Sensex, Nifty start cautious ahead of RBI policy

Domestic equity benchmarks BSE Sensex and NSE Nifty opened on a cautious note Thursday as investors await RBI's monetary policy decision.

Liquidity concerns loom large

Ahead of RBI's MPC announcement today, Crisil on Wednesday downgraded DHFL to 'D', for non-payment to bond-holders. Already, the shadow banking crisis has caused a lot of liquidity concerns in the system, preventing effective transmission of the rate cuts. It can play a large role in the RBI's decision.

RBI Policy: 25 bps rate cut likely, transmission key

Given that the domestic and global economic growth momentum has slowed further and inflation risks are not on the horizon, the monetary policy committee (MPC) is all set to give a minimum of 25 basis point rate cut today but the markets may be looking for the RBI's stance on maintaining the liquidity in the banking system to facilitate the transmission of rate reduction.

Rupee slips 19 paise ahead of RBI MPC meet

The rupee opened on a weak note and declined by 19 paise to 69.45 against the US dollar in opening trade Thursday, ahead of the Reserve Bank of India's monetary policy decision. Forex traders said, foreign fund outflows and rising crude oil prices also kept pressure on the Indian rupee. The rupee opened weak at 69.41 at the interbank forex market and then fell further to 69.45, down 19 paise over its last close.

Price rise likely?

"CARE Ratings expect CPI inflation to average 4% in FY20, 60 bps higher than a year ago. The rise in inflation will mainly be on account of the waning of favourable base effect, rise in consumer and general spending, a possible upward movement in the oil prices and increase in food prices," says Madan Sabnavis, Chief Economist, Care Ratings.

CPI inflation is projected to be around 2.9-3% for H1FY20 and 3.5-3.8% for Q3FY20 by the RBI in its last monetary policy.

DH Poll: RBI may go for rate cut to propel growth

Of the 11 economists polled byDH,eight are of the opinion that the central bank's monetary policy committee (MPC) will opt for 25 basis points or morecut in the repo rate

Read more

Markets in red!

Indian shares edged lower on Thursday as investors remained on the sidelines ahead of the outcome of the central bank's policy meeting later in the day. The broader NSE index was down 0.17% at 11,999.80, while the benchmark BSE index was 0.09% lower at 40,042.03.

DHFL tanks after ratings downgrade

Shares of home loan lender Dewan Housing Finance Corporation Ltd fell as much as 18.30% to its lowest since December 2013. Ratings agencies ICRA Ltd and Crisil Ltd slashed ratings on the company's commercial paper programme on Wednesday.

Crisil on Wednesday downgraded commercial papers (CP) of troubled Dewan Housing Finance Corporation Ltd (DHFL), citing delays in debt servicing.

Crisil downgraded the CP of the housing finance firm to 'D' (Default) from 'A4+', it said in a release.

DHFL has Rs 850 crore of outstanding CPs of which Rs 750 crore is due in June, the rating agency said.

Change in stance likely

"Given the comfort accorded from the fall in crude oil prices and bolstered with a strong mandate and thus longer term view being probable, the RBI in our view may additionally choose to shift its stance to accommodative from neutral, so as to ensure better transmission of policy rates change,”Lalitabh Shrivastawa, AVP – Research, Sharekhan by BNP Paribas

Measures on liquidity expected

"So one can expect both liquidity measures and a rate cut. Rate cut expectation ranges from 25 bps to 50 bps. The central bank will see how the fiscal situation unfolds with the budget announcement and spending measures. It will also take into account global factors, trade tensions, crude price trends, geopolitical equations and the monsoon outlook," says Shanti Ekambaram, President – Consumer Banking, Kotak Mahindra Bank.

Current rates

Here's a lowdown on the current rates ahead of the RBI MPC decision:

Policy Repo Rate: 6.00%

Reverse Repo Rate: 5.75%

Marginal Standing Facility Rate: 6.25%

Bank Rate: 6.25%

Markets continue in red!

Indian shares edged lower on Thursday as investors remained on the sidelines ahead of the outcome of the central bank's policy meeting later in the day. The broader NSE index was down 0.54% at 11,956.40, while the benchmark BSE index was 0.38% lower at 39,929.11.

More OMOs likely

We believe RBI’s effort to ease liquidity will continue both via OMOs and long term rupee dollar swap. However, this would be more via OMO purchases, says Madan Sabnavis of Care Ratings.

Growth targets lowered

The Reserve Bank also maintained its outlook stance neutral. However, the bank has lowered the growth of the target to 7.0% from existing 7.2% for FY20.

Lower transmission

Transmission of the cumulative reduction of 50 bps in the policy repo rate in February and April 2019 was 21 bps to the weighted average lending rate (WALR) on fresh rupee loans. However, the WALR on outstanding rupee loans increased by 4 bps as the past loans continue to be priced at high rates. Interest rates on longer tenor money market instruments remained broadly aligned with the overnight WACR, reflecting near full transmission of the reduction in policy rate.

Stance Changed

The RBI has changed its stance from nuetral to accomodative.

NBFCs get a snub

The shadow banks, that have been reeling under the stress of late have been completely ignored by the RBI in policy statement.

Unanimous call for rate cut

All members of the MPC -- Chetan Ghate, Pami Dua, Dr.

Ravindra HDholakia, Michael Debabrata Patra, Viral V. Acharya and Shaktikanta Dasunanimously decided to reduce the policy repo rate by 25 basis points and change the stance of monetary policy from neutral to accommodative.

Markets witness buying

Indian shares witnessed a bit of buying after RBI announced a rate cut on Thursday. The broader NSE index was down 0.40% at 11,973.30 as of 0400 GMT, while the benchmark BSE index was 0.27% lower at 39,974.65.

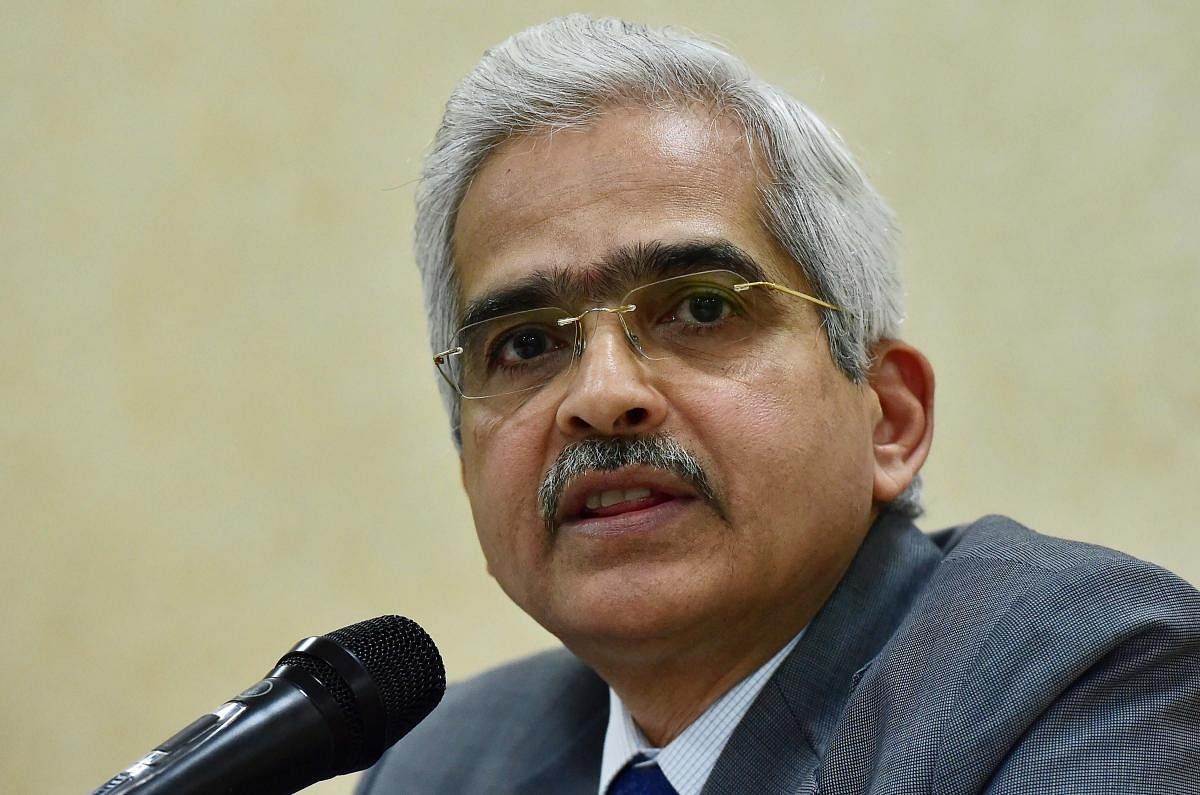

RBI Governor addresses media

Rate cut decision reflects the resolve of the MPC to act decisively and in a timely manner: RBI Governor Shaktikanta Das

Global factors at play!

Economic activity in major global economies has slowed or contracted which called for a change in stance to “accommodative: RBI Governor

OMOs held in May

RBI has conducted open market operations worth Rs 25,000 crore to inject durable liquidity, says RBI Governor Das

Muted manufacturing

Manufacturing activity has weakened, normal growth in rural wages and organised sectors staff cost continue to remain muted: Shaktikanta Das.

Markets witness selling.

Markets witness selling. Sensex down191.05 points at39,892.49. Nifty down78.70 points at11,942.95.

Assurance on liquidity!

A word of assurance from the RBI Governor. RBI to ensure that availability of adequate liquidity in the system for productive purposes,said Das.

Bank stocks tank

The stocks have seen heavy selling with Bank Nifty declining by1.29% to31,181.65 points, as RBI decides to waive oncharges on RTGS and NEFT transfers.

Markets disappointed over liquidity apathy

"While the rate cut of 25 basis points was in line with our expectation, concerns over growth and challenges regarding liquidity continue to linger. The market is not necessarily cheering the rate cut as it had already factored in and something more was expected,"Naveen Kulkarni, Head of Research, Reliance Securities said.

Revised circular on bad loans soon

Revised circular onNPAclassification to be issued in 3-4 days, says Das.

Lack of focus on NBFCs

“No specific measure has been announced that would provide immediate relief to the much-troubled NBFC sector. In the presser the Governor did reiterate multiple times that RBI will do whatever it takes to ensure financial stability of the system. Jittery markets are facing a crisis of confidence with respect to the precariously perched NBFC (including HFCs) & fixed-income mutual fund sectors. It looks highly unlikely that these broad, motherhood statements will assuage market concerns,” Ajay Bodke CEO PMS Prabhudas Lilladher.

In nutshell

Deccan Herald is on WhatsApp Channels | Join now for Breaking News & Editor's Picks