Fitch Ratings cuts India's economic growth forecast to 8.4% for FY22 from 8.7% projection in Oct

Fitch Ratings cuts India's economic growth forecast to 8.4% for the current fiscal year from 8.7% forecast in October (PTI)

UPI transaction limit for GSECs, IPOs increased from Rs 2 lakh to Rs 5 lakh

On-tap liquidity windows of Rs 50,000 crore for Covid-related health infra to continue till March 31, 2022

CPI inflation for FY22 projected at 5.3%: Das

Inflation to peak in Q4 FY21 and soften thereafter: Das

CPI inflation up 4.5% in October: Das

Real GDP growth projection reatined at 9.5% for FY22

Economic recovery not yet strong enough to be self sustaining: Das

Vegetable prices to see seasonal correction with winter arrivals: Das

Price pressures may persist in the immediate term. Vegetable prices are expected to see a seasonal correction with winter arrivals in view of bright prospects for Rabi crops: RBI Governor Shaktikanta Das (ANI)

Reductions in petrol prices to support consumptiuon demand by increasing purchasing power: Das

Real GDP growth at 8.4% yoy Q2 FY22

Reverse repo rate remains at 3.35%: Governor Das

Indian economy hauled itself out of its deepest contraction: Das

RBI maintains repo rate at 4%

We are now better prepared to deal with invisible enemy Covid-19: Das

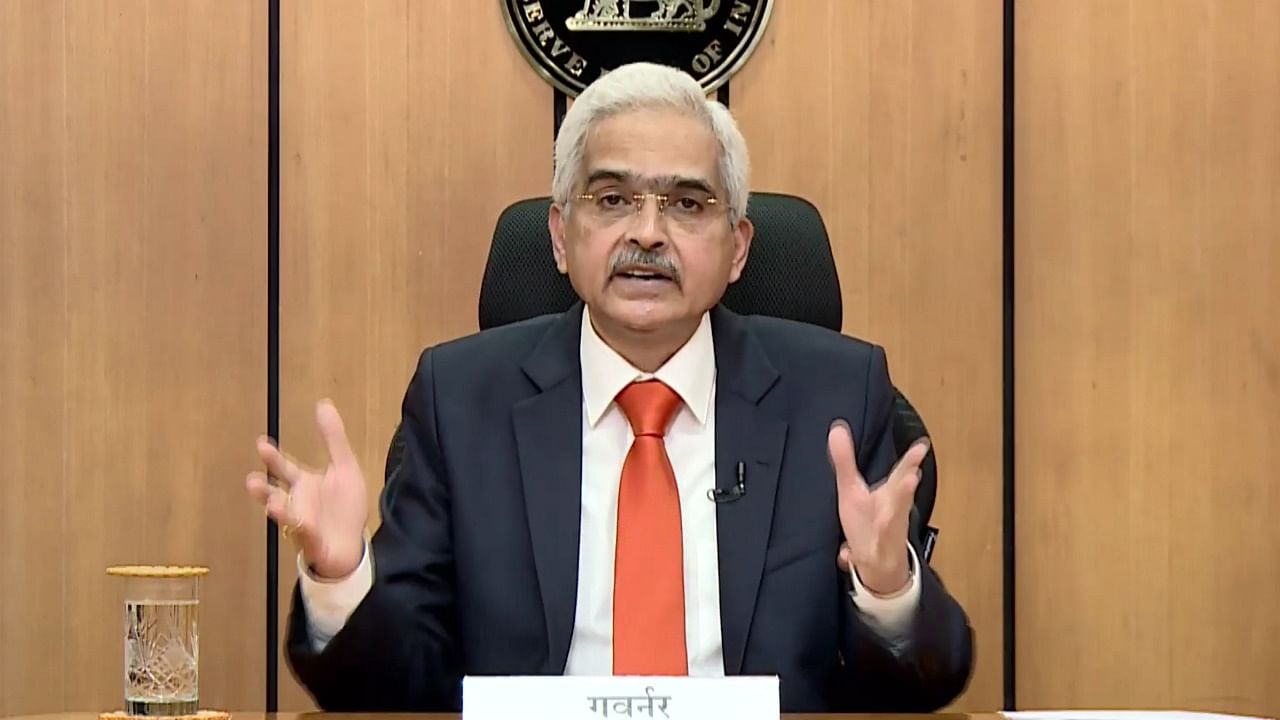

Watch Governor Das' address here

A hike in reverse repo rate is on the cards.

While the stance has been accommodative, RBI has started to unwind some of the liquidity measures like the government securities acquisition programme (GSAP) as there was a huge liquidity overhang in the system. A section of the market is expecting further measures to normalise the ultra-loose stance of the policy in the December review meeting.

The gap between the reverse repo and the repo rate – which is known as the rate corridor – was widened in March and May 2020 policy reviews, to 65 bps, from 25 bps.

With a new variant of Covid-19, Omicron, surfacing last month, economists now suggest that the central bank should wait for some more time before it hikes the reverse repo rate.

On the economic growth front, most indicators have surpassed pre-Covid levels. Two backbones of India’s economy — manufacturing and services sector — point towards a sharper recovery in the Oct-Dec quarter.

But Omicron may pose a threat to near double-digit growth and prompt the RBI to hold rates.

But inflationary pressures may force the central bank to give the first rate hike as early as in the next policy review in February.

RBI in its monetary policy review will most likely keep the key policy interest (repo) rate on hold to give economic growth a leg-up

Repo rate is the rate at which the RBI lends money to banks or financial institutions against government securities. It is currently at 4%, the lowest ever. A status quo on interest rates will also ensure home, auto and other personal loans remain cheap.

The central bank has maintained an extremely accommodative monetary policy since the onset of the Covid-19 pandemic, that is, since March 2020. RBI has said that the accommodative stance will be maintained till growth revives on a durable basis.

The repo rate has remained unchanged since May last year

The last time the policy rate was changed was in May 2020, when the repo rate was reduced by 40 bps (1 percentage point = 100 bps). The repo rate was kept unchanged at fourper cent in the next eight policy review meetings.

Repo rates likely to remain unchanged

The six-member monetary policy committee (MPC) of the Reserve Bank of India (RBI) is expected to keep interest rates unchanged for the ninth consecutive occasion when it meets to review the policy between December 6-8.

Good morning, readers, and welcome to DH. We bring to you the latest updates from the Monetary Policy Committee meeting review. Shaktikanta Das will be addressing the media at 10 am.

Stay Tuned!

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks