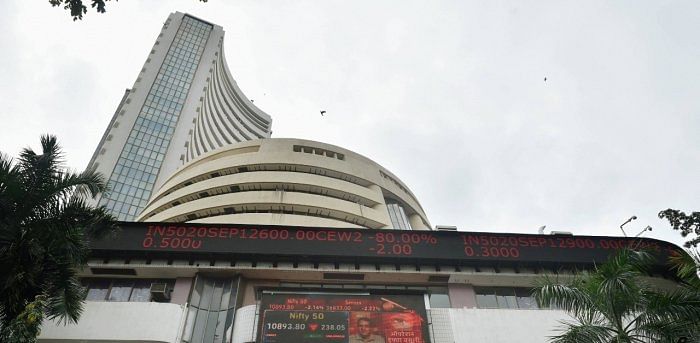

Equity benchmark Sensex slipped 85 points on Wednesday, tracking losses in ITC, HDFC twins and Infosys amid a mixed trend in global markets.

The 30-share BSE index ended 85.40 points or 0.16 per cent lower at 51,849.48, while the broader NSE Nifty inched up 1.35 points or 0.01 per cent to 15,576.20.

ITC was the top loser in the Sensex pack, shedding nearly 3 per cent, followed by Tech Mahindra, Axis Bank, Asian Paints, TCS, HCL Tech, HDFC and Kotak Bank.

On the other hand, IndusInd Bank, PowerGrid, Reliance Industries, Bajaj Auto and Maruti were among the gainers.

"Ahead of the MPC policy, domestic market continued its volatility with a mixed bias. Selling was witnessed in financials, IT and FMCG stocks but it reduced towards the close of trading," said Vinod Nair, Head of Research at Geojit Financial Services.

Weakness across US and Asian markets also added to the negative trend, he noted.

"PSU banks attracted buyers in hopes that the government will soon finalise the list for privatisation. In the policy, RBI is expected to focus on economic growth by maintaining the status quo on policy rates and ensuring liquidity while keeping an eye on the inflationary pressure due to rising commodity prices," Nair said.

Elsewhere in Asia, bourses in Shanghai and Hong Kong ended in the negative territory, while Tokyo and Seoul rose.

Equities in Europe were trading with gains in mid-session deals.

International oil benchmark Brent crude was trading 0.98 per cent higher at $70.94 per barrel.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks