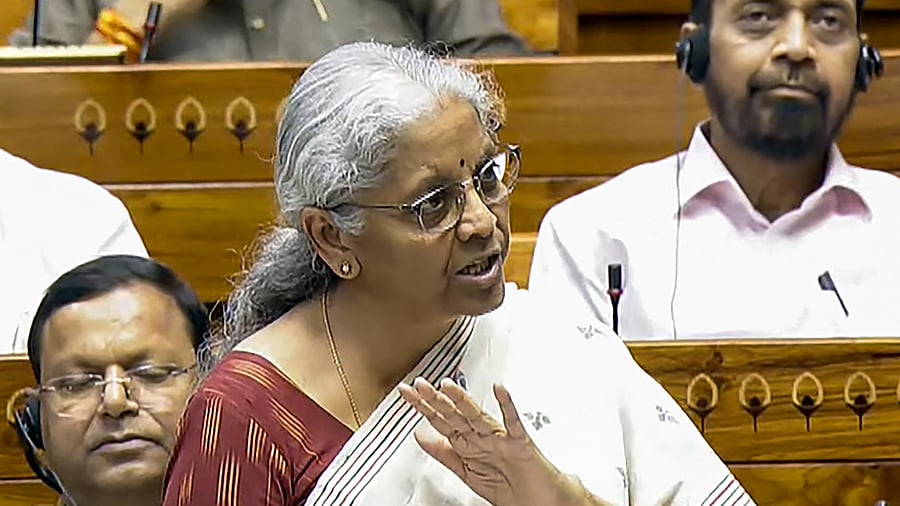

FM Sitharaman in the Lok Sabha on Tuesday.

Photo: PTI File Photo

New Delhi: The Lok Sabha on Tuesday passed the Finance Bill, 2025 with 35 amendments proposed by the government, including a 6 per cent equalisation levy on digital advertisements, commonly referred to as the 'Google tax'.

Replying to the discussions on the Finance Bill in Lok Sabha, Finance Minister Nirmala Sitharaman said, “Equalisation levy on online advertisements to be abolished to address uncertainty in international economic conditions.”

Once approved by the Parliament, these taxes will be abolished effective from April 1, 2025.

American tech giants Google, Meta and Elon Musk’s X will be the main beneficiaries of this move, which comes amid growing threat of imposition of higher tariffs on the Indian goods by the US President Donald Trump’s administration.

Colloquially referred to as the ‘Google tax’, the equalisation levy was introduced in 2016 to tax certain digital transactions of non-residents (NRs) without physical presence in India. With effect from June 1, 2016 any specified person making a payment to non-residents for online advertisement and related services was obligated to deduct equalisation levy at 6 per cent of the gross consideration.

The Finance Act, 2020, had extended the scope of this levy to e-commerce transactions at a rate of 2 per cent. However, that was abolished with effect from August 1, 2024.

"Equalisation levy of 6 per cent that applied to online advertising revenues earned by non-resident companies was effectively a cost on Indian businesses," said Rajendra Nayak, Partner and National Leader, International Corporate Tax Advisory, EY India.

"Given the dominant position of a few players in the online advertising space, these players were in a position to pass on the levy to Indian businesses by grossing up the same,” he added.

Other major amendments include removal of seven custom tariff rates for industrial goods, exemption of 35 additional capital goods for EV batteries and 28 for mobile manufacturing from customs duties and simplification of the safe harbour regime for investment funds.

Sitharaman said the government has introduced the amendments in the Finance Bill as part of a broader effort to align India’s trade and investment policies with global standards while ensuring fair taxation and promoting domestic industry.

She said the rationalisation of customs duty structures and cuts announced in the Union Budget would help boost domestic manufacturing.

Sitharaman further added that the Finance Bill, 2025 seeks to provide tax certainty and relief to the middle class. “It rationalises a lot of provisions which are towards ease of doing business and also provides unprecedented tax relief," she said.

The Bill will now move to the Rajya Sabha for consideration. Being a Money Bill, the Upper House’s approval is not a necessity.

Cut-off box - ‘Income Tax Bill to be discussed in monsoon session’ New Delhi DHNS: The new Income Tax Bill which seeks to replace the over six-decade old Income Tax Act 1961 will be taken up for discussion in the Monsoon Session of Parliament Finance Minister Nirmala Sitharaman said on Tuesday. Replying to the discussions on the Finance Bill 2025 in the Lok Sabha Sitharaman said the new bill which was introduced in the House on February 13 is currently being vetted by a select committee. “This Budget Session has introduced provisions and certain reformatory steps which we hope will be taken up for discussion in this House during the Monsoon Session” Sitharaman said. Although the new proposed regulation will not have any financial implications in terms of tax liabilities for individuals and corporations it seeks to make the country’s direct tax framework easy to understand for the common people. As per the draft bill tabled in Parliament ‘tax year’ will replace the existing concept of financial year (FY) and assessment year (AY).