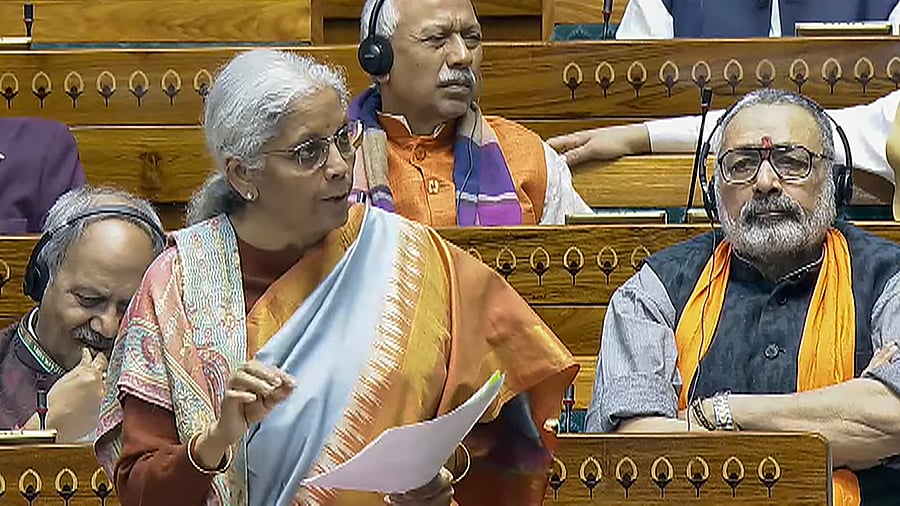

FM Sitharaman in the Lok Sabha on Tuesday.

Credit: PTI Photo

New Delhi: The Banking Laws (Amendment) Bill, 2024 that proposes to increase the number of nominees allowed for a bank account to four from the current one and enhance the tenure of directors, was passed in Lok Sabha on Tuesday.

Speaking in the lower house of Parliament, Finance Minister Nirmala Sitharaman said the amended law would strengthen governance in the banking sector and enhance customer convenience.

Underlining the need for a robust regulatory system to keep banks stable, Sitharaman said, “We can’t have our banks struggling. We must credit RBI and Finance Ministry for it. Since 2014, we are cautious that banks remain stable.”

The amendments to the banking laws were first announced by the finance minister in the 2023-24 Budget speech.

Amendments are proposed in the Reserve Bank of India Act, 1934, the Banking Regulation Act, 1949, the State Bank of India Act, 1955, the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970, and the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980.

There will be radical change in the nominee system. At present, a single nominee is allowed to be linked to a bank account. The new system will allow nomination of upto four individuals to a bank account.

The bill also seeks to redefine “substantial interest” for bank directorships by raising the threshold from Rs 5 lakh to Rs 2 crore. It also grants banks greater freedom in deciding the remuneration for statutory auditors and modifies regulatory reporting deadlines to the 15th and last day of every month, replacing the existing second and fourth Fridays.

“Banks are being professionally run today. The metrics are healthy so they can go to the market and raise bonds, raise loans & run their business accordingly,” Sitharaman said.