With Maharashtra on Wednesday joining the list of states which have reduced or waived VAT or cess on cooking gas and diesel, Karnataka Chief Minister B S Yeddyurappa had declared earlier that he will not reduce tax on diesel or LPG.

On the contrary, within 24 hours of the latest Central hike, the state government increased bus fares. The increase is as much as twice what was warranted on account of the diesel price hike.

The Karnataka Commercial Taxes Department has imposed 1 per cent VAT on domestic LPG, while it is 14 per cent on commercial usage cylinders. The annual revenue through sales tax on domestic LPG is Rs 50 crore per year. In the case of commercial cylinders, the tax collection would be at least four times more.

The department also imposes a 5 per cent entry tax on diesel landing cost and 18 per cent sales tax on the landing cost plus entry tax. In all, the tax component works out to be nearly 24.2 per cent.

Analysts said that the State’s refusal to cut the burden on consumers was “inexplicable”, especially when 12 states, mainly ruled by either Congress or regional parties have reduced the value added tax or cess on LPG or diesel.

Though some NDA-ruled states like Punjab and Bihar have reduced the cess on LPG and diesel, none of the BJP-ruled states have cut tax on these products.

Most of the states reduced the cess on LPG and kerosene while a few others also reduced the cess on diesel.

This followed Finance Minister Pranab Mukherjee’s statement asking states to reduce VAT or cess on petroleum products. The Congress high command too had asked party-ruled states to do the same. Maharashtra government announced a decrease of 2 per cent on VAT on kerosene and diesel.

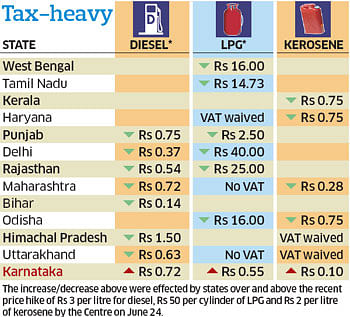

West Bengal Chief Minister Mamata Banerjee, was the first chief minister to announced cut in the cess on LPG prices. Her government announced cut the prices of LPG cylinders by Rs 16. Now the price would be Rs 401.10.

Tamil Nadu on Tuesday decided to drop the 4 per cent VAT on LPG, a decision which will be effective July 1. Chief Minister J Jayalalitha said the decision of total waiver of VAT on LPG would cost the exchequer Rs 120 crore per year. The 4 per cent VAT waiver will reduce the price of LPG by Rs 14.73 per cylinder to Rs 389.67.

Kerala too decided to forgo the extra sales tax and thereby bringing diesel price down by 75 paise. The BJD-led government in Odisha announced complete waiver of VAT on LPG and PDS kerosene.

Congress-ruled Haryana decided to waive off the 5 per cent VAT on kerosene while Punjab exempted VAT on the hiked amount of diesel and LPG, making fuel and cooking gas cheaper by about 25 paise a litre and Rs 2.50 per cylinder.

The Delhi government has reduced Rs 40 less per LPG cylinder only for BPL and Antyodaya families while it reduced diesel 37 paise less for all. LPG cylinders in Rajasthan will cost Rs 25 less and diesel 54 paise less for all.

Karnataka government’s rigid stand owes primarily to enhanced transport costs contributing to higher tax rates, sources said. Unlike Hyderabad, Delhi, Kolkata or Chennai, the delivery of petroleum products to Bangalore is by road.

This pushes up the cost of LPG, diesel and kerosene. Besides, the state has estimated that the growth rate of the commercial taxes in the current financial year will be 20 per cent. This could be achieved provided the present tax rates are maintained.

Deccan Herald is on WhatsApp Channels| Join now for Breaking News & Editor's Picks