30% to close at Rs 114.60.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks