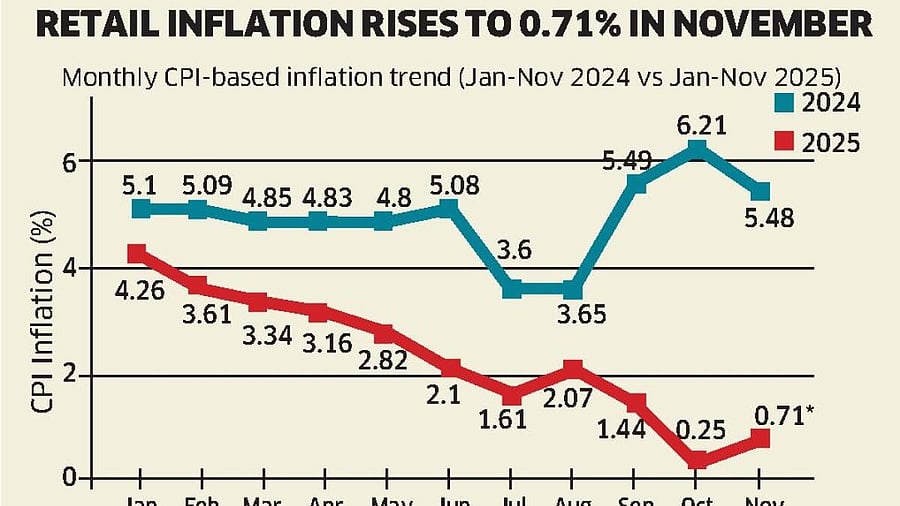

Retail inflation rises to 0.71% in November

MOSPI

New Delhi: India’s annual retail inflation rose marginally to 0.71% in November from a record low of 0.25% in the previous month, as prices of some food items, especially vegetables, eggs, meat and spices firmed up, as per government data released on Friday.

The Consumer Price Index-based (CPI) inflation witnessed 46 basis points increase on a month-on-month basis. Despite the firming up, the headline inflation has remained below the Reserve Bank of India’s medium-term target of 4% for the 10th straight month.

Food deflation narrowed to 3.91% in November, from 5.02% in the previous month. This indicates firming up in the prices of food items on a month-on-month basis. “The base effect, which has been suppressing vegetable and pulses inflation, is now beginning to fade,” said Crisil Principal Economist Dipti Deshpande.

Adjusting for seasonality, food prices recorded a mild uptick of 0.2% on-month (with a 1.6% uptick in vegetable prices), reflecting the impact of unseasonal rains and delayed harvest arrivals, she said.

Core inflation, which excludes the volatile prices of food and fuel, declined marginally to 4.3% in November from 4.4% in October. All the major sub-items saw a moderation in the inflation levels, reflecting the impact of GST rate rationalisation.

This was despite personal care and effects inflation touching a fresh high of 24% in November, mainly due to the increase in gold and silver prices. Gold inflation stood at 58% in November. “If we exclude gold from headline CPI, it turns negative at -0.12% YoY,” SBI Research said in a note.

“We believe, given the current trend, CPI excluding gold will remain negative in the next month as well,” it added.

According to SBI Research, GST rationalisation has led to 25 basis points reduction in CPI inflation in the September-November period. “We believe that this impact doesn’t account for the discounts on e-commerce sales which could be higher because of GST reduction,” it said.

Inflation has remained below the RBI’s lower tolerance limit of 2% for the third successive month.

India Ratings and Research Associate Director Paras Jasrai said such low inflation is not good for the Indian economy, especially from a fiscal point of view.

“The deflationary trend prevails still across various food items as per the latest price data available (till 11 December 2025). Thus, with continuation of benign food prices, we expect the retail inflation to be near 1% in December 2025,” Jasrai said.

According to ICRA, in December, inflation may rise to over 1.5%. “A continued base-normalisation and the hardening in prices of some vegetables could make the headline CPI inflation cross 1.5% in the next print, which will be the last before the next MPC,” said ICRA Chief Economist Aditi Nayar.

The next meeting of the RBI’s rate setting panel monetary policy committee (MPC) is scheduled from February 4-6.

“In our view, the evolving inflation-growth outlook, as well as the fiscal policy measures unveiled by the next Union Budget, will guide the MPC’s next decision. Our base case suggests a pause in the MPC’s February 2026 policy review,” Nayar said.