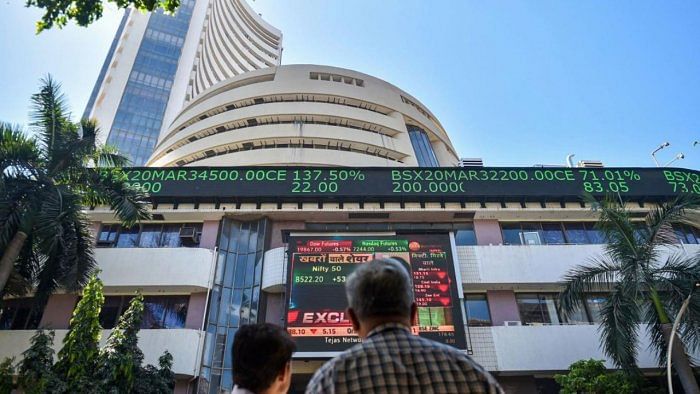

Equity benchmark Sensex soared 834 points on Tuesday, tracking strong gains in index majors HDFC twins, ICICI Bank and Reliance Industries amid an upbeat trend in global markets.

The 30-share BSE index ended 834.02 points or 1.72 per cent higher at 49,398.29.

Similarly, the broader NSE Nifty surged 239.85 points or 1.68 per cent to 14,521.15.

Bajaj Finserv was the top gainer in the Sensex pack, rallying around 7 per cent, followed by Bajaj Finance, HDFC, L&T, ICICI Bank, Sun Pharma and NTPC.

On the other hand, Tech Mahindra, ITC and M&M were the laggards.

According to Binod Modi, Head-Strategy at Reliance Securities, having seen massive pullbacks in last two trading days, domestic equities witnessed sharp rebound mainly led by strong cues from global markets.

"Positive statement from Janet Yellen about possibility of acting big to support economy bolstered confidence among investors globally," he said.

US President-elect Joe Biden's nominee for treasury secretary, former Federal Reserve chair Janet Yellen is calling on Congress to do more to fight the recession to avoid an even worse downturn.

In the testimony prepared for her confirmation hearing on Tuesday before the Senate Finance Committee, Yellen said more aid is needed to get coronavirus vaccines distributed -- key to ending outbreaks -- to reopen schools and help families struggling with job losses stay fed and housed.

Elsewhere in Asia, bourses in Hong Kong, Seoul and Tokyo ended with significant gains, while Shanghai was in the red.

Stocks exchanges in Europe were also trading on a positive note in early deals.

Meanwhile, the global oil benchmark Brent crude was trading 1.22 per cent higher at USD 55.42 per barrel.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks