India's Reliance Industries Ltd expects to hive off its oil-to-chemicals (O2C) business into a 100 per cent subsidiary in the September quarter, the company said on Tuesday, paving the way for a stake sale in the new company.

Reliance, which operates the world's biggest refining complex, is in talks with Saudi Aramco to sell a fifth of its O2C business.

"Reorganization of O2C Business facilitates participation by strategic investors and marquee sector focused investors," the oil-to-telecom conglomerate said in a presentation to investors.

The new entity, Reliance O2C Ltd, will subsume Reliance's investment in oil refining, marketing and petrochemical business. After the re-organisation, Reliance's stake in Retail Ventures will be 85.1 per cent, while it will hold 67.3 per cent in its telecom and digital arm, Jio Platforms.

Reliance would extend a $25 billion long-term loan to Reliance O2C, which the new entity could repay through a stake sale.

Shares of Reliance Industries, which said creation of the new subsidiary will not impact its consolidated financials, were up 1.6 per cent at Rs 2,041.70 by 0610 GMT.

The demerger move for O2C is a step towards monetisation and acceleration of Reliance's new energy and material plans into batteries, hydrogen, renewables and carbon capture, said Morgan Stanley in a report. "All of which point to the next leg of multiple expansion and clarity on the next investment cycle."

"Until the stake sale is completed, there will be no subordination risk for Reliance's lenders, as the company will continue to have full access to the O2C business' cash flows, given its full ownership of and no external debt at the new subsidiary," said Sweta Patodia, analyst, Corporate Finance Group, Moody’s Investors Service.

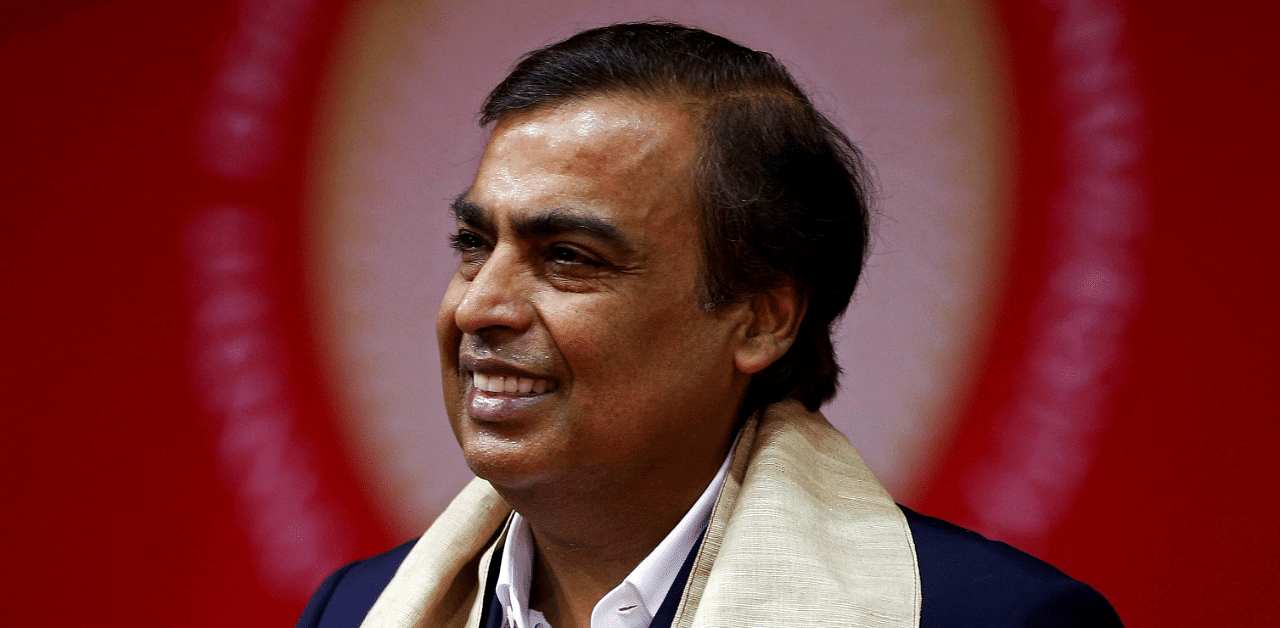

The group, majority-owned by billionaire Mukesh Ambani, aims to become net carbon zero by 2035 and invest in developing renewable energy systems to meet energy demand and speed up the transition from traditional carbon-based fuels to hydrogen.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks