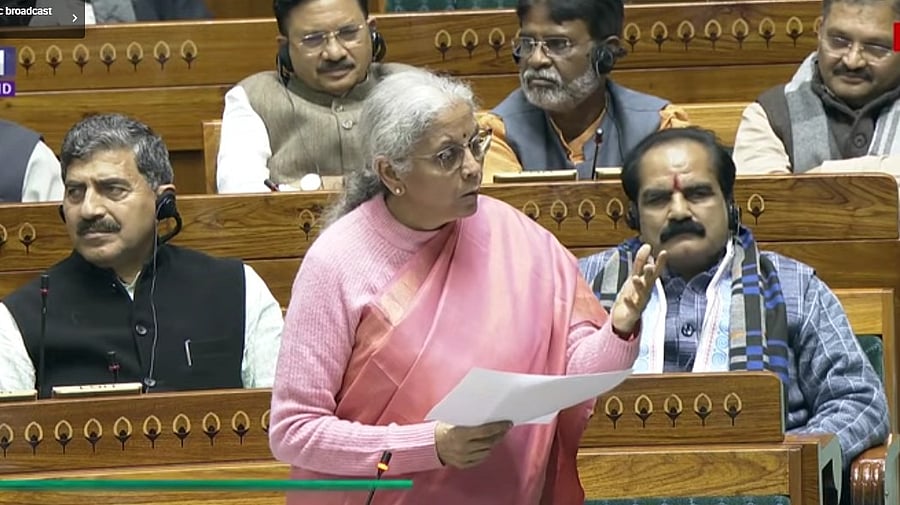

FM Nirmala Sitharaman in Lok Sabha.

Credit: Sansad TV

Union Budget, which will lay foundation for government's economic and fiscal roadmap for the next financial year, will be presented by Union Finance Minister Nirmala Sitharaman on February 1.

Every year, the finance minister has the power to propose changes in tax structure for the upcoming financial year. These changes are with respect to various existing laws, such as the Income Tax law, the Stamp Act, and the Money Laundering law, which govern different taxes in the country.

What is the Finance Bill?

It is the Finance Bill that incorporates the amendments with all the proposed changes into the relevant laws without necessitating separate amendments for each Act.

The Bill is introduced in the Lok Sabha soon after the presentation of the Union Budget in the Parliament.

Until Parliament passes the Finance Bill, none of the proposed tax changes legally apply.

The Finance Bill must be approved by the Parliament within 75 days, accompanied by a memo justifying the inclusion of provisions.

While a Finance Bill is also a Money Bill, the two terms represent distinct concepts.

Money Bills specifically address matters outlined in Article 110 of the Constitution. According to Article 110, a Bill is classified as a Money Bill if it solely deals with:

1. The imposition, abolition, remission, alteration, or regulation of any tax.

2. The regulation of borrowing money or providing guarantees by the Government of India, or amending laws related to financial obligations undertaken by the government.

3. The custody of the consolidated fund or the Contingency fund of India, and the withdrawal or payment of funds.

4. The appropriation of funds from the Consolidated Fund of India.

5. The declaration of any expenditure as charged on the Consolidated Fund of India or an increase in such expenditure.

6. The receipt of money for the Consolidated Fund of India or the public account of India, the custody or issue of such money, or the audit of the Union or State accounts.

If a Finance Bill is classified as a Money Bill, the Rajya Sabha cannot amend it and can only make recommendations. The Lok Sabha has the final authority to accept or reject those suggestions.

The Speaker has the power to determine whether the bill is a Finance or a Money Bill, or neither.

Once the Finance Bill is approved by the Parliament, the President gives assent, making it the Finance Act. It is only then that the tax changes formally come into effect.

While some provisions take effect immediately, others apply from April 1 of the next financial year, depending on how they are framed in the law.