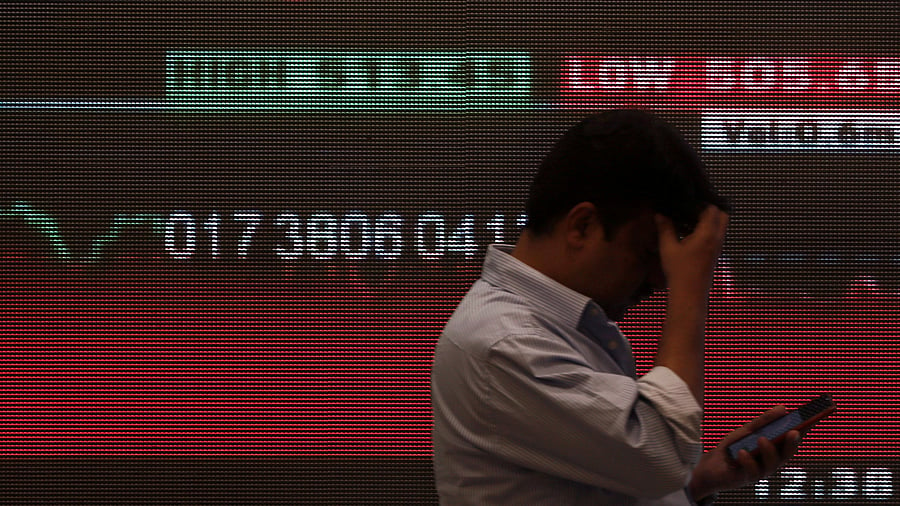

File Photo: A man stands in front of a screen displaying news of market updates inside the Bombay Stock Exchange (BSE) building in Mumbai.

Credit: Reuters Photo

In a significant move aimed at enhancing market efficiency and accessibility, the Securities and Exchange Board of India (Sebi) has announced the implementation of the T+0 settlement system. This new system, which ensures the transfer of securities and funds on the same day of the trade, is expected to revolutionise the trading landscape for retail Investors.

For the unversed, the regulator had shortened the settlement cycle to T+3 from T+5 in 2002 and subsequently to T+2 in 2003. It introduced T+1 in 2021 which was implemented in phases and completed in January 2023. The T+0 settlement cycle will now be made available as an option alongside T+1.

A few countries that have adopted this system so far include the Moscow Exchange (MOEX) and Korea Exchange (KRX) for certain securities in Russia and South Korea.

The benefits

The T+0 settlement system marks a departure from the previous T+1 system, where the settlement was usually completed a day after the trade. This shift will substantially reduce the risk exposure for retail investors. The system guarantees same-day access to funds and securities, thereby mitigating counterparty and duration risks.

The new system is also expected to significantly improve liquidity for retail investors. With faster access to funds, investors can execute more trades and explore more opportunities in a shorter time frame. This is particularly beneficial for sellers, who will now be able to access 100% of their funds on the same day of the sale vs only 80% of the funds available currently on the same day to be utilised after a sale. However, buyers may still prefer the T+1 system, which requires them to provide only the peak margin upfront currently.

The quicker settlement process is likely to boost investor confidence and simplify the trading process for retail investors. However, there may be technical limitations due to the high volume of trades.

On the sidelines, online trading platforms are also likely to benefit from this system as it simplifies trading for retail investors. The T+0 system could also potentially further benefit the e-brokers and stock exchanges as increased volumes may lead to more revenue.

Importance of data

A strong emphasis was placed on the power of data in making informed decisions. Additionally, it will be important to incorporate facts or data points into the works, potentially suggesting that roles might involve producing data-informed reports, analyses, or articles. This highlights a significant trend in the industry towards data-driven insights and strategic decision-making. This is an integral part of the industry and will keep evolving as the sector matures.

The challenges

Despite its advantages, the T+0 system is not without potential drawbacks. Since it is optional and not mandated for all market participants, there may be challenges in executing trades. For instance, institutional investors will not have access to the T+0 settlement, which could lead to liquidity issues for retail investors. Additionally, arbitrageurs may offer prices lower than the market price, leading to potential losses for investors.

The advanced trading strategies, such as the recently proposed T+0 settlement system, often pose adoption challenges due to inherent complexities. This only emphasises the pivotal role of the industry in guiding investors and brokers through these financial decisions.

In conclusion, SEBI’s T+0 settlement system is poised to bring significant changes to the trading landscape for retail investors. While it offers numerous benefits such as reduced risk exposure and improved liquidity, investors must also be aware of potential drawbacks and challenges. As the system is rolled out, its impact on market efficiency, accessibility, and the burgeoning retail broking (especially online broking) market will be closely watched.

(The writers: Mittal is Senior Director of Investment Research and Tripathi, Associate Director, Investment Research at Acuity Knowledge Partners)