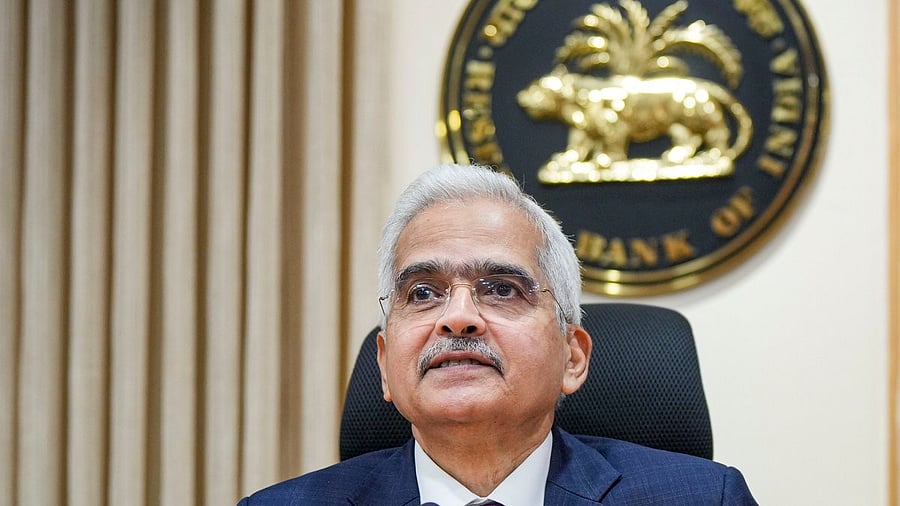

Credit: PTI File Photo

RBI Governor Shaktikanta Das to announce monetary policy today

Reserve Bank Governor Shaktikanta Das will announce the next set of monetary policy on Friday morning amid expectations of a status quo on the benchmark interest rates.

Read more

RBI likely to keep policy interest rates unchanged for 8th time in a row

The Reserve Bank of India (RBI) is widely expected to keep key policy interest rates unchanged for the eighth time in a row on Friday as food prices remain volatile despite easing in inflation and a coalition government at the Centre raises concern over fiscal populism, economists and experts said.

The monetary policy committee (MPC) of the RBI started its three-day meeting on June 5, a day after Lok Sabha election results showed diminished mandate for Prime Minister Narendra Modi-led coalition National Democratic Alliance (NDA).

Read more

RBI Guv Shaktikanta Das begins address

Indian shares set to open higher ahead of RBI monetary policy decision

Indian shares are set to open slightly higher on Friday, ahead of the Reserve Bank of India's policy meeting at which it is widely expected to keep interest rates unchanged.

The Gift Nifty was trading at 22,905 as of 07:40 am IST, indicating that the benchmark Nifty 50 will open marginally higher than its close of 22,821.40 on Thursday.

The RBI is expected to keep rates steady and retain its tighter monetary stance, as robust economic growth continues to give it space to focus on bringing down inflation towards its medium-term target of 4 per cent. The decision is due at 10 am IST. (Reuters)

Rupee to hold above 83.50/USD as RBI policy, US jobs data awaited

The Indian rupee is expected to open broadly unchanged on Friday, holding near to a key level and awaiting the Reserve Bank of India's policy decision and the US non-farm payroll report.

Non-deliverable forwards indicate rupee will mostly be flat from 83.4725 in the previous session.

"Now with the election excitement out of the way, it should be a quiet session," a spot currency trader at a bank said.

There is a "low probability that we inch past 83.50 (on dollar/rupee) and on the downside, the dip will not be at most 3-4 paise."

On the RBI's policy, he said it was "difficult to see any form of market-moving stuff".

The RBI is widely expected to make no changes to the policy rate or the stance amid robust growth and inflation higher than its target level. The focus will be on inflation and liquidity commentary. (Reuters)

Indian govt bond yields seen little changed with focus on RBI policy decision

Indian government bond yields are expected to move largely unchanged in the early session on Friday as market participants await the Reserve Bank of India's monetary policy decision later in the day.

India's benchmark 10-year yield is likely to move in a 6.99 per cent-7.03 per cent range till the policy decision, following its previous close of 7.0112 per cent, a trader with a state-run bank said.

"Market has recovered in the last couple of days from Tuesday's sharp upswings in yields, and they are now waiting for the RBI policy decision, with the major focus on guidance on inflation as well as liquidity management," the trader said.

The RBI is widely expected to keep interest rates steady and retain its tighter monetary stance at its policy review, amid robust economic growth and an uncertain inflation outlook. (Reuters)

Rupee rises 6 paise to 83.47 against US dollar ahead of RBI announcement

The rupee appreciated 6 paise to 83.47 against the US dollar in early trade on Friday ahead of the RBI monetary policy announcement.

Forex traders said the outflow of foreign funds and an upward movement in the crude oil prices weighed on the Indian currency even though the local unit found support from positive domestic equity markets and softening American currency overseas.

They said that market participants are likely to take cues from the decision of Reserve Bank's rate-setting panel. The Monetary Policy Committee (MPC) of RBI, which began its three-day deliberations on Wednesday, will announce the outcome on Friday. (PTI)

Markets open slightly higher ahead of RBI policy decision

Benchmark equity indices climbed in early trade on Friday, taking their rally to the third day running, ahead of the RBI monetary policy decision to be announced later in the day.

Buying in IT stocks added to the positive trend in markets.

The 30-share BSE Sensex climbed 254.53 points to 75,329.04 in early trade. The NSE Nifty went up by 99.4 points to 22,920.80.

In the past two days, the BSE benchmark surged 2,995.46 points or 4.15 per cent after Tuesday's massive rout. (PTI)

India is ready to embark on new era of transformation, says Shaktikanta Das

As RBI approaches its centenary year, it will gear up even more to remain future-ready for India's fast growing economy, says Guv Das

Repo rate to remain unchanged at 6.5 per cent, announces Guv Das

Inflation continues to remain moderate, says RBI Guv Das

Food inflation, however, remains inflated, said Das, which could possibly derail efforts towards disinflaton.

India's real GDP for FY23-24 at 8.2 per cent, as per NSO

Domestic economic activity has been resilient in FY24-25, says Guv Das

In FY24-25, domestic economic activity has been resilient, and manufacturing has been gaining ground. Core industries have posted healthy growth, Das said, adding, that India's PMI was the highest globally. Services sector remains buoyant, Das further said.

Real GPD growth for FY24-25 projected at 7.2 per cent, Guv Das announces

Quarterly break-up of projected growth:

Q1 - 7.3 per cent

Q2 - 7.2 per cent

Q3 - 7.3 per cent

Q4 - 7.2 per cent

CPI inflation for FY24-25 is projected at 4.5 per cent, announces Guv Das

Quarterly break-up of projected CPI inflation:

Q1 - 4.9 per cent

Q2 - 3.8 per cent

Q3 - 4.6 per cent

Q4 - 4.5 per cent

Relative stablity of Rupee is a testament to India's sound economic fundamentals and macroeconomic stability, says Guv Das

RBI to remain nimble and flexible in liquidity operations, assures Guv Das

Increase in contingency risk buffer by 0.5 per cent for FY24 will further improve RBI's balance sheet, says Guv Das

Customer protection is a top priority for RBI, assures Guv Das

Banking sector, NBFC sector, MFI sector, overall financial sector remains healthy and stable, says Guv Das

Current account deficit is expected to have moderated in Q4 FY23-24, says Guv Das

With a 15.2% share, India is the largest recipient of remittances globally, says Guv Das

India's forex reserves hit a historical high of $651.5 billion as of May 31, announces Guv Das

RBI to rationalise Foreign Exchange Management Act (FEMA) guidelines related to export-import of goods and services, announces Guv Das

Monetary policy has greater elbow room to pursue price stability, said Guv Das

Guv Das cites Mahatma Gandhi, ends presser

"If we are sure of our path, we should go on striving for it incessantly and uninterruptedly," Guv Das said, quoting Gandhi.

That marks the end of this presser. The next press conference by Guv Das is scheduled for 12 noon today.