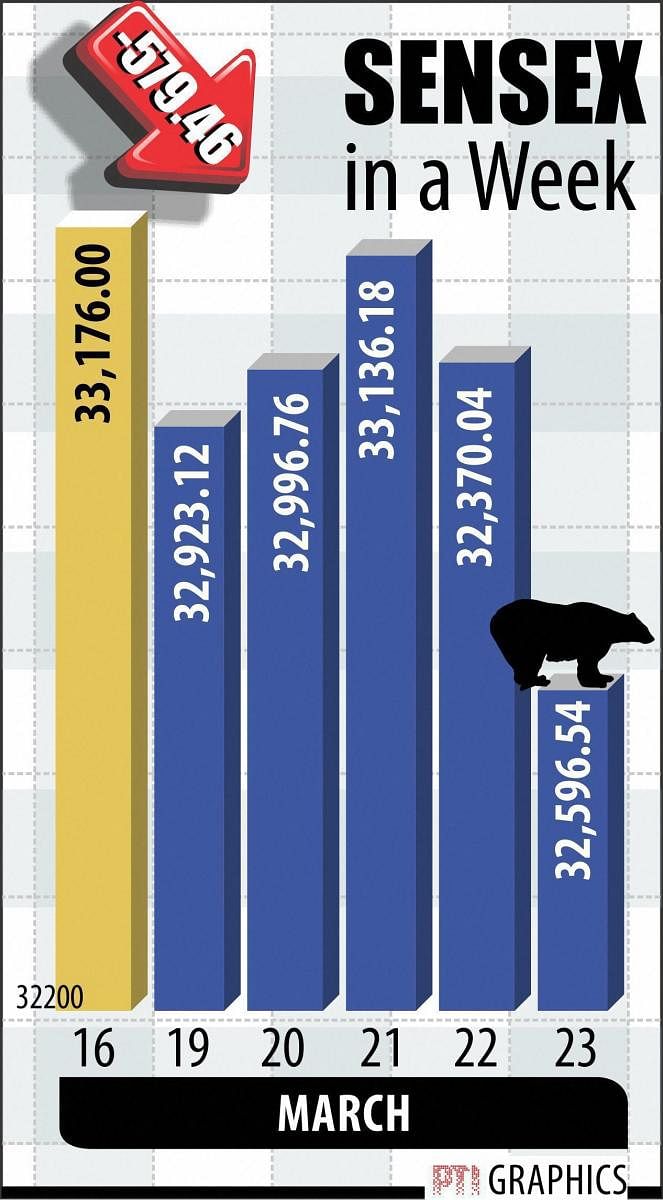

The market existential fear of global trade war fell into place this week as the benchmark Sensex slid 579.46 points and marked five month lows at 32,596.54, while broader Nifty was sent below the psychological 10,000-level at 9,998.05.

Bears were in command during weeks trading momentum with all indices suffering heavy losses, bridled by Parliament logjam, US Federal Reserve interest rate hike and above-all global trade war concerns which came into materialize after US President Donald Trump announced tariffs on Chinese goods.

Starting on poor note due to global market volatility ahead of the FOMC meet as well as country's widened current account deficit (CAD) concerns, the subsequent market session saw the key indices languishing under selling pressure on every value buying as well as shortcovering surge.

Concerns of a global trade war became a reality following US President Donald Trump's decision to impose duties worth $60 billion on Chinese goods amid violation of its commitments in intellectual property, while China responded by announcing plans to impose tariffs of up to $3 billion on the US imports.

The Sensex started the week up by 33,268.97 and hovered between 33,354.93 and 32,483.84, it closed the week at 32,596.54, showing a fall of 579.46 or 1.75%.

The Nifty also resumed the week higher at 10,215.35 and traded between 10,227.30 and 9,951.90 before ending the week at 9,998.05, showing a loss of 211.58 points, or 2%.

Sectorwise, the sell-off was led by Realty, Metal, PSUs, Banks, IPO, Oil&Gas, HealthCare, Auto, Capital Goods, IT, Teck, FMCG, Power and Consumer Durables. The broader midcap and smallcap company shares also dipped on substantial selling.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks