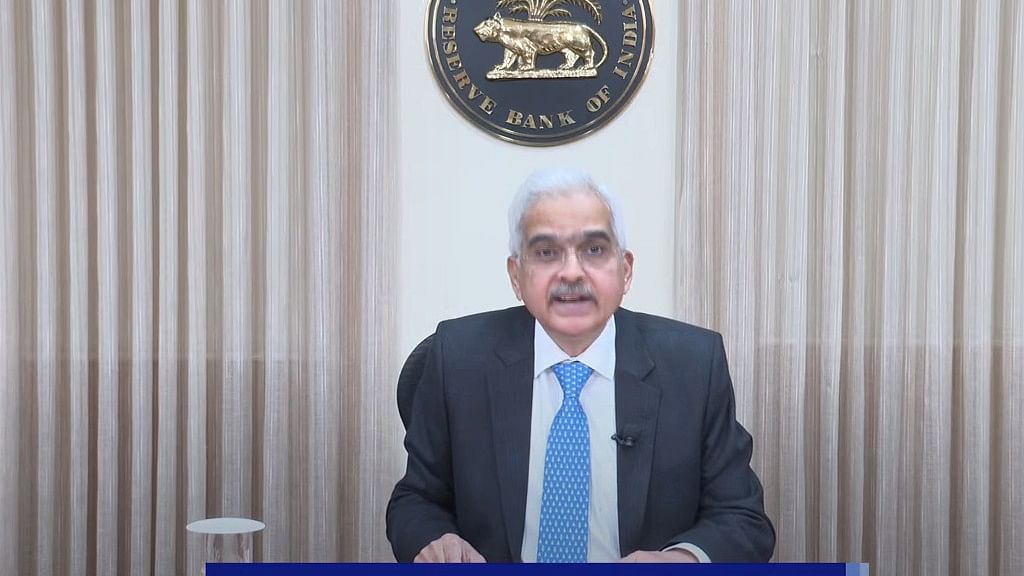

RBI Governor Shaktikanta Das.

Credit: Screengrab of YouTube video.

Good morning readers, Reserve Bank of India (RBI) Governor Shaktikanta Das will address the media to announce the decision of the Monetary Policy Committee (MPC). Track the latest updates with DH!

It will be a closely watched event, as it comes in the backdrop of a rise in prices of essential food items like tomato, pulses, spices and cooking oil, putting pressure on households.

While the MPC is widely expected to maintain its pause on interest rates - the key weapon against inflation - it will be interesting to see the tone and tenor of Das’s speech.

Here are some of the things that investors and policy watchers need to look out for in his address:

Inflation projections

Currently, the RBI’s headline retail inflation forecast stands at 5.1% for the current financial year (FY24), which it had cut slightly from 5.2% in the last MPC meeting in June.

Cautious stance

Even while markets were clamouring for rate cuts to boost economic activity as inflation came down in the past few months, the MPC had maintained its cautious outlook. And that seems set to continue.

Shaktikanta Das begins his address to announce policy rates

The MPC has decided unanimously to keep the repo rate unchanged at 6.5%, says Das.

Indian economy exuding enhanced strength and stability, says RBI Governor Shaktikanta Das.

Indian economy exuding enhanced strength and stability, says Shaktikanta Das.

Indian economy has made significant progress towards controlling inflation, says RBI Governor.

India is uniquely placed to benefit from ongoing transformational shift in global economy, says Das.

Das says policy rates could stay higher for longer.

India is expected to withstand external headwinds far better than other nations, says Das.

"Our economy has continued to grow at a reasonable pace becoming the fifth largest economy in the world, contributing around 15% to global growth," says Das.

This is the third time that the repo rate has been kept unchanged at 6.5%.

Monetary policy transmission still under way, headline inflation remains higher than 4 per cent target, says RBI Governor.

He says the core inflation has softened since January.

Das says a substantial increase in headline inflation is likely in the upcoming months.

"Global economy continues to face daunting challenges of inflation, geo political uncertainty and extreme weather conditions," says Das.

FMCG sales pick up in rural areas reflect incipient revival of rural demand; expected to get further boost with good Kharif harvest: Das

RBI retains growth projection at 6.5% for FY24 with risks evenly balanced, says Governor Das.

A spike in tomato prices and rise in cereal, pulses contributed to inflation, says Das. He adds that vegetable prices may see significant correction in the coming months.

Flow of resources to commercial sector has increased to Rs 7.5 lakh crore this year from Rs 5.7 lakh crore last year, say RBI Governor.

Indian economy is exuding enhanced strength and stability despite the massive shocks to the global economy, says Das

RBI ups retail inflation projection to 5.4% during FY24 from earlier estimate of 5.1% due to vegetable price shocks, says Das.

Meanwhile, the RBI has projected Q2 retail inflation at 6.2%; Q3 at 5.7% and Q4 at 5.2% in FY24.

Indian financial sector has been stable and reselient as is being reflected in sustained growth numbers, says RBI Governor.

RBI remains steadfast in commitment to safeguard financial system from challenges, says Das.

On liquidity surplus, Das says the level of surplus liquidity has gone up due to withdrawal of Rs 2000 banknotes, and dividend to government.

Net FDI fell to $5.5 billion during April-May compared to $10.6 billion in corresponding period last year, says Das.

Three major announcements on UPI:

> RBI has proposed to enable conversational payments on UPI.

> Introduce offline payments on UPI through UPI Lite.

> Enable payment of small amount offline on UPI and raise payment limit via UPI Lite to Rs 500 from Rs 200.

"The RBI will allow offline payment of UPI by using near-field communication," says Das.

RBI proposes transparent system to reset interest rates on floating interest rate loans

It is proposed to put in place a transparent system for reset of interest rate on floating interest rate loans, says RBI Governor. The proposed framework will allow borrowers to switch to fixed interest rate regime.

With this, the RBI Governor has ended his statement.

Thank you for tuning in to our coverage. For more latest news, views and updates, visit www.deccanherald.com.

Deccan Herald is on WhatsApp Channels | Join now for Breaking News & Editor's Picks