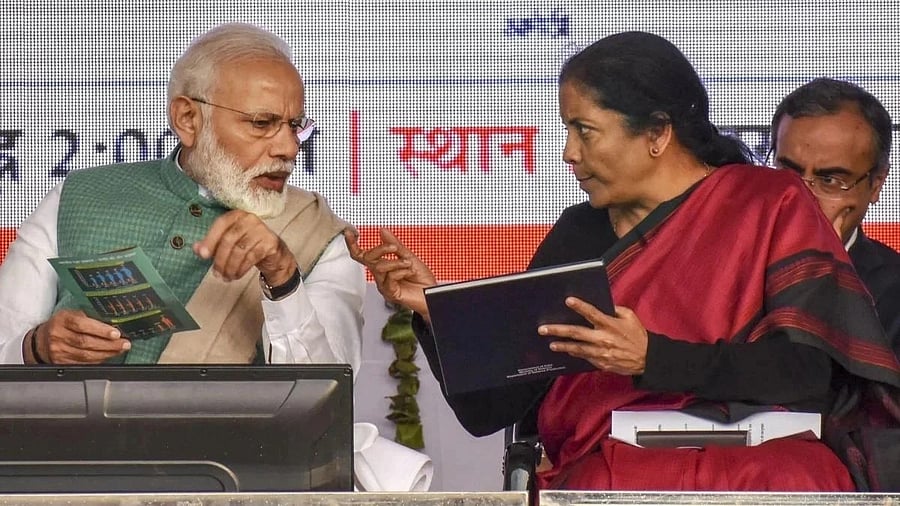

PM Modi and Finance Minister Nirmala Sitharaman

Credit: PTI Photo

By Mihir Sharma

Sometime in the coming months, the impact of US tariffs will begin to be felt in India — and it will not be pretty. Jobs will be lost. Labor-intensive sectors like leather, textiles, and jewelry that face 50% duties are concentrated in politically sensitive areas, such as the giant bellwether of Uttar Pradesh or Prime Minister Narendra Modi’s own home state of Gujarat. These are sectors that the government will want to protect.

But they will not want to spend a lot of money doing so. One of the hallmarks of Modi’s administration has been fiscal sobriety. He tends to avoid spending liberally, even in emergencies, instead using his ample political capital to talk up whatever largesse he does hand out.

India’s exporters think this is happening again. The committee set up to look into what could be done to help them has disappointed companies hoping for financial support: It’s stacked with lower-level officials than they would like, and its mandate is to cut red tape and reduce costs, not plan a subsidy bonanza.

This is familiar from the pandemic. At a time when many of its peers turned on the fiscal taps to try and protect their economies, New Delhi chose instead to use credit guarantees and loans. The impact on federal finances was manageable, and the country’s macroeconomic stability survived those difficult years. Modi has taken credit for that, saying that India’s fiscal prudence during Covid was an example to the world.

It is likely that something similar will be on the agenda this time around. Brazil — which is the only other large economy to have been hit by a 50% rate — may have set aside $5.5 billion to support those affected by the US levies. But Indian officials are only looking at a $255 million package, meant to marginally increase access to credit. And that’s just money that was already promised to exporters repurposed for a post-tariff world.

Modi’s frugality may not be the only reason the government is being hesitant about spending. Some may hope that relations with President Donald Trump will improve in the coming months and exports will resume.

If so, all exporters will need to do is somehow stay in business till the politicians can work something out, and a little extra credit will help them do that. But if that’s what lies behind the government’s thinking, then it’s taking a big risk. Trump might remain intransigent longer than small businesses can stay solvent.

But the government could argue that caution is amply justified. Since the budget was presented earlier this year, the calls on the federal purse have only increased. So when officials met last week to decide on how much the administration will borrow over the next six months, they had one eye on the bond markets. Yields spiked as government paper had the biggest sell-off of government paper in the past three years in August.

Finance Minister Nirmala Sitharaman said publicly that higher yields made her reluctant to borrow. In the end, the government largely stuck to its financing plans. That fits with its propensity to prefer messaging over spending. This tendency was very visible over the past weeks, when New Delhi insisted that its reorganization of the indirect tax code should be seen as Modi’s “Diwali gift” for his people.

But the numbers suggest that it wasn’t a particularly expensive present. Finance ministry estimates that the tax cut will cost it merely Rs 480 billion($5.4 billion) or so. The deficit target for the current fiscal year is 4.4% of gross domestic product, and the new tax rates might shift that upward by only 0.1% of GDP once increased demand is taken into account.

The problem is that more handouts may be needed in the coming months — particularly for those sectors where Trump’s 50% tariffs will have a disproportionate impact on jobs.

The best-case scenario, unless the US president comes around, is that the government does succeed in cutting red tape and Indian goods become marginally more competitive — while new export destinations open up, possibly through a long-delayed free-trade agreement with the European Union. But that would require an unusually short timeline for administrative reform by Indian standards, as well as a fairly optimistic view of how quickly its exporters can refocus on entirely new markets.

If the tariffs begin to bite before any such changes kick in, however, Modi will face a reckoning. A few months down the line, he may be forced into a choice between expensive — and open-ended — support for some sectors and his well-earned reputation for fiscal prudence. Indian businesses should be prepared for him to choose the latter.