Indian equities seem to have gained the most out of the November global stock market rally among the emerging market peers, owing to the strong inflow of foreign funds.

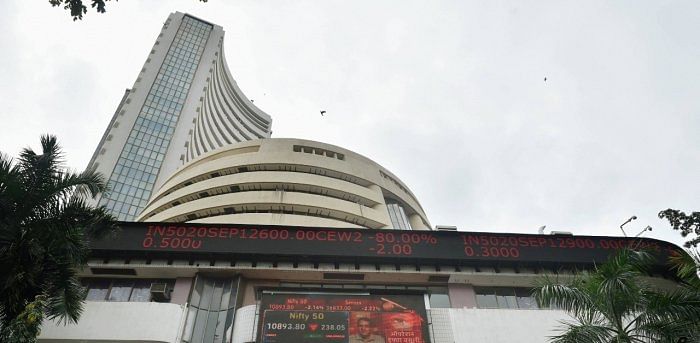

Indian benchmark index BSE Sensex has surged by 11 per cent in the month of November so far, 200 basis points more than the 9 per cent growth in Morgan Stanley Capital International’s Emerging Market index.

Indian indices have outperformed Asian peers -- Hong Kong’s Hang Seng Index and China’s Shanghai Composite Index -- both of which have seen single-digit growth in November.

However, at the time of the market close on Tuesday, the indices had underperformed the equities in developed economies: Dow 30 has grown by 13 per cent, Britain’s FTSE100 by 14.5 per cent, and Japan’s Nikkei225 by 13.2 per cent.

The equity markets across the globe have seen a surge in November owing to multiple announcements of Covid-19 vaccine and the election of Democrat Joe Biden as the next President of the US.

The growth in Indian equities has been pushed by the heavy foreign fund net inflow of Rs 38,137.70 crore so far in November -- the highest in the history. FIIs have been attracted to the Indian markets backed by further stimulus announced by the Centre and unrealistic valuations in home countries of foreign funds.

“Indian markets continue to outperform and continue to offer FPI’s better risk-reward propositions in terms of corporate earnings recovery and reforms measures undertaken by the government to revive investment activities in the country. Additionally, weaker dollar index and absence of quality value play at reasonable valuations in FPI’s home markets has further aided FPIs to make more allocation to emerging markets and India,” Arjun Yash Mahajan, Head - Institutional Business, Reliance Securities said.

Meanwhile, on Tuesday, Sensex breached the 44,000-mark five days after it breached the 43,000-mark, opening at 44,096 points, up 457 points. After touching its lifetime peak of 44,161.16 during the session, the 30-share BSE Sensex settled 314.73 points or 0.72% higher at its new closing record of 43,952.71.

Similarly, the broader NSE Nifty touched a fresh intra-day high of 12,934.05. It finally finished 93.95 points or 0.74% up at its lifetime peak of 12,874.20.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks