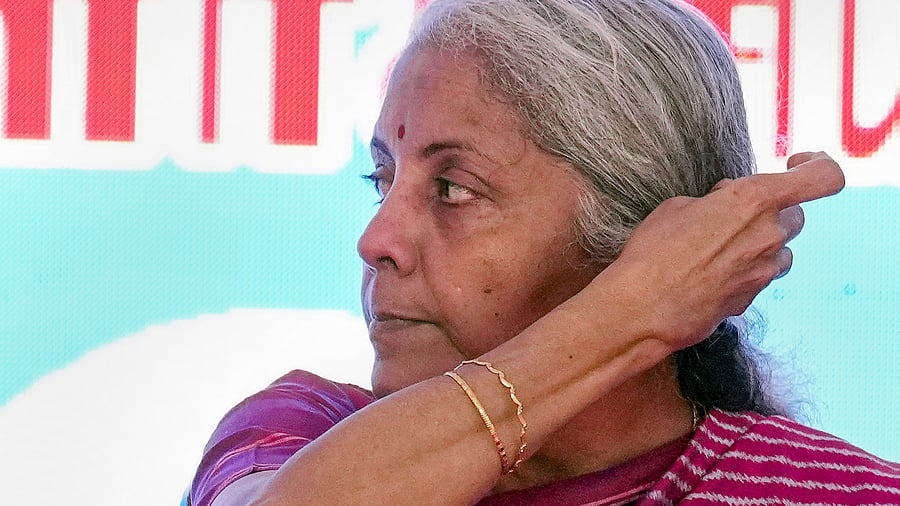

Union Finance Minister Nirmala Sitharaman

Industry body Confederation of Indian Industries (CII) said on Wednesday that in her upcoming budget, Finance Minister Nirmala Sitharaman should aim to increase capital expenditure outlay for the upcoming financial year by 20% to Rs 12 lakh crore, revise the beneficiary criteria for the free food scheme, and announce some pilot projects to test an urban employment guarantee scheme on the lines of the Mahatma Gandhi National Rural Employment Guarantee Act (NREGA).

In its summary of budget recommendations, CII also said that the budget should move to expedite privatisation of public sector units (PSUs), signal intent to streamline GST to a three-rate structure, announce measures to boost affordable housing, aim for a fiscal deficit of 5.4% in FY25, and signal intent to set up a new Ministry of Investment.

“Set up an independent Ministry for Investment, as a single point of contact for facilitating private investment, both domestic and foreign, as well as for Indian investors to invest abroad,” CII said as part of its recommendations. Sitharaman is set to present the interim budget for the next financial year (FY25) on February 1.

CII also sought to link exemption limit and rebate of personal income tax with inflation, extension of the interest subvention scheme available on low-cost housing to cover total housing cost of up to Rs 35 lakh instead of Rs 25 lakh at present, and increased allocation for flagship schemes such as the Pradhan Mantri Awas Yojana, Pradhan Mantri Gram Sadak Yojana, and the National Rural Employment Guarantee Scheme.

“To enhance quality and productivity in manufacturing, launch a National Mission for Advanced Manufacturing, which should strengthen the ecosystem for building a technologically advanced manufacturing industry and accelerate the adoption of transformative technologies,” the CII said in its report.

It also sought an expansion of the Production-linked Incentive Scheme (PLI) to labour intensive sectors, such as apparel, toys, footwear for boosting employment generation, and to sectors with large imports but domestic capability, like capital goods, chemicals, to reduce import dependence.

Additionally, Bank of Baroda (BoB), in a report shared by its Chief Economist Madan Sabnavis, also presented its expectations from the upcoming budget. It said that the government is expected to stick to its path of fiscal consolidation, without compromising on quality of expenditure.

“In the wake of weaker monsoon and pressure seen in Rabi sowing season, focus will be on providing support to rural growth. For the government to achieve fiscal consolidation, while maintaining spending momentum at the same time, we do not foresee room for any tax cuts,” BoB’s report stated.