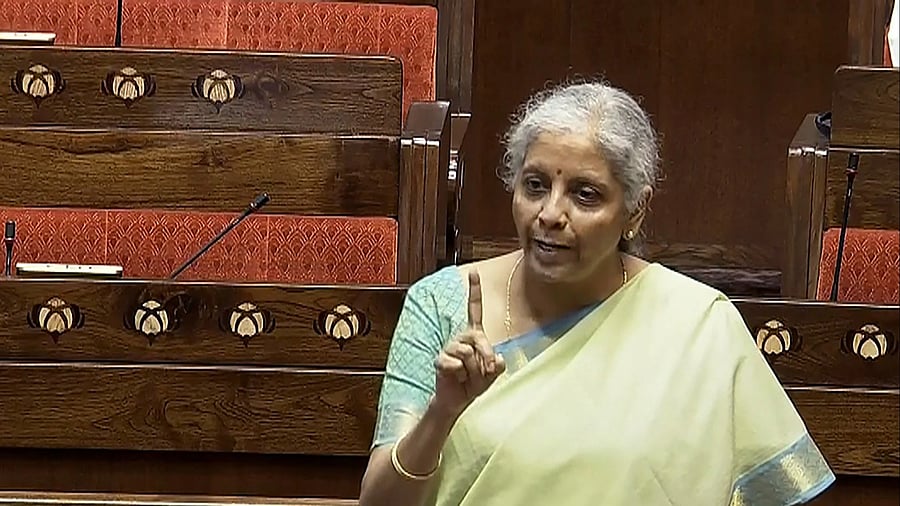

Union Finance Minister Nirmala Sitharaman.

Credit: PTI Photo

Insisting that the GST rate cut benefits fully passed on to consumers, Union Finance Minister Nirmala Sitharaman on Saturday said the government has been tracking 54 essential items to ensure that companies and retailers transfer tax savings to end-users.

Speaking at a joint press conference with Commerce Minister Piyush Goyal and Electronics & IT Minister Ashwini Vaishnaw, Sitharaman said she also said in quite a few cases, a "more-than-expected" price reduction due to GST reforms has been passed on to end consumers.

Sharing data, the Minister highlighted a surge in demand across multiple sectors. Three-wheeler dispatches grew 5.5% year-on-year, while two-wheeler sales touched 21.6 lakh units in September. The passenger vehicle segment recorded 3.72 lakh dispatches, driven by a festive surge in the last nine days of the month.

Consumer durables also reported strong growth as air conditioner sales doubled on the first day of the GST cut, while a leading TV manufacturer saw 30–35% higher sales. LG India reported exponential growth during the Navratri season, and the FMCG sector posted broad-based gains.

Effective September 22, Goods and Services Tax (GST) have become a two-tier tax structure of 5 and 18 per cent, and a special 40 per cent rate for ultra-luxury items. Prior to this, GST was taxed at rates of 5, 12, 18, and 28 per cent, plus a compensation cess on luxury items.

In items like shampoo, talcum powder, face powder, table, kitchenware, and utensils made of iron, steel and copper, besides toys, umbrellas -- all saw more-than-expected price reduction.

Sitharaman said except for the Portland variety of cement of one or two brands, all cement companies have reduced prices. GST on cement, which is the largest input cost in construction activities, was cut from 28 per cent to 18 per cent.

Sitharaman also said the Department of Consumer Affairs has received 3,169 complaints related to non-reduction in prices commensurate with GST cut. Of this, 3,075 complaints have been forwarded to nodal officers in the Central Board of Indirect Taxes and Customs (CBIC). Total 94 complaints have been resolved by the department.

The department will enable a functionality on the grievance reporting portal so that the complaints can be forwarded to the chief commissioners of the respective zones from where complaints have come in, the minister said.

Answering a question on opposition terming GST reforms a course correction, Sitharaman said the Modi government set the course for GST and implemented it.

"The Opposition neither brought GST nor even dared to attempt it. What we are doing today is not a correction, but a conscious decision - a reflection of cooperation between the Central government and the GST Council to pass on greater benefits to the people. During the Congress era, they didn't even attempt a course correction. They kept the income tax rate above 90 per cent," the Minister said.