Making it simple for small and medium businesses, the GST Council on Thursday exempted traders with an annual turnover of Rs 40 lakh from paying any Goods and Services Tax. Earlier the limit was Rs 20 lakh.

The Council also increased the annual composition limit for services by Rs 50 lakh to Rs 1.5 crore, implying they would pay taxes at a concessional rate and reduced cost.

In another significant decision, the Council allowed Kerala, which was ravaged by a devastating flood, to impose a cess of up to 1% on intrastate sales for two years.

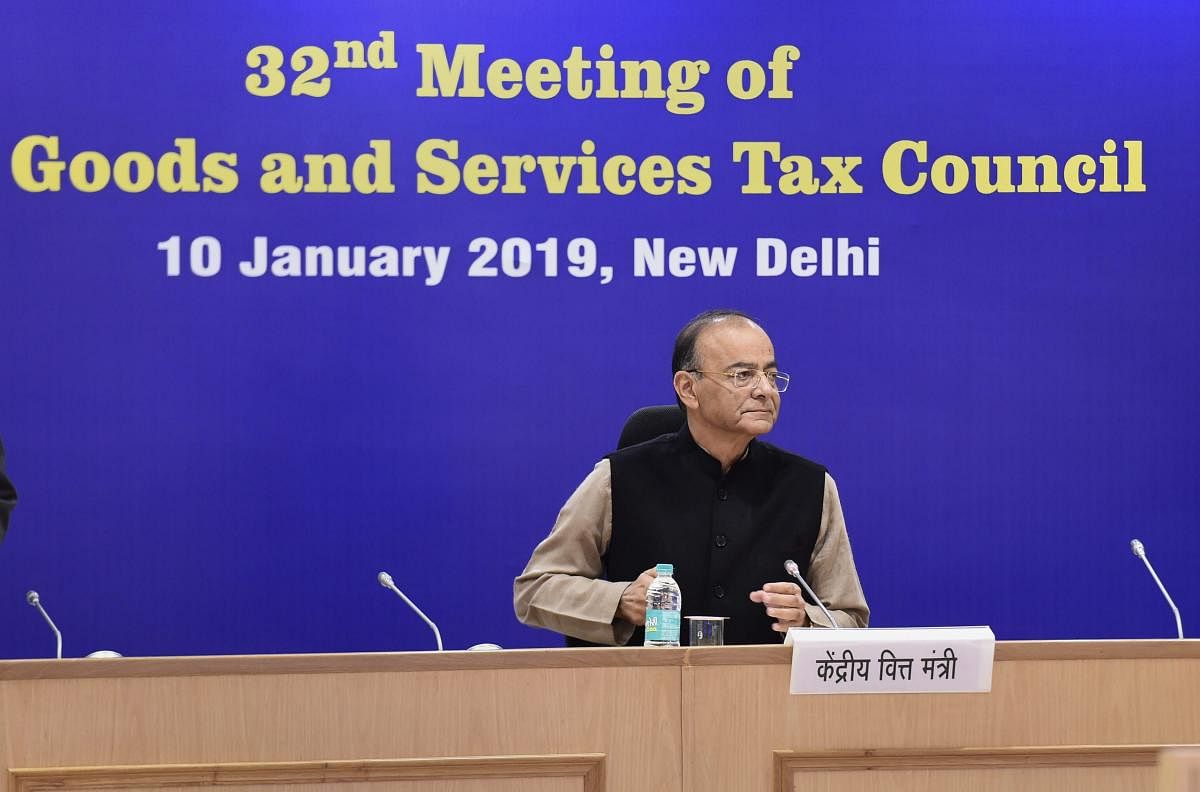

Taking everyone by surprise, Finance Minister Arun Jaitley said there will be no revenue implications on the exchequer of the exemption move.

“Revenue impact will just be notional,” he said to a question at a briefing after the GST Council meeting and explained that a large part of GST comes only from the formal sector and large companies.

“The current exemption in the threshold is mainly to help MSME sector,” he said.

Most of the businesses under India's MSME sector are unorganised.

Jaitley said the Council will also discuss rate reduction on goods and services once the revenues from GST start rising.

The GST revenues have been falling in the past as many months with the centre collecting an average of Rs 90,000 crore per month from the new indirect tax levy.

The Council also set up a Group of Members to look into real estate rates and inclusion of lottery into GST regime.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks